From Stocks to Altcoins: How To Be a Smarter Investor

📈 PLUS 3 investment strategies you can apply right away

Hey everyone,

welcome to Investing Tuesday—our free weekly newsletter where we share investing tactics and market insights.

The stock market is the most studied market in the world, with plenty of knowledge we may use as a guideline when talking investing.

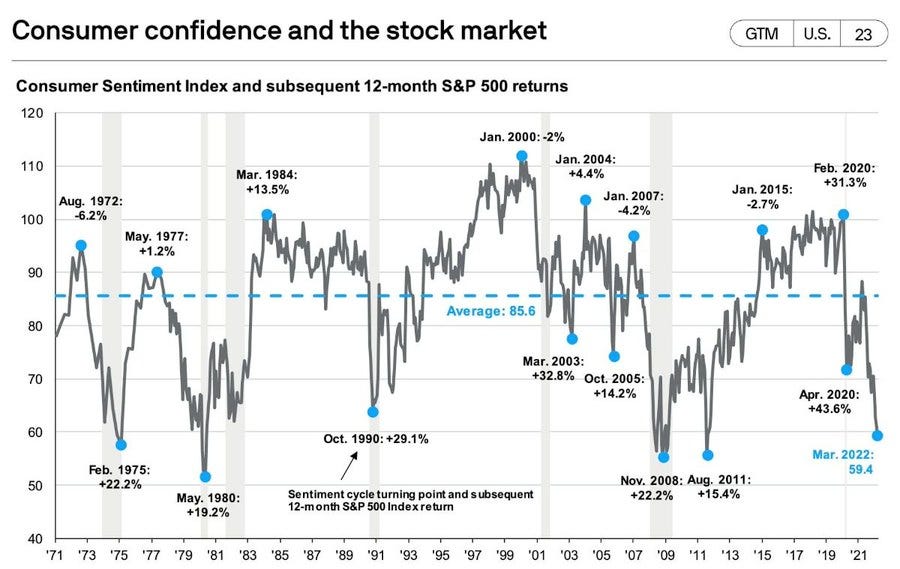

If you look at the stock market history, you can find that the market always gives opportunities to buy assets at a lower price.

However, most people miss out on these opportunities as they are busy following the crowd and afraid to invest when the overall sentiment is bad.

Nathan Rothschild, a 19th-century British financier, is credited with saying that "the time to buy is when there's blood in the streets."

Another meaningful saying "Be fearful when others are greedy, and greedy when others are fearful”, a Warren Buffet’s phrase that encapsulates two extremely counterintuitive concepts:

The higher the price > the higher the risk

The lower the price > the lower the risk

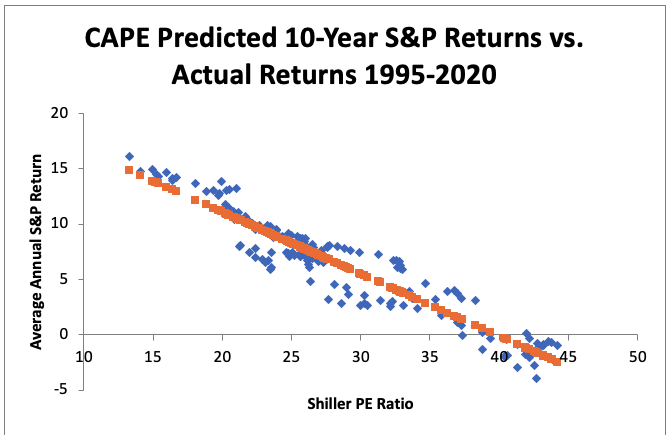

Let’s take the CAPE as an example.

According to Investopedia, the CAPE ratio is a valuation measure that uses real earning per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle.

From 1995 to 2020, we can see that the higher the CAPE the lower the returns and vice versa.

For example:

when the CAPE is below 25, the average annual S&P returns is at least 10%.

when the CAPE is above 30, the average annual S&P returns is at most 5%

So, when prices fall and markets tremble, a contrarian investment could reap high profits.

What about the crypto market?

Fortunately, there are many useful indicators crypto investors can leverage to make contrarian decisions.

One of those is the Crypto Fear & Greed Index. You can find more info about the index here.

If we look at the chart below, we can see the correlation between BTC price and the Crypto Fear & Greed Index.

In the last bull markets (Dec 18, March 20, July 21 and Nov 22), the average Crypto Fear & Greed Index has been around 13.25.

We’re now at 68, a peak level since November 2021.

So…

Is this a bad time to invest in the crypto market?

Not exactly. (By the way, every month we share a market update like this).

Financial markets, especially crypto assets, are driven by irrational decisions all the time.

Therefore, even though the market is probably due for a correction, it could still be a good time for investing.

Here are 3 investing strategies you can apply despite this extremely greedy market:

Tactical trades: leveraging market momentum could be a smart move in order to make some profits in the short term. Two weeks ago, we talked about two complementary trading strategies, while last Saturday we share a small bet idea leveraging Avalanche positive trend.

Undervalued blockchains: Blockchains are platforms on top of which developers can build products and they’re essential for the development of the crypto industry. Undervalued top protocols are therefore evergreen profitable investments. By subscribing to our premium subscription, you get access to our monthly list of undervalued quality blockchains to buy, followed by our ratings and analysis.

Micro Altcoins: even if the market is extremely greed, you’re probably haven’t see the full potential of micro quality altcoin projects in terms of market valuation. Micro altcoin investing carries the potential for massive returns that don’t exist in other asset classes and even in the major tokens. When you invest in a token early, you get in on the ground floor. If the asset takes off, then your modest investment could multiply exponentially. If you’re interested in learning more, you check our article on micro altcoin investing.

That's it for this week. See you next week.

🚨 QUICK REMINDER: LAST 2 DAYS TO GET 50% OFF

Instead of the usual €85 a year, the annual premium subscription will be €42.50 (50% off) until Thu Nov 30.

With this deal, you can get access to all our picks, portfolios, trading ideas and premium tools for just €3.5 a month!

Forward this email to a friend you think might like it.

Thanks for reading!