Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every Thursday, we send actionable tips to help you build a profitable altcoin portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

Sui is a smart contract platform for decentralized applications (a blockchain) founded by Evan Cheng, Sam Blackshear, Adeniyi Abiodun, George Danezis and launched in 2022.

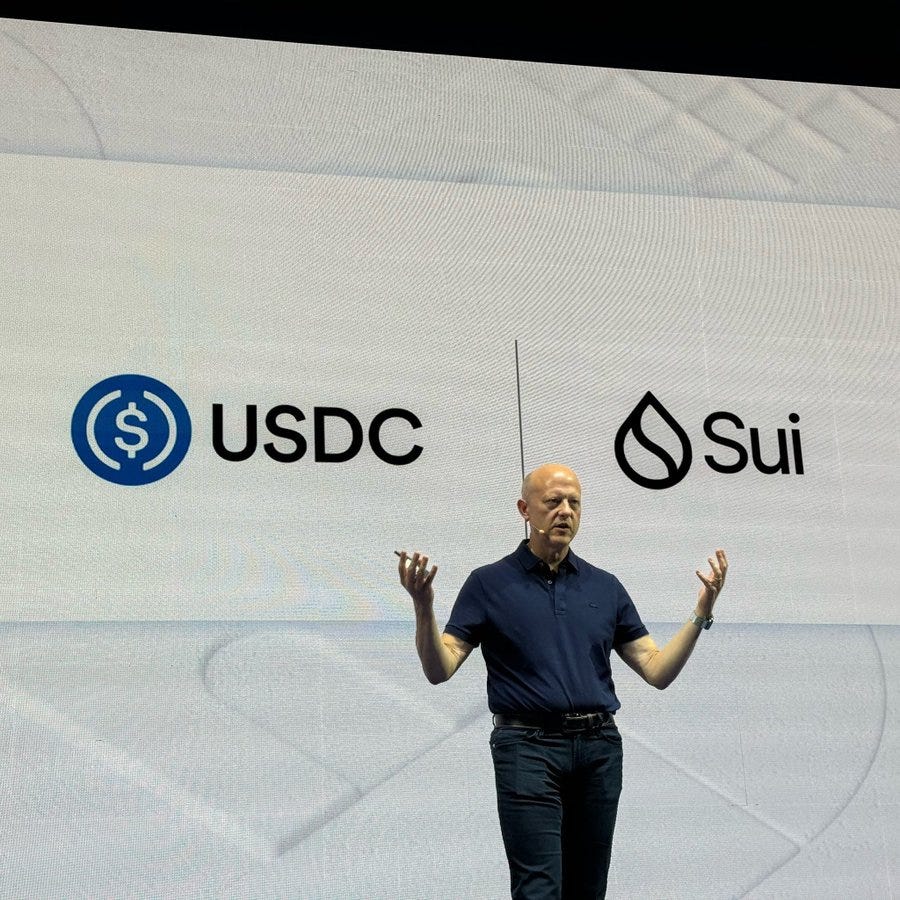

Lately, Circle, issuer of the the second-largest stablecoin by market capitalization, USD Coin, has officially launched USDC on Sui.

Sui is the first blockchain based on the Move programming language to support native USDC. With the arrival of USDC, developers can build with the largest regulated dollar-backed stablecoin in the industry.

But is Sui an interesting token? Let’s find out.

Sui - The Basics

Industry: Smart Contract

Vertical: Layer 1, EVM

Market Cap: $5.15B

24H Real Volume: $631M

X Community: 758K

Current price: $1.87

All-time high: $2.16 (down 15.15%)

Investors: a16z, Electric Capital, Lightspeed Venture Partners, Binance Labs, Jump Crypto, Circle, Coinbase Ventures

Markets: Binance, Coinbase, Upbit, WhiteBIT, Bybit, OKX

Overview

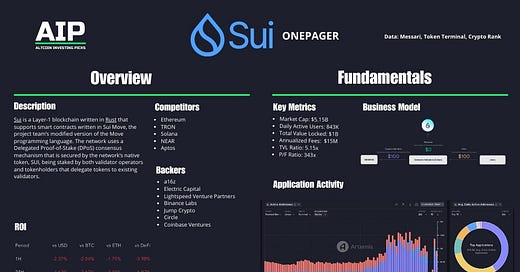

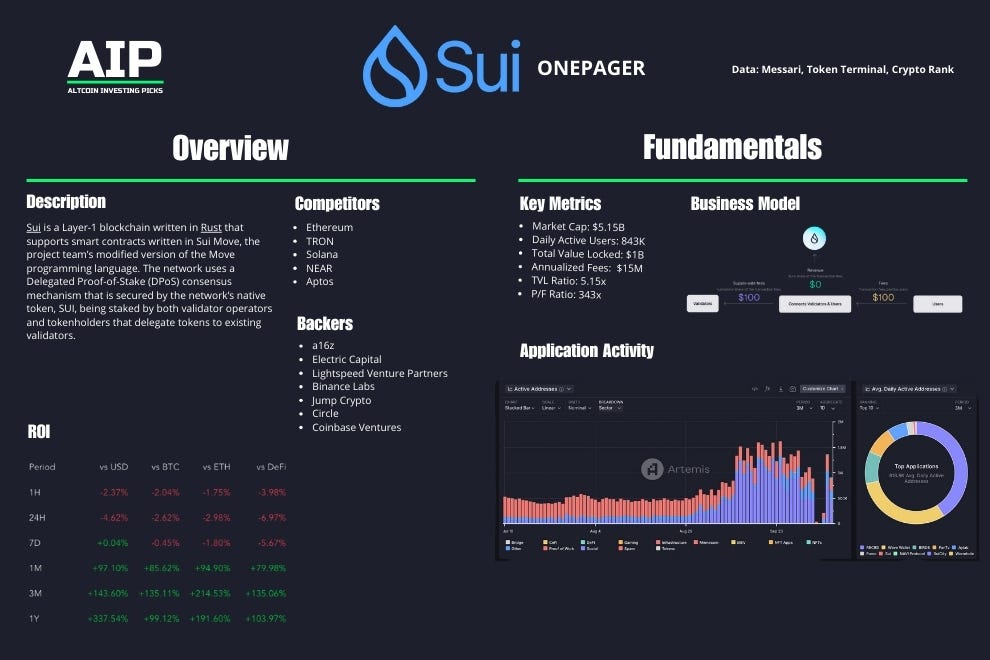

Here’s a onepager with the essentials of Sui:

(Click on the picture to expand)

Tokenomics

Three main types of participants characterize the Sui economy:

Users submit transactions to the Sui platform to create, mutate, and transfer digital assets or interact with more sophisticated applications enabled by smart contracts, interoperability, and composability.

SUI token holders have the option of staking their tokens to validators and participating in the proof-of-stake mechanism. SUI owners also hold the rights to participate in Sui governance.

Validators manage transaction processing and execution on the Sui platform.

The Sui economy is composed of five core components:

SUI: The SUI token is the Sui platform native asset.

Gas fees: Gas fees are charged on all network operations and used to reward participants of the proof-of-stake mechanism and prevent spam and denial-of-service attacks.

Storage fund: The Sui storage fund is used to shift stake rewards across time and compensate future validators for storage costs of previously stored on-chain data.

Proof-of-stake: The delegated proof-of-stake mechanism is used to select, incentivize, and reward honest behavior by Sui Validators and the SUI owners that stake with them.

Voting: On-chain voting is used for governance and protocol upgrades

Now let’s dive into the most important part:

Is SUI a Long-Term Buy?

To understand whether Sui is an attractive opportunity, we will calculate its market potential and expected return.

After that, we will provide a summary score (✅ Buy, ➖ Wait, ❌ Sell) that reflects the investment potential of the asset.

Let’s dive in!