Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Will Bitcoin reach $70K in October?”

If you haven’t yet, subscribe to get access to this post, and every post

In today's newsletter:

💡 State of DEX: Solana Edition

📣 BTC hits $70K!

📈 BTC is up ~400% since hitting its cycle low

Let’s dive in!

💡 Insight

State of DEX: Solana Edition

In this article, we talked about the state of DEX, primarily focusing on Ethereum’s activity.

In today’s issue, we dive into the Solana ecosystem.

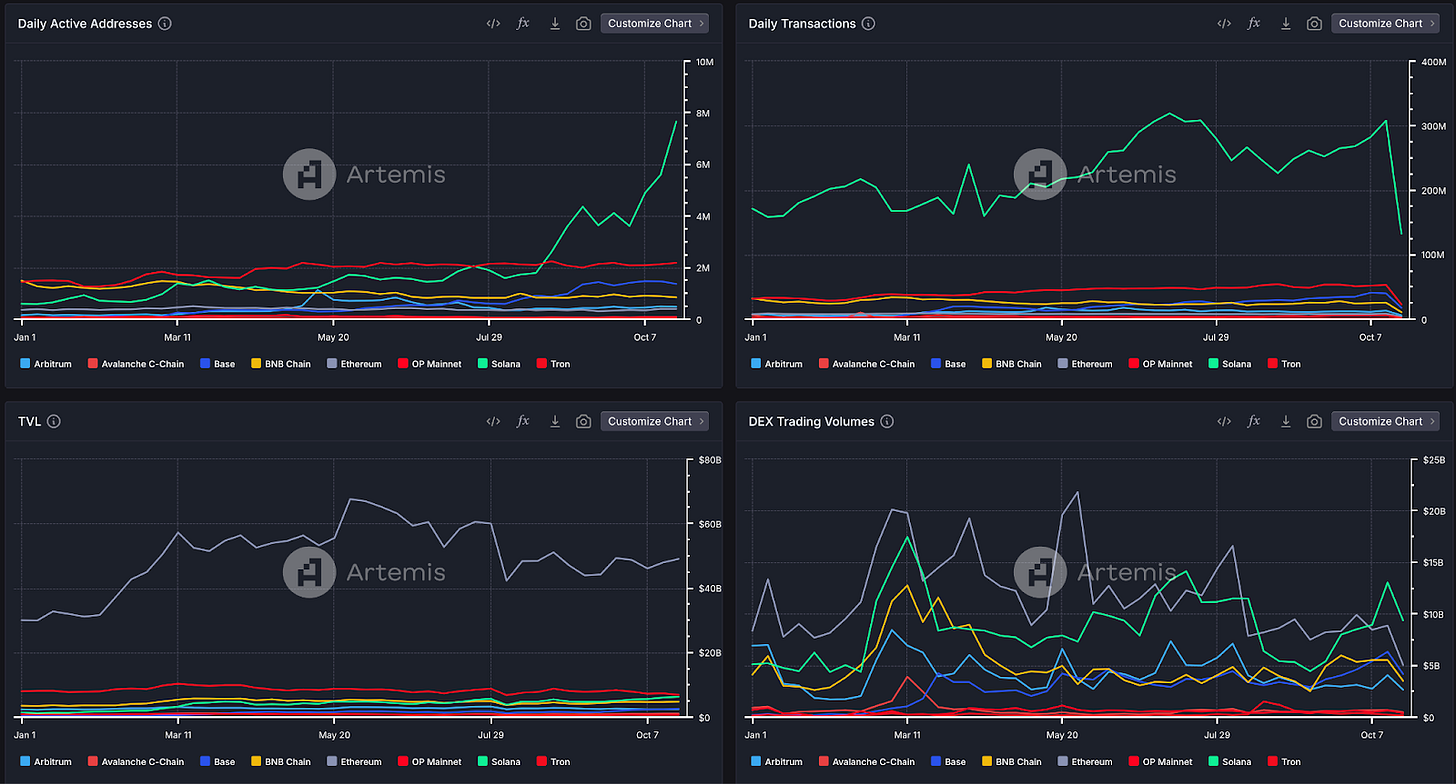

Solana has been, by far, the most used Layer 1 this cycle, and continues to dominate amongst the other L1 in terms of trading activity.

Solana continues dominating in metrics relating to user activity, such as Daily Active Addresses, Daily Transactions, and DEX trading volumes:

This means that DEXes on Solana have been doing extremely well - more traders means more fees, which means more revenue to the protocol.

Raydium

Launched in 2021, Raydium is an automated market maker (AMM) built on Solana, enabling permissionless pool creation, lightning-fast trades, and ways to earn yield. The key differentiating factor about Raydium lies in its structure - Raydium was the first AMM on Solana, and launched the first orderbook-compatible hybrid AMM in DeFi.

Raydium currently offers three different type of pools, namely:

Standard AMM Pools (AMM v4)

Constant Product Swap Pools (CPMM)

Concentrated Liquidity Pools (CLMM)

For every swap that occurs on Raydium, a small fee is charged depending on the specific pool type and pool fee tier. This fee is split and goes to incentivizing liquidity providers, RAY buybacks, and the treasury.

Today, Raydium ranks 1st amongst the other Solana DEXes, doing the most volume out of every one of them. Raydium dominates 60.7% of total Solana DEX volume - and this is because Raydium allows all sorts of activity to be done on them - from memecoins, to stablecoins.

In fact, Raydium’s popularity can also be attributed to the resurgence of memecoins on Solana, especially by PumpFun, a memecoin launchpad that has made over $100mm in fees since inception earlier this year.

🚀 Take Action

Solana wants to become the king of "consumer" blockchain—a fast, cheap, and mobile-friendly alternative for everybody.

The Opportunity

The Solana ecosystem features a growing set of projects across many sectors, including DeFi, consumer, DePIN, payments, and privacy.

We have selected the best Solana Ecosystem tokens we think will outperform (including Raydium), followed by the related sector, number of X followers, and our buy recommendation.

📣 Update

BTC hits $70K!

BlackRock’s IBIT led the inflows, with $315 million flowing into the product.

Bitcoin traded up 4.75% over the past 24 hours at $71,200, reaching a new high since June.

📈 Signal

BTC is up ~400% since hitting its cycle low

Bitcoin has completed four cycles that each included both bull and bear markets. In this chart, we see how the current market cycle, which began in 2022, compares to the previous cycles.

In the current cycle, BTC is up ~400% since hitting its cycle low in November 2022.

The current cycle most closely resembles the cycle from 2018-2022, which saw BTC hit a high that was up 2,000% from the cycle low.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our most popular premium posts:

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

That’s all for today!

Cheers