📈 Market Trends - May 25

Actionable metrics highlighting the current trends of the crypto market and broader economy

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter we’ll track actionable metrics highlighting the current trends of the crypto market and broader economy.

This data is an educational resource to better understand market cycles. While these trends often correlate well with crypto performance, the analysis should not be used as a short-term trading strategy.

Let’s dive in!

Asset Class Returns (YTD)

Indicator of the Month

Coinbase Premium → 🟢

Coinbase Premium is the gap between Coinbase Pro price (USD pair) and Binance price(USDT pair).

Coinbase Premium is one of the indicators that shows a sign for "whale accumulation”:

Positive Coinbase Premium = institutions are bullish (and buying)

Negative Coinbase Premium = institutions are bearish (and selling)

Macro Trends

Interest Rates (Market Expectations) → 🟢

If the US economy slows enough, the Fed will likely step in with rate cuts of their own to stimulate growth.

GDP (U.S.) → 🟠

The U.S. economy contracted at an annualized rate of 0.3% in the first quarter of 2025, marking the first decline since the first quarter of 2022. This was a sharp reversal from 2.4% growth in the previous quarter and came in below market expectations of 0.3% growth, according to an advance estimate.

Inflation (U.S.) → 🟢

The annual inflation rate in the US eased for a second consecutive month to 2.4% in March 2025, the lowest since September, down from 2.8% in February, and below forecasts of 2.6%.

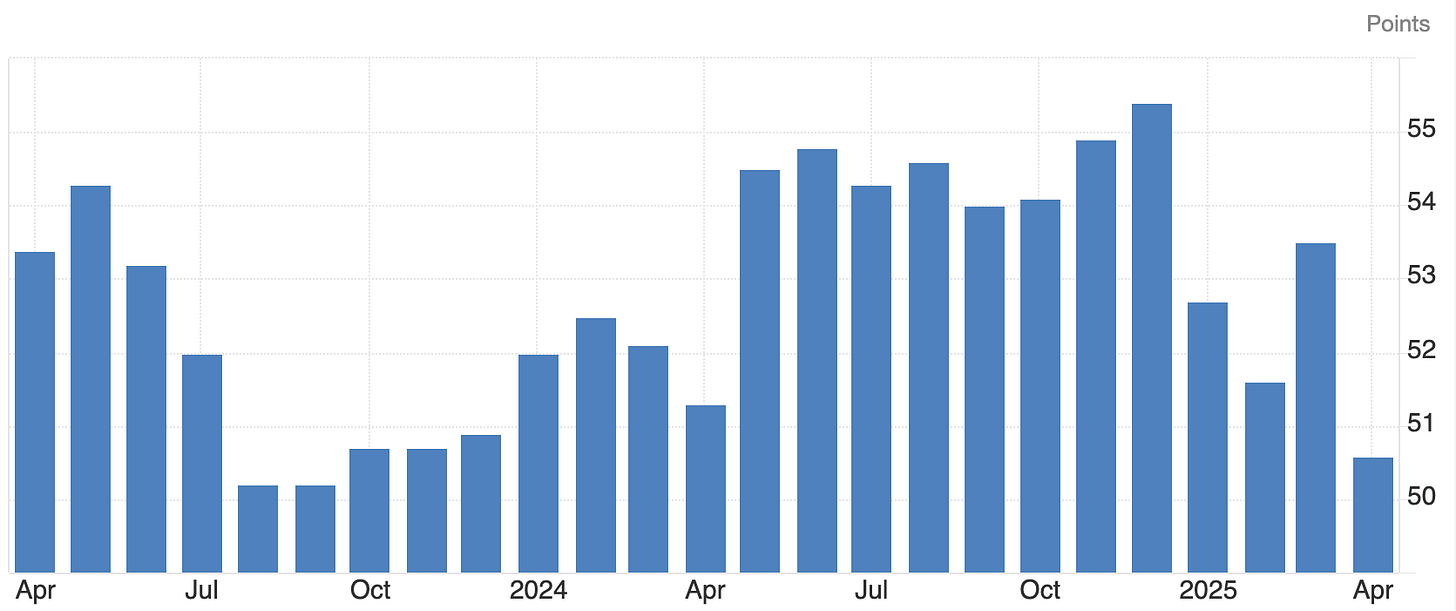

Composite PMI (U.S.) → 🟡

The S&P Global U.S. Composite PMI was revised down to 50.6 in April 2025, from a preliminary estimate of 51.2 and well below March’s reading of 53.5. The latest figure signaled the weakest expansion in the U.S. private sector since September 2023, with demand growth reportedly constrained by policy uncertainty, particularly around trade.

The index is based on data collected from a representative panel of over 800 companies and follows variables such as sales, new orders, employment, inventories and prices. A reading above 50 indicates expansion in business activity while below 50 points to contraction.

Unemployment Rate (U.S.) → 🟠

The US unemployment rate was at 4.2% in April 2025, the same as in March and in line with market expectations.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts: