Altcoin Investing Pick: The Ethereum Of Derivative Trading 📈

Hey everyone,

it’s Pick Day!

Every Saturday, you get deep dives on quality Altcoin projects that have numerous growth potential included in our watchlist.

Let’s dive in!

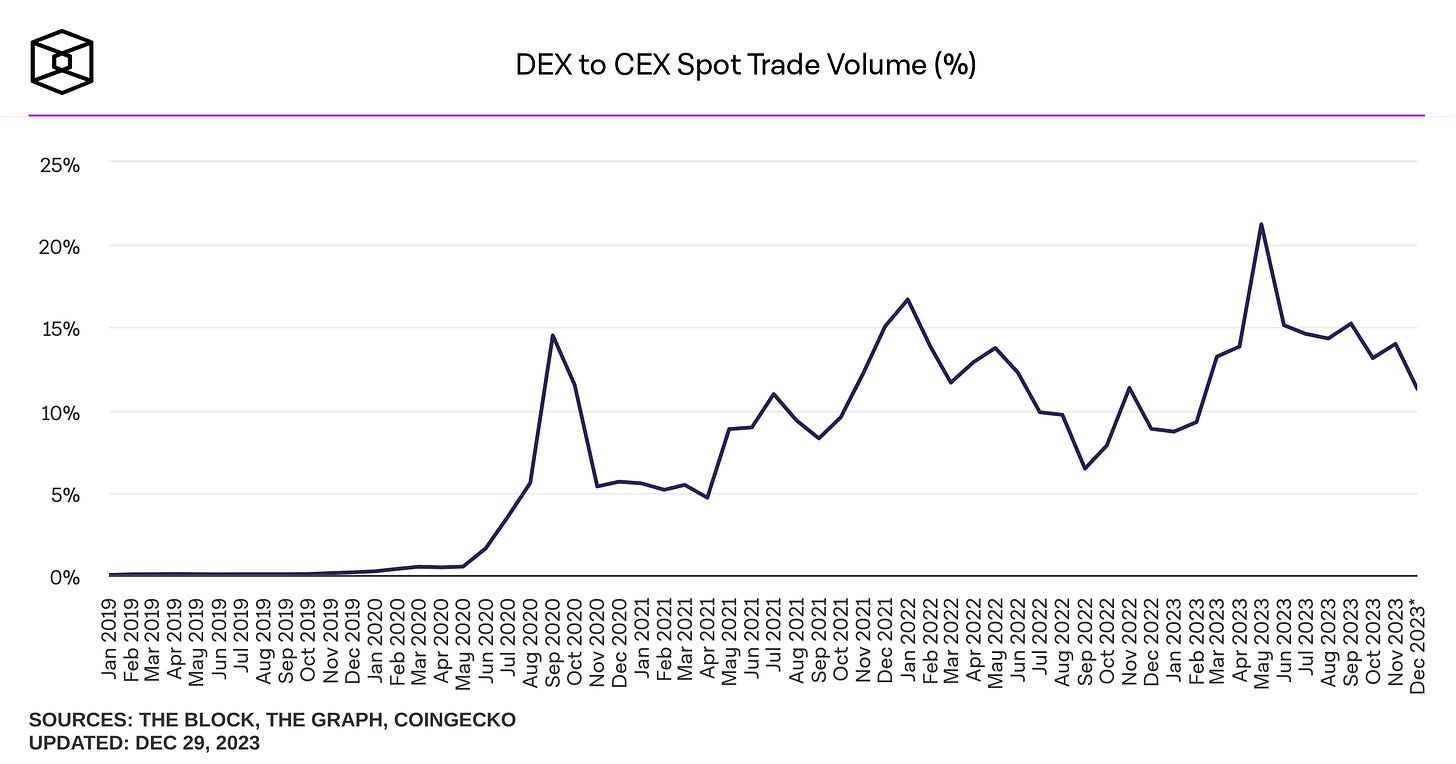

Even during a bull market, the monthly volume of all decentralized exchanges across all blockchains would be roughly 10-20% of the monthly volume of all centralized exchanges.

Why Are We Still Using Centralized Exchanges?

One factor could be that it is difficult to trade huge volumes or use tactics that require leverage efficiently on decentralized exchanges.

For crypto day traders, perpetual futures have become the standard instruments.

In other words, trading on DEX currently means higher slippage and more liquidity issues getting in and out of positions.

To solve this liquidity issue, our next pick uses a incentivization scheme to attract market makers.

In particular, its protocol is designed to be optimized for trading derivatives, enabling traders to execute orders at high speed and low costs.

Our next pick is backed by top crypto VCs and has been actively and continuously developed as shown by its Github page.

Now let’s tell you which project we are talking about and share the full investment case with you: