🏆 How To Put Yourself In The Top 10% Of Investors

5 Investing Principles That Will Change Your Life

Welcome to this week’s free edition of Altcoin Investing Picks.

I hope you enjoyed last week’s issue on Toncoin, on one of the fastest-growing L1s in 2024.

If you’re not a premium subscriber, here’s what you missed this month:

Micro Altcoins

Thursday Tactics

Subscribe to get access to these posts, and every post.

Top Chains Performance (30d)

Gainers ⬆

Mkt Cap: $STRK (+62.7%), $SUI (+59.1%), $SOL (+23.8%)

Total Value Locked: $STRK (+35%), $SOL (+23%), $SUI (+21.7%)

Daily Active Addresses: $SUI (+6,652.6%), $ARB (+132.6%), $APT (+106.5%)

Losers ⬇

Mkt Cap: $MNT (-76.1%), $STX (-52.1%), $SEI (-41.5%)

Total Value Locked: $STX (-18.4%), $SEI (-14.2%), $ADA (-7.4%)

Daily Active Addresses: $MNT (-76.1%), $STX (-52.1%), $SEI (-41.5%)

5 Investing Principles That Will Change Your Life

About 90% of retail investors end up losing money over the long term, and it’s important to figure out what they do wrong so you can do it right.

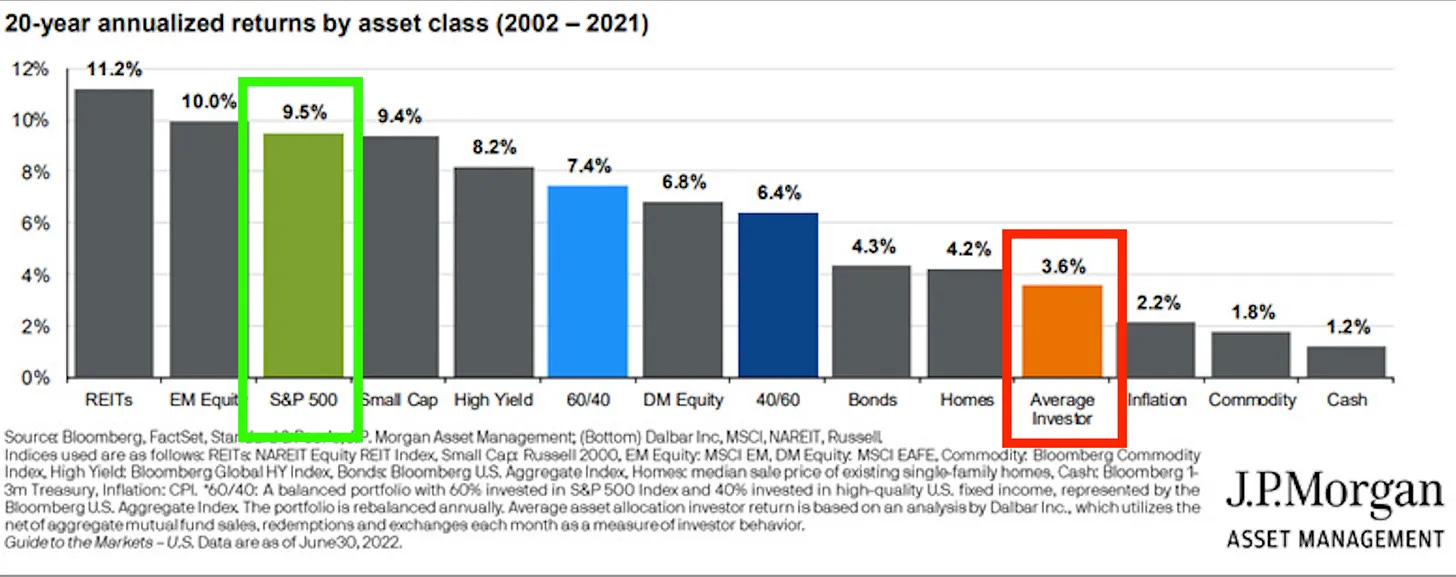

This study by JP Morgan shows that the average investor achieved an annual return of 3.6%, while the S&P 500 returned 9.5% over the past 20 years.

This means that only 10% make money. The good news is that you can do a few simple things to ensure you’re alongside the best of them.

Let’s dive in!

1/ Set the right expectations

Too many investors not only want to make a lot of money, they want to make it fast. But making a lot of money either requires a lot of time or risk. And even if you manage to triple one of your investments in a few weeks, you’re unlikely to repeat it over a few years.

So write down your financial objectives (the range of returns you’re aiming to achieve), your constraints (like the maximum loss you can handle), your edge (anything in your favor that will allow you to produce superior returns), and your timeframe (how long you can realistically devote to managing your portfolio).

Then make sure your objective is realistic given your constraints, and that you’re prepared to handle the losses that will undoubtedly come your way.

2/ Don’t reinvent the wheel

Crypto is already the best-performing asset in history.

Just holding the major cryptos (BTC, ETH & SOL) - can generate 150+ IRR%.

That’s 10 times more than Warren Buffett, considered the greatest investor in history.

3/ Establish a process

An investment process reduces the impact of your emotions, allows you to learn from your mistakes, and it helps keep you on track when times are tough.

By focusing more on the process than on the outcome, you’ll also deal better with the inherent randomness of markets.

Your investment process should include:

a written description of your objectives and constraints

how you’ll generate investment ideas

how you’ll enter and exit your investments (link: 5 signals to check before cashing out 💸)

how much you’ll risk on each position

how you’ll manage the risk in your portfolio

how you’ll analyze your performance and learn from your mistakes.

4/ Be fearful when others are greedy, and greedy when others are fearful

This Warren Buffet’s sentence encapsulates two extremely counterintuitive concepts:

The higher the price > the higher the risk

The lower the price > the lower the risk

Looking at the market history, you can find that the market always gives opportunities to buy assets at a lower price.

However, most people miss out on these opportunities as they are busy following the crowd and afraid to invest when the overall sentiment is bad.

Nathan Rothschild, a 19th-century British financier, is credited with saying that "the time to buy is when there's blood in the streets."

5/ Don’t underestimate the importance of asset allocation

Asset allocation is basically like the master plan for your investment portfolio, deciding where to put your money across different types of assets.

By allocating assets, you are essentially adopting an investment strategy that can balance your portfolio’s risk and reward - keeping in mind your financial goals and investment time horizon.

Historical portfolio returns analysis provides overwhelming evidence that asset allocation is the most important attribute of portfolio performance.

P.S. Whenever you’re ready

If you want to level up your crypto journey, consider subscribing to the premium package.

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

Hope to see you on the inside!

Cheers