Is the market peaking out?

PLUS: 🚨 Special 40% offer!

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Crypto's Turning Point: Actionable Strategies to Maximize Gains”

If you haven’t yet, subscribe to get access to this post, and every post

In today's newsletter:

💡 Is the the market peaking out?

📣 AI and big data tokens surge 131%

📈 Solana leads all blockchains in daily Net Inflows… but the Ethereum ecosystem dominates 2024

Before we dive in..

Black Friday Offer: Get 40% off our premium subscription!

We’re offering a 40% (!) discount for the people who take a yearly subscription.

This means you only pay €83 instead of €139!

This offer is valid until Sunday, November 24th.

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios.

Access to the micro altcoin watchlist.

Deep dive about micro altcoins with 10x+ potential.

… and immediate access to:

Time is running out — upgrade now to secure your place.

💡 Insight

Is the the market peaking out?

Bitcoin is up about 37% over the last 30 days.

The Fear & Greed Index indicates that we are currently in ‘Extreme Greed’ Mode.

So, the question is: “Is the the market peaking out?”

In this issue, we’ll review some key market indicators to assess where we’re at in the cycle.

MVRV Ratio: 🟢 Undervalued

Bitcoins Market Value is currently 2.79x its "Realized Value”, a proxy for the cost basis of all Bitcoins in circulation — measured by the value of each bitcoin on the network the last time it was moved onchain.

In the last cycle, the MVRV ratio peaked at 7.6. In the prior cycles, it peaked out much higher.

Consumer Trends: 🟡 Fairly Valued

Bitcoin interest on Google is a proxy for measuring the current interest of retail investors. We are still far from 2021 levels but we’re entering in the “retail zone”.

Mayer Multiple: 🟢 Undervalued

The Mayer Multiple measures the difference between the current price of bitcoin and the 200-day moving average. According to Trace Mayer, a value of 2.4 or more is considered a speculative bubble. The current multiple is 1.39.

TVL Ratio: 🔴 Overvalued

The TVL Ratio compares a project’s market cap to its total value locked.

During the 2021 peak, the global crypto TVL Ratio was 15x while now it’s 28x.

November 2021

Market Cap: $2.7T

Total Value Locked: $175B

TVL Ratio: 15x

November 2024

Market Cap: $3.1T

Total Value Locked: $110B

TVL Ratio: 28x

BTC Dominance Ratio: 🟢 Undervalued

BTC dominance is currently at 60%. It was closer to 40% when the cycle peaked out.

Our View

BTC typically takes the energy out of the market in the early stages of a frenzied bull market. I believe that’s the phase we are in right now 👇🏻

📣 Update

AI and big data tokens surge 131%

Artificial intelligence and big data tokens have seen their market capitalization soar by 131.4% since hitting their lowest point of the year on June 8, riding the momentum of Bitcoin’s ongoing bull run.

On Nov. 19, the total market capitalization of AI and big data crypto projects and tokens grew to $42.1 billion, led by $NEAR, $ICP and $RENDER.

📈 Signal

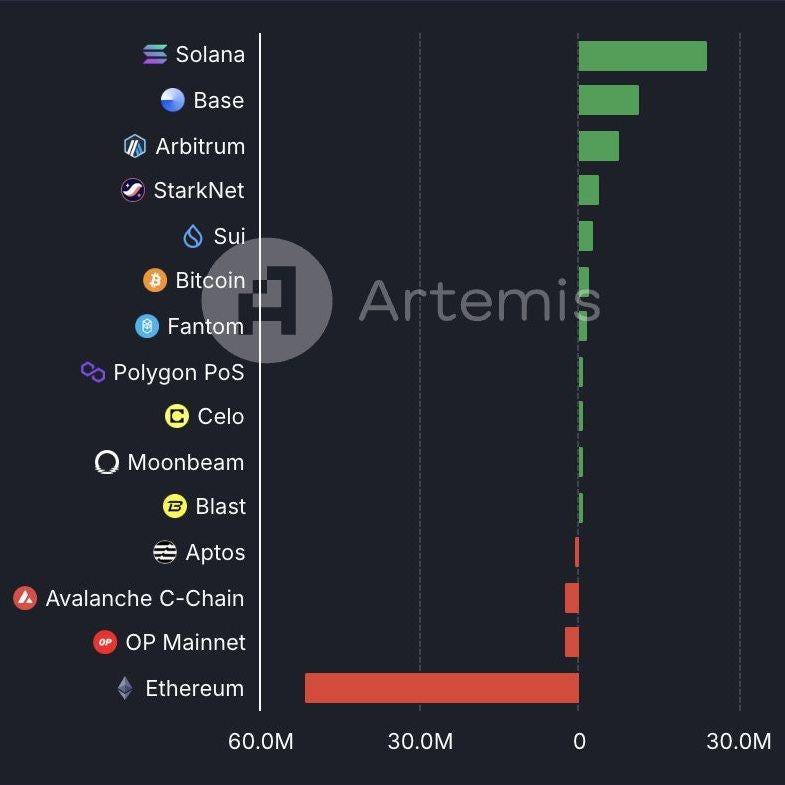

Solana leads all blockchains in daily Net Inflows…

1D Chart

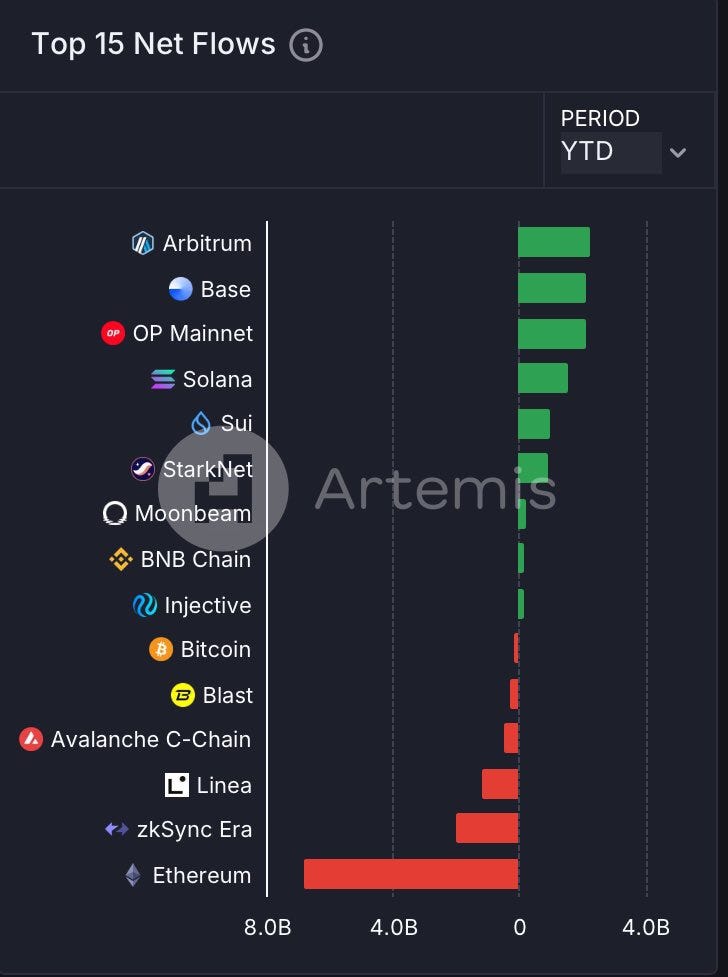

… but the Ethereum ecosystem dominates 2024

YTD Chart

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

That’s all for today!

Cheers