👀 Is HYPE the Most Undervalued Altcoin of 2025?

PLUS: Forward Industries acquired nearly 7 million SOL tokens for $1.58 billion

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Revolut’s $75B Valuation: Crypto Is the Engine”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Is HYPE the Most Undervalued Altcoin of 2025?

📣 Forward Industries acquired nearly 7 million SOL tokens for $1.58 billion

📈 Holders with 10K–100K ETH just hit a new all-time high

Let’s dive in!

💡 Insight

Is HYPE the Most Undervalued Altcoin of 2025?

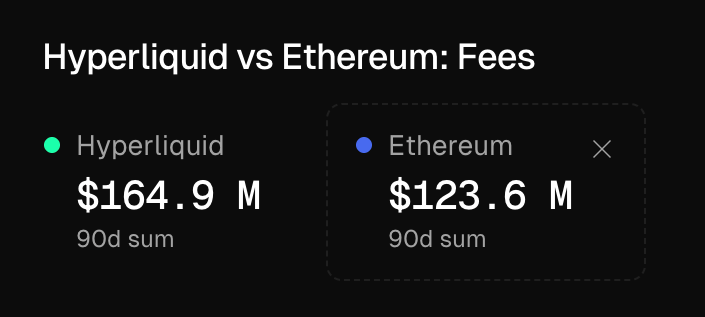

Over the past 90 days, Hyperliquid has quietly racked up $165 million in fees — outpacing Ethereum and Solana.

Yet, the token behind the protocol, HYPE, trades at a massive discount on a fully diluted basis:

88% cheaper than ETH

62% cheaper than SOL

So… is Hyperliquid undervalued?

This week, we dive deep into the story, fundamentals, and upside of what could be crypto’s best product-market fit since Uniswap.

TL;DR – Why HYPE is Gaining Attention

$165M in fees in the last 6 months

$1.95T in trading volume in the past year — more than all decentralized perps competitors combined

Only 11 contributors, no VC allocations, and $1.2B in airdrops to early users

Expanding from perps DEX into full Layer 1 with EVM compatibility

Protocol buys back nearly all fees to reduce token float

The Hyperliquid Playbook: Why It’s Working

No VCs. No Unlocks. Just Users.

Hyperliquid skipped the VC route entirely — no tokens to investors, no cliffs, no dumps. Instead:

31% of tokens airdropped to users (worth $1.2B at launch, now $4.7B+)

Buybacks funded by protocol fees

Foundation bootstrapped with just 6% of token supply

→ Result: Strong community ownership, viral word-of-mouth, and consistent token demand.

The Product is Actually Great

Sub-second finality, low fees, CEX-like performance

100% self-custodial and transparent (public positions, leaderboards, liquidation heatmaps)

Traders can connect with email or wallet — no friction

It’s the first onchain perps platform that doesn’t feel like a downgrade from centralized exchanges.

It’s Becoming a Full L1 (Not Just a DEX)

With the launch of HyperEVM, developers can now build apps that natively access the protocol’s deep order books.

The roadmap includes:

Permissionless perps listings

Tokenized asset bridges (BTC, ETH, SOL)

Lending apps (already $1B TVL combined)

→ It’s no longer just “the best perps DEX.” It’s building an ecosystem.

Our Take

If Hyperliquid were just another perps DEX, we wouldn’t be writing this.

But it’s quickly turning into a high-performance, self-custody trading Layer 1 — with real traction, sticky users, and a token model that’s actually working.

Is it undervalued?

It’s hard to say with a $52B FDV…

But if ETH and SOL can trade at 5–10x those levels with less usage per user, it’s a comparison that will keep resurfacing.

📣 Update

Forward Industries acquired nearly 7 million SOL tokens for $1.58 billion

Forward Industries acquired nearly 7 million SOL tokens for $1.58 billion, making it the largest publicly traded Solana treasury.

The firm bought unlocked SOL tokens via on-chain and open-market transactions.

Shares of FORD rose 1.21% amid the news, now up more than 28% in the last week.

📈 Signal

Holders with 10K–100K ETH just hit a new all-time high

Whales tend to accumulate during periods of low hype and distribute into strengt: this isn’t retail speculation but long-term positioning.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

4 Undervalued Crypto Protocols Generating Real Fees (link)

Best Buys August 2025 (link)

Value Investing Ratings - August '25 (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time