👀 Ethereum just hit all-time highs… quietly

PLUS: Gemini Plans to Go Public via Nasdaq

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Ethereum Just Flipped Netflix”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Ethereum just hit all-time highs… quietly

📣 Gemini Plans to Go Public via Nasdaq as Crypto IPOs Boom

📈 Solana Hits All-Time High TVL Even as Trading Volume Crashes

Let’s dive in!

💡 Insight

Ethereum just hit all-time highs… quietly

Most people only notice Ethereum when the price moves.

But under the hood, Ethereum is busier — and more valuable — than ever.

Here’s what just hit all-time highs on Ethereum:

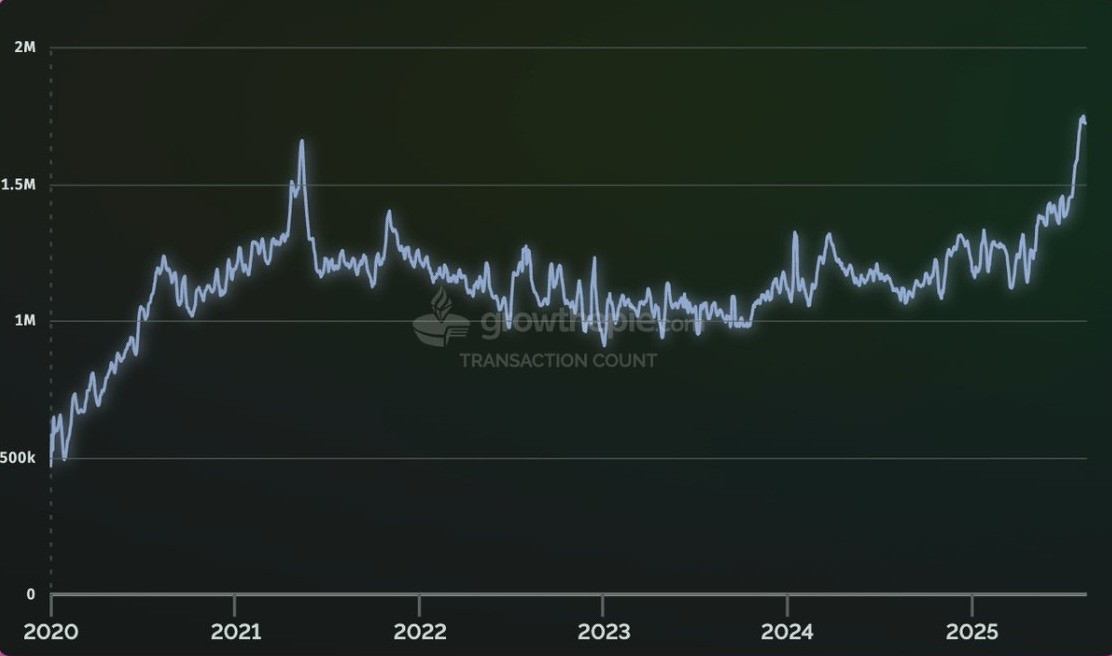

📈 Transaction count: More transactions than any day in history.

👥 Active addresses: More wallets interacting than ever before.

⚙️ Throughput (gas per second): 1.88 million gas/sec — the network is maxing out on compute.

That’s millions of dollars in on-chain activity, fees, and network demand — even with ETH still down from its ATH.

💡 What This Means

Ethereum is doing more than ever, even without hype.

This is the kind of “underpriced usage” that precedes big price moves.

If the market sees what’s happening under the hood, $ETH could catch up to fundamentals fast.

🎯 Actionable Take

📈 If you believe in fundamentals → accumulating ETH here is asymmetric.

🧠 For altcoin hunters: Ethereum activity = early signal. It’s ground zero for upcoming narratives (L2s, DeFi, RWAs, etc.)

🚀 Related Picks

📣 Update

Gemini Plans to Go Public via Nasdaq as Crypto IPOs Boom

Cryptocurrency exchange Gemini announced Friday that it has submitted a public S-1 filing with the SEC to launch a planned initial public offering, two months after previously revealing a confidential filing with the regulator.

Gemini, which was founded in 2014 by billionaire Bitcoin investors Tyler and Cameron Winklevoss—perhaps best known for their role in the creation of Facebook—plans to list via the Nasdaq Global Select Market under the ticker GEMI.

📈 Signal

Solana Hits All-Time High TVL Even as Trading Volume Crashes

Trading on Solana has dropped drastically since January, following the previous all-time high driven by memecoin trading euphoria. At its peak, Solana processed $103 billion in a single week’s worth of trading volume. Meanwhile it managed just $16.9 billion over the last seven days, an 84% drop from the highs.

Despite the massive dropoff in memecoin activity, inflows to the chain have kept its DeFi scene in a growth phase. But the chain’s fee accrual is down substantially as well compared to the highs, falling from $530 million at the previous high, to $72.3 million now, all but mirroring the total trading activity chart.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

Thanks for reading!

See you next time