Is This the Start of Altseason 2.0?

PLUS: Over 92% of BlackRock's BUIDL fund is tokenized on Ethereum

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “ETH Isn’t Dead — It’s Just Waiting for the Fed”

If you haven’t yet, subscribe to get access to this post, and every post.

In today's newsletter:

💡 Is This the Start of Altseason 2.0?

📣 US 30-Year Yield Hits Highest Since 2003 After Moody’s Downgrade

📈 Over 92% of BlackRock's BUIDL fund is tokenized on Ethereum

Let’s dive in!

💡 Insight

Is This the Start of Altseason 2.0?

For the first time since Q4 2023, we’re seeing sustained rallies across altcoins and memecoins. And something critical just happened: BTC dominance may have peaked.

If this is the beginning of true altseason, there’s still a long runway ahead.

Signals

We’ve been here before. And there are 5 key signs that tell us altseason might be loading:

Late-stage cycle dynamics. Risk starts rotating outward.

BTC dominance peaks. Historically around 65–70%—we’re hovering there now.

Shift from QT → QE. Liquidity wants out of bonds and into high-beta assets.

Rising ETH/BTC ratio. Smart money rotates before retail notices.

Retail reawakens. We’re already seeing this in memes, Discords, and volume.

Right now, we’re still early. ETH/BTC is just 0.024. ETH is trading at a 46% discount from ATHs. The Fed is still doing QT.

But the 20% move ETH made last week rhymes with January 2021—when ETH jumped 68% in 7 days… and never looked back.

Back then, ETH/BTC ran from 0.03 → 0.07 in four months. ETH/USD followed with a 370% rally.

That spark lit the match for NFTs, metaverse tokens, DeFi 2.0, and alt L1s. Altseason went full send.

How We’re Playing This

We’re not aping into everything. But we are positioning now—before retail floods in.

Here’s our playbook:

✅ Avoiding BTC. It's unlikely to outperform from here. Focusing on ETH, SOL, etc.

✅ Targeting narratives (e.g. SUI, VIRTUALS), tokens with fundamentals (e.g. Raydium, Pendle)

✅ Leveraging memes (e.g. BONK, PEPE)

But Let’s Be Real — There Are Risks

This setup could break bullish. But if it doesn’t, you need to be ready.

🚧 Key risks we’re watching:

BTC must make new highs

Rising yields: could weigh on valuations in crypto and equities.

Stablecoin legislation blocked

So no—we’re not “all in.” But the setup here is asymmetric: modest exposure with potentially outsized upside.

👉 Want our full analysis and picks? Join Altcoin Investing Picks

📣 Update

US 30-Year Yield Hits Highest Since 2003 After Moody’s Downgrade

This is because investors now forecast a longer term term of elevated inflation.

Moody’s announced Friday evening it was downgrading the US to Aa1 from Aaa, reinforcing Wall Street’s growing worries over the nation’s fiscal outlook.

📈 Signal

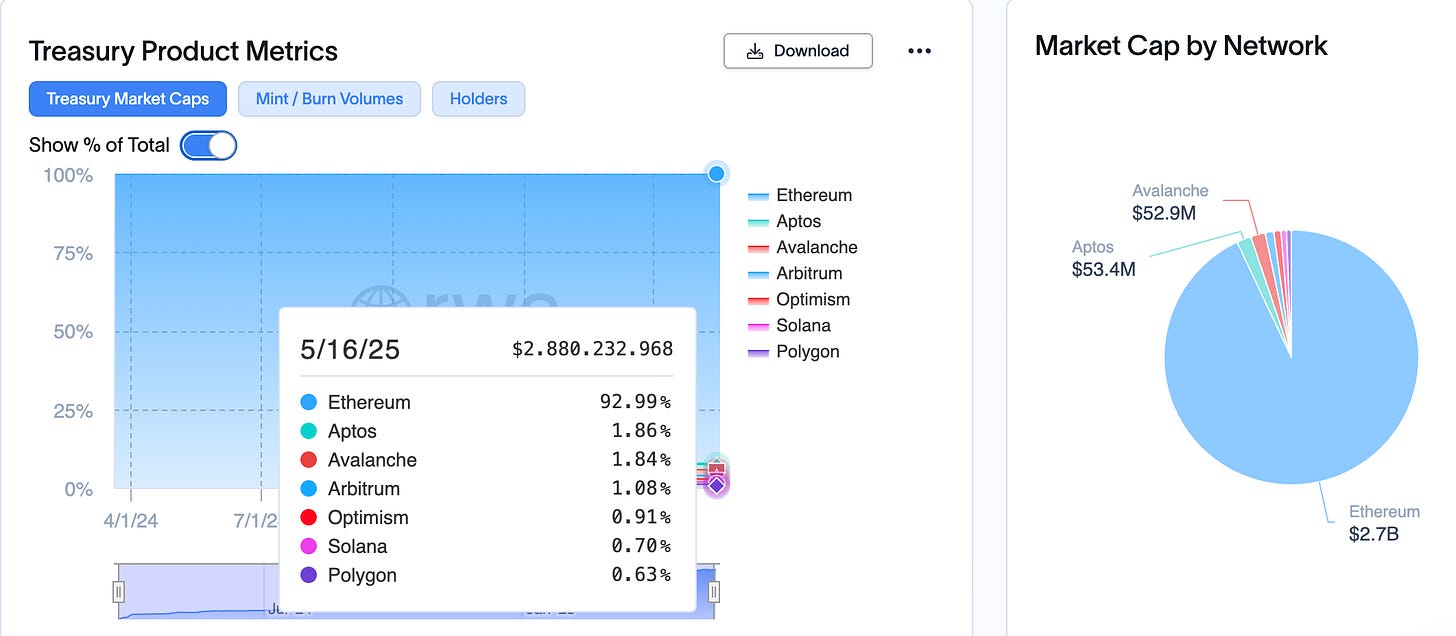

Over 92% of BlackRock's BUIDL fund is tokenized on Ethereum

Ethereum remains the undisputed leader in the RWA sector.

Are you buying ETH?

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

Thanks for reading!

See you next time