Modular Blockchains

Hey everyone, The Altcoin Investor here 👋🏻

Welcome to our free weekly newsletter where you get crypto insights, trends, and investment ideas.

I hope you enjoyed last week’s issue “Where It’s All Going? Market Fundamentals, Trends & Catalysts”.

Today I want to talk about Modular Blockchains.

Let’s dive in👇

The Basics

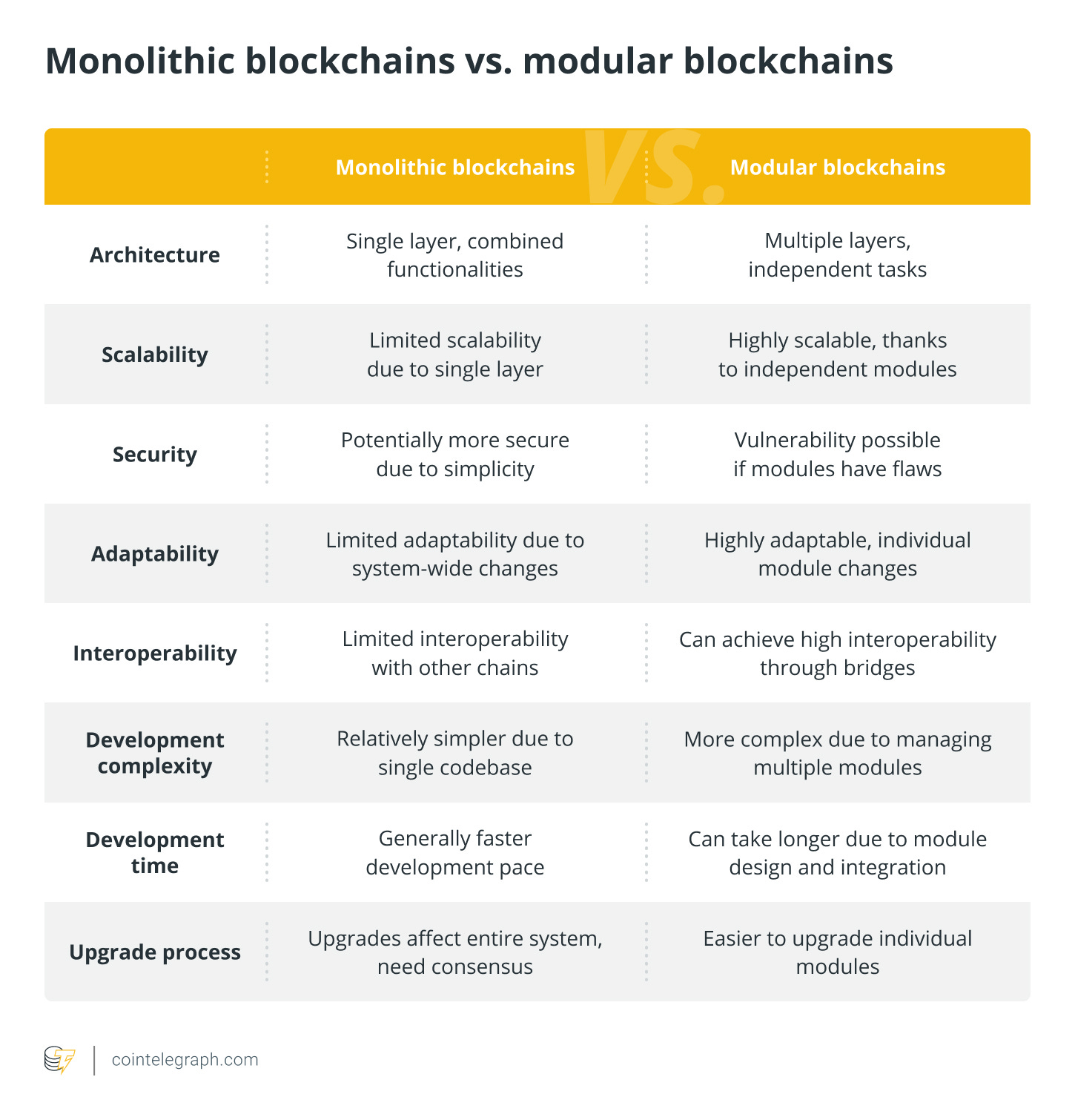

The first approach to building blockchains was a monolithic design where a single blockchain does everything.

In monolithic chains like Bitcoin and Ethereum, the same set of validators handles all the functions: consensus, execution, settlement and data availability.

On the other hand, the idea of a modular blockchain is that it can specialize in a couple of functions instead of trying to do everything.

Opportunities

The thesis is simple: by disaggregating the core components of a Layer 1 blockchain, modular blockchain can make 100x improvements on individual layers, resulting in a more scalable, composable, and decentralized system.

Modular blockchain architecture theoretically provides some major advantages when compared to monolithic designs.

Scalability is improved upon greatly with a modular design. The offloading of resource-intensive tasks to separate layers allows for greater overall throughput with no cost to decentralization. This high throughput is especially noticeable on Ethereum-based solutions, where transaction costs can get quite high during periods of network congestion.

Flexibility: Modular blockchains offer developers the freedom to mix and match pre-built modules or create their own, tailoring solutions to specific project requirements.

Interoperability → Modular base layers are also designed to be highly flexible and promote interoperability amongst other layer one and layer two chains. This allows developers to run the EVM or other virtual machines of their choosing. Through modularity, blockchains and wallets become more interoperable due to layer flexibility, which can allow for the development of universal applications and reduce overall friction for users.

The Modular Ecosystem

The modular approach represents a big trending narrative in the crypto market.

Modularization breaks down the blockchain into individual components, allowing the blockchains to scale beyond their current limits.

Execution takes place on Layer 2s like Optimism and Arbitrum, which execute and send batched transactions to the parent chain. Even Layer 2s are becoming modular, as seen in the OP Stack, which modularizes all elements of a Layer 2 chain into standardized open-source modules, which developers can use to build new chains.

Layer 1s like Celestia are also adopting a modular architecture to their blockchain. In the case of Celestia, it focuses on consensus and data availability, optimizing storage.

Here are some modular blockchain tokens that I'm paying attention to:

Execution

Optimism ($OP)

Starknet ($STRK)

Arbitrum ($ARB)

AltLayer ($ALT)

Settlement/Consensus

Aptos ($APT)

Sui ($SUI)

Celestia ($TIA)

Evmos ($EVMOS)

Dymension ($DYM)

Data Availability

Celestia ($TIA)

Ternoa ($CAPS)

Neutron ($NTRN)

And that’s it for today.

If you enjoyed reading this issue, subscribe to the newsletter for more content like this in the future.

Whenever you’re ready

If you want to level up you crypto investment strategy and and avoid costly mistakes, consider subscribing to the premium package.

Here’s what you’ll get every month:

4x+ Micro Altcoin Picks: micro projects we think are willing to be tomorrow's market leaders.

2x+ Tactical Trade Ideas: short-term bets to make profits from narratives and trends.

1x Value Investing Analysis: undervalued blockchains we think will outperform the market.

1x Monthly Market Analysis: our view on the current market situation supported by data-driven analysis.

Thanks for reading!

The Altcoin Investor