👀 Ethena: The Leading Yield-bearing Stablecoin

PLUS: Ethereum Ecosystem Hits A New All-Time High

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “3 Reasons You're Losing Money in Crypto (and How to Fix Them)”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Ethena: The Leading Yield-bearing Stablecoin

📣 With ETFs in Sight, Solana’s Latest Network Health Report Is Upbeat

📈 Ethereum Ecosystem Hits A New All-Time High

Let’s dive in!

💡 Insight

Ethena: The Leading Yield-bearing Stablecoin

What happens when stablecoins go from static to income-generating? You get Ethena’s USDe.

In a market flooded with passive stablecoins, Ethena has built something different—and it’s catching fire.

Meet USDe, the first crypto-native, yield-bearing stablecoin backed by ETH and BTC.

With APYs in the 20–25% range, USDe doesn’t just sit in your wallet—it works for you.

And in 2025, that narrative is going vertical!

⚙️ How Ethena’s USDe Actually Works

Most “stable” coins give you... nothing. Ethena flipped that script.

Here’s how it works:

Collateral: Users deposit stETH, ETH, or USDT to mint USDe.

Delta-Neutral Strategy: Ethena short-sells ETH/BTC perpetual futures to hedge out volatility risk.

Yield: USDe earns from two sources:

Staking rewards (from stETH)

Funding rate spreads (positive when longs pay shorts)

The end product? A synthetic dollar that stays stable and generates serious yield.

It’s DeFi’s answer to the “Internet Bond.”

📈 Traction: From $0 to $3.9B in Months

Ethena isn’t theory—it’s exploding:

USDe market cap: ~$3.9B (up 60% in 6 weeks)

Total value locked: ~$5.2B

Over-collateralized: 101.17% buffer as of June 2025

ENA token staked: 950M+ ENA locked (~45% of supply)

It’s now the 4th largest stablecoin behind USDT, USDC, and DAI—and it’s gunning for #3.

🔥 Why USDe Matters in 2025

The yield-bearing stablecoin category is booming:

Category size: Grew from $1.5B to $11B in 2025

USDe dominance: 75% of all stablecoin TVL on Pendle is USDe

No other stablecoin offers this combo:

Native on-chain yield

High liquidity

Institutional integrations (Deribit, Securitize, MEXC)

This is what DeFi needed post-Terra: safe, structured yield without the Ponzi risk.

📌 The ENA Token Angle

Ethena’s governance token ENA plays a key role:

Staking utility: Required to access boosted APY

Governance: Vote on collateral types, risk parameters

Upcoming unlock: ~5.5% of ENA supply set to unlock on July 6

ENA is a high-beta altcoin tied directly to USDe growth. As Ethena scales, so does demand for ENA.

💡 Why This Matters for You

Stablecoins are no longer “dumb money.” USDe is turning them into productive assets.

If you:

Park stablecoins in cold wallets

Want yield without leaving DeFi

Missed the Lido/Curve/Pendle cycles…

…then Ethena deserves your attention.

📣 Update

With ETFs in Sight, Solana’s Latest Network Health Report Is Upbeat

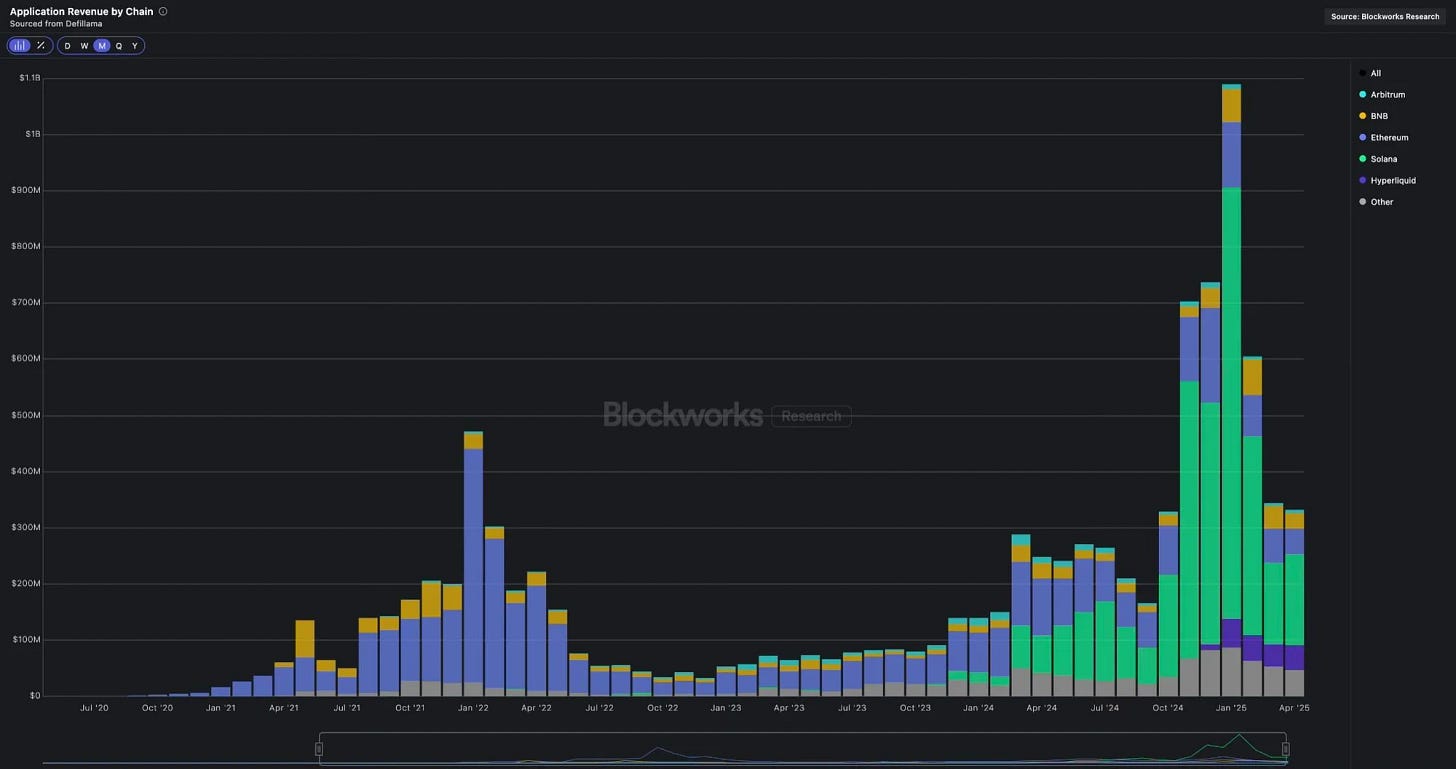

Solana is booming, with record-beating app revenue and 100% network uptime for 16 months, per the latest report from the Solana Foundation.

It’s by far the leader in application revenue, consistently beating Ethereum for at least seven months, and in several cases absolutely demolishing it, according to the report. App revenue has exceeded $1 billion for two consecutive quarters.

📈 Signal

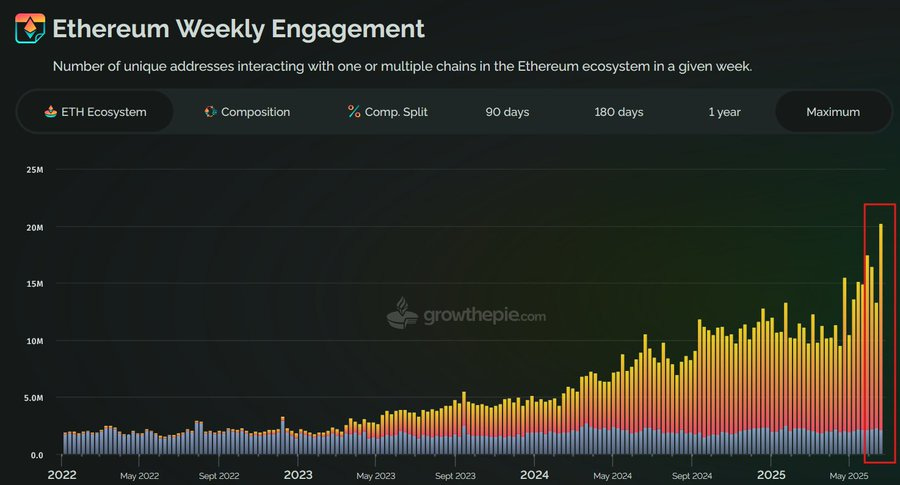

Ethereum Ecosystem Hits A New All-Time High

Active weekly addresses: 20.2M (new ATH)

658K addresses active across multiple chains

Layer 2 multiplier: 8.8x (+75% WoW)

Take action 🚀

you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

Thanks for reading!

See you next time