This is scaring the heck out of me…

Everything is About to Change…

Dear reader,

We have an important message from our publisher.

Please take a moment to review it.

Everything is About to Change…

Everything

I’m worried about my future. I truly am. Everything’s about to change for me. But I have a plan…

See, a whole lot of financial professionals, including myself, may soon be out of a job. We’re quickly becoming obsolete. Technology is replacing us.

Now, before I, Luke Hodgens, Director of Publications at Alpha Edge Media, get into what’s happening (and what my plan is) …

I know we’ve got a lot of new subscribers. I believe our newsletters are growing by well over a thousand new readers a week. Which is fantastic.

But, because of our rapid growth, some of our new readers may not know what’s coming down the pike, while long-time readers probably have at least some idea.

So, here’s a quick recap:

On January 2, I wrote to readers about an all-hands-on-deck meeting that our parent company, Nasdaq-listed Aether Holdings, called.

In that meeting, it was revealed to me and the rest of the editorial team here at Alpha Edge Media, that a new trading technology the Fintech arm of the company has been working on… would soon be ready for testing.

Since that meeting, the tech has been tested. Over and over again.

Now, I’m going to show you plenty of examples of these tests in just a second, but please remember to come back to this message, because what comes next is very important.

You can see testing results of the tech HERE…

HERE…

HERE…

And HERE.

Now that you’ve reviewed those examples, especially the real-money trades, you’ll see why I’m worried about my future.

If technology like this can spot, pinpoint even, investing ideas and buy/sell areas better than financial professionals can…

Well, you get the picture.

So, what’s my plan to deal with obsolescence?

Well, for one, this isn’t a “woe is me” article today. I actually see this as an amazing opportunity for me.

Because no matter what happens, I’ll still have access to the trading tech highlighted in those links above…

And I’ll have the ability to utilize it on a full-time basis should I choose to. Even though it looks like I could make a killing in the market while participating only a couple hours a day.

But, for now, I’ll continue to find great stock ideas…

While heavily relying on the tech to better identify opportunities. And, of course, I’ll continue to bring those ideas to you.

But…

I know you want access to the technology too. And I don’t blame you. You’ve seen the real-money trades. You’ve seen how much could be made, and you know the tech’s that good.

So…

As promised, you’ll be given the opportunity to access the entire tech suite, all the indicators, all the algorithms… NEXT WEEK!

We call it SentimenTracker. And right now, the Fintech team is putting finishing touches on it. Once I get the go-ahead, I’ll email you the invite. It’s going to be a very exclusive invite.

You’ll see why. So, keep an eye on your inbox…

Because it’s coming.

Hershey Is Ripping…

Here’s When to Add More

We began covering Hershey (NYSE: HSY) back in June with the stock was trading around $170.

We made a case as to why readers should seriously consider adding HSY to their long-term portfolios, based on our thesis on cocoa prices.

Then, months later in mid-December, we suggested adding more when we wrote you…

“We’ve been convinced that the collapse in cocoa will lead to better margins for the company, and better stock performance for its investors…

“Now, better late than never, Morgan Stanley has shown up. Acknowledging our investment thesis in HSY…

“Raised it grade on HSY from “equal weight” to “overweigh”, a buy rating…

“Giving it a price target of $195 to $211 (we think it could go higher).”

Turns out were right.

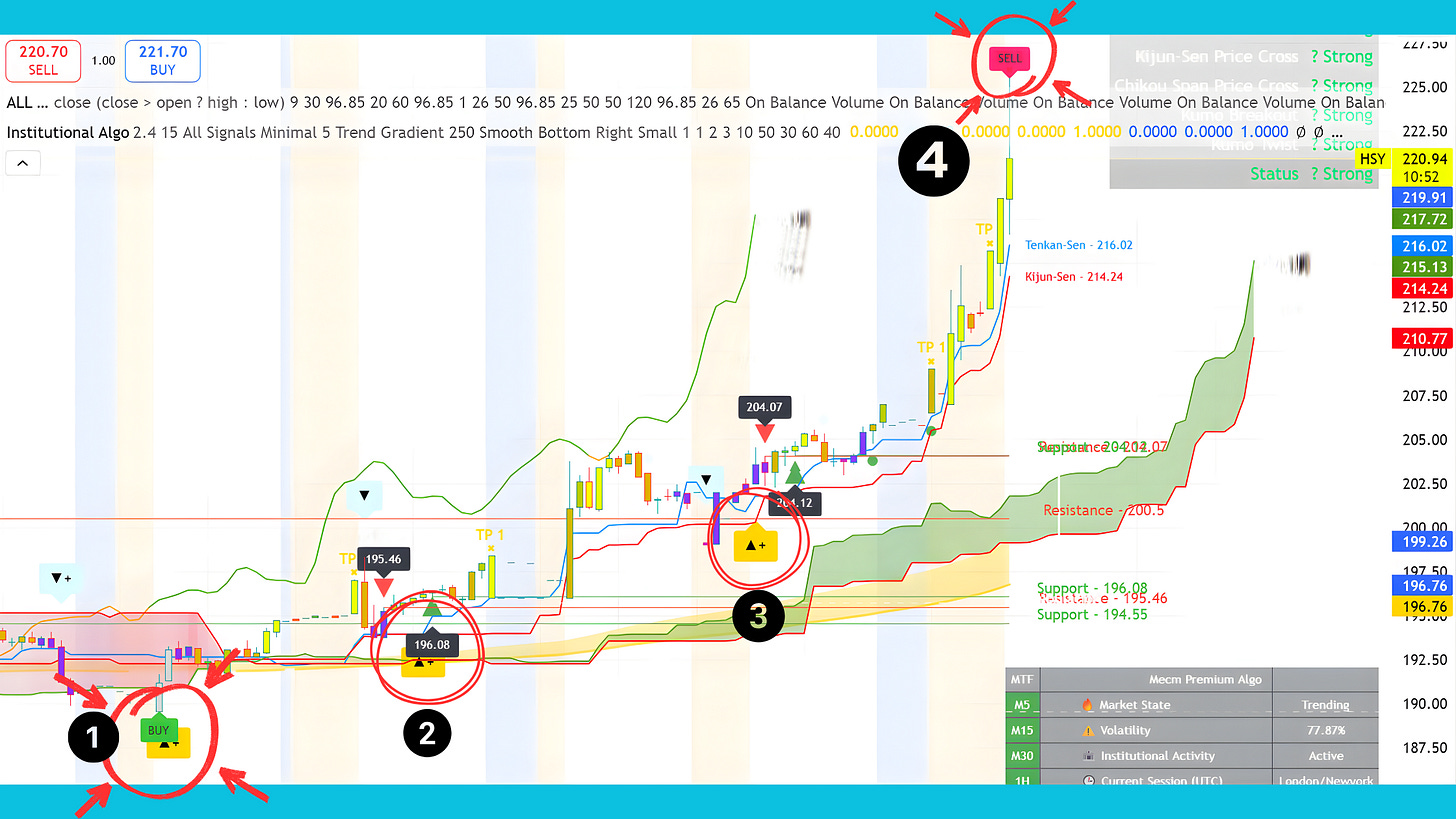

Have a look at this chart…

This shows cocoa prices over the last couple of years. The green circled area is where we first suggested buying Hershey stock.

Not only did cocoa prices collapse since then, but the stock has now gone even higher (as we thought it would) than Morgan Stanley’s target price. As of this writing, Thursday, the stock breached $225/share.

Of course, it’s latest earnings (released Thursday morning) was a blowout…

And it’s now up as much as 32% (while paying a nice dividend) since we first brought it to your attention.

So…

If you’re a long-time reader, and you took advantage of our original analysis, congrats.

But if you’re a new subscriber, you might not have HSY in your long-term portfolio yet. And you may be thinking, “is now the time to add it?”

Well…

Have a look at this chart, it’s going to tell you when the next buy opportunity may be:

This is HSY stock over the past week, as of about 9:45 Thursday morning. It’s up about 16% in just 5 trading days. As of noon, it’s still trading around $221.

Now, remember that 16% and have a close look at the red circle with the #1 next to it. Do you see the green “buy” signal and the yellow “up +” arrow? They’re piled atop each other.

Those are two of my favorite indicators that our technology, SentimenTracker, alerted to.

They’re the All-in-One indicator and the Institutional Algo. Yes, the same tech (as well as Edison’s preferred indicators you’ll see below) that you’ll be getting invite-only access to, next week.

Now, have a look at #2. That’s the Institutional Algo alerting again…

Same as #3, another Institutional Algo alert.

These indicate a likelihood of institutional buying continued… as the stock kept rising.

But…

Look at #4. That’s our All-in-One indicator saying it’s time to sell. That alert popped up at about 9:35 or so this (Thursday) morning.

As of this writing, noonish on Thursday, the Institutional Algo hasn’t shown a sell signal yet, but even if it does by the time you read this…

We’re holding HSY for the long-run. Because we like the stock, it’s dividend payments, and we think cocoa may have even more downside ahead.

Now, for new subscribers, those who don’t have HSY in their portfolios but want to add it…

The best time, in our opinion, to add HSY is when both the All-in-One indicator and the Institutional Algo signal buys at nearly the same time again, like they did last Friday.

So, once you get ahold of SentimenTracker, keep an eye on this stock and consider adding when those two algos/indicators alert closely together.

Because it means a potential buy opportunity for you, in real-time. And the potential for another big run.

Oh, if you’re a swing trader, the All-in-One and Institutional Algo could be used for HSY too. Great buy points and great sell points as illustrated by the 16% in five trading days during the alert window.

And if you’re a crypto trader, well… you get the idea.

Now, like I said earlier, the Fintech team is putting finishing touches on SentimenTracker, before they allow us to share it with you.

Once I get the go-ahead, sometime next week, I’ll email you the exclusive invite. So, keep an eye out.

More Real Money Trades by Edison

In total, there’s 13 algos/indicators in SentimenTracker. I like the All-in-One Indicator and the Institutional Algo. Edison likes the MOM_Algo_V15 & the Momentum Ultima +.

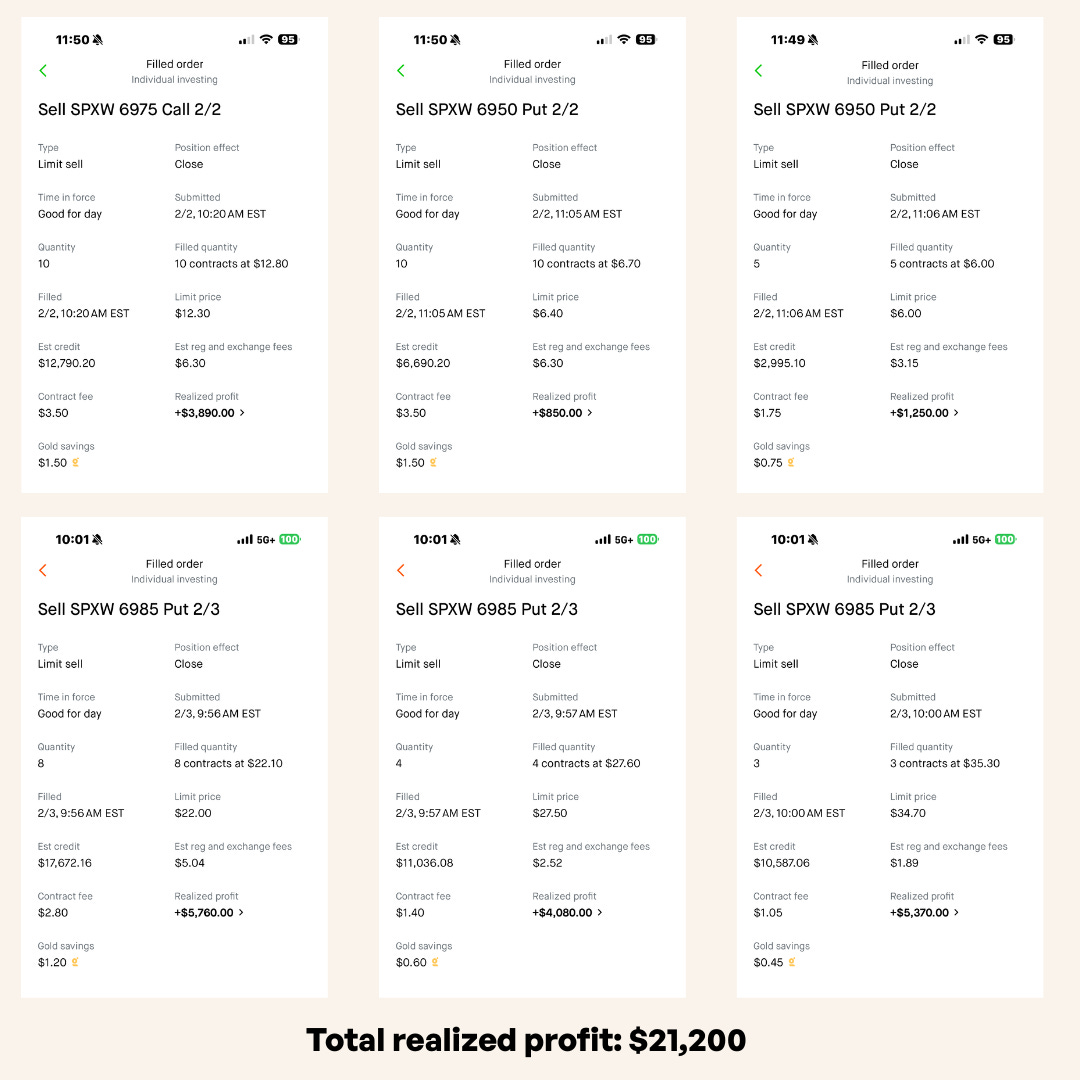

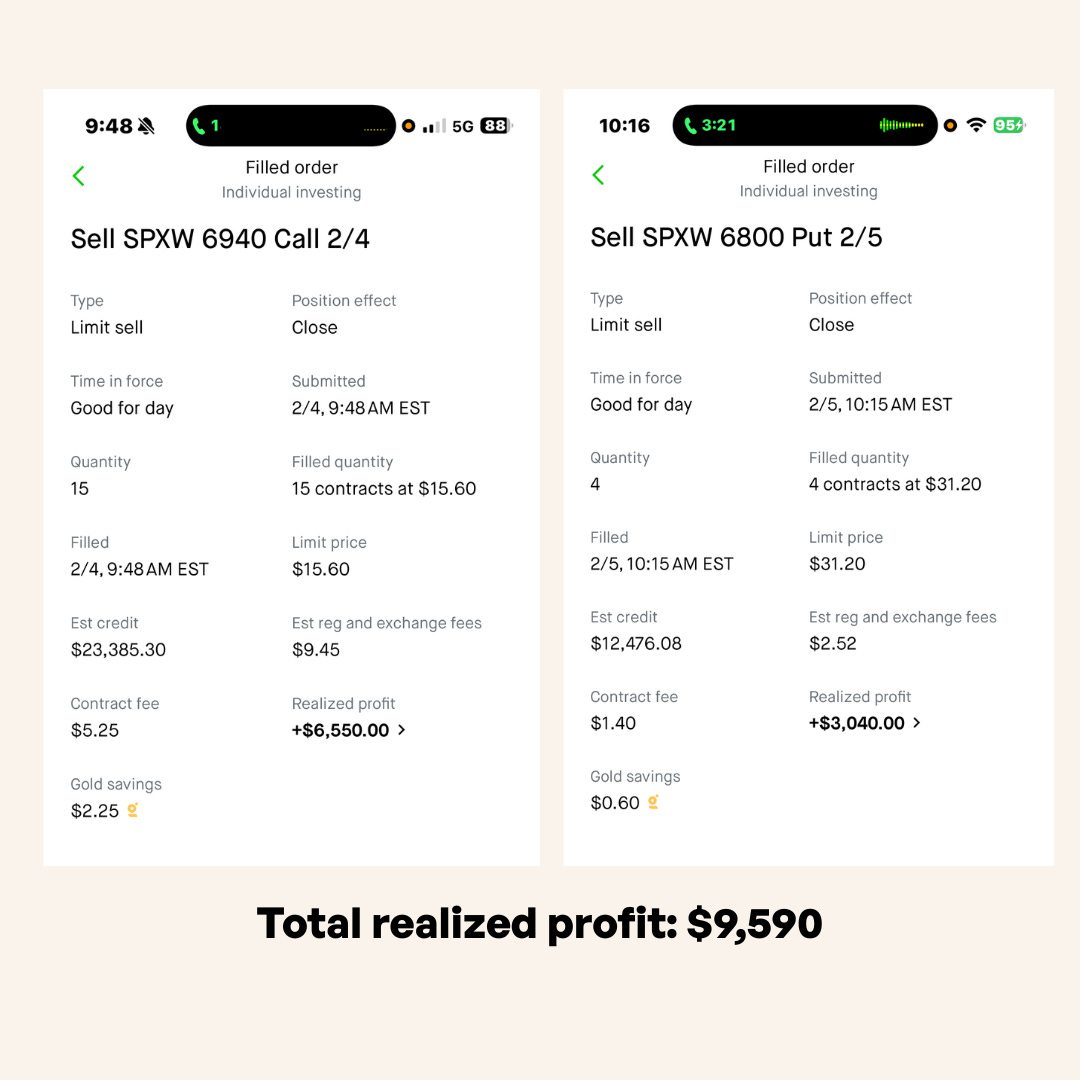

Here’s some of the trades he shared with me this week using his preferred algos…

Of course, these realized profits are insane. And Edison has to have some losing trades, right?

Nobody, I repeat, nobody wins every time…

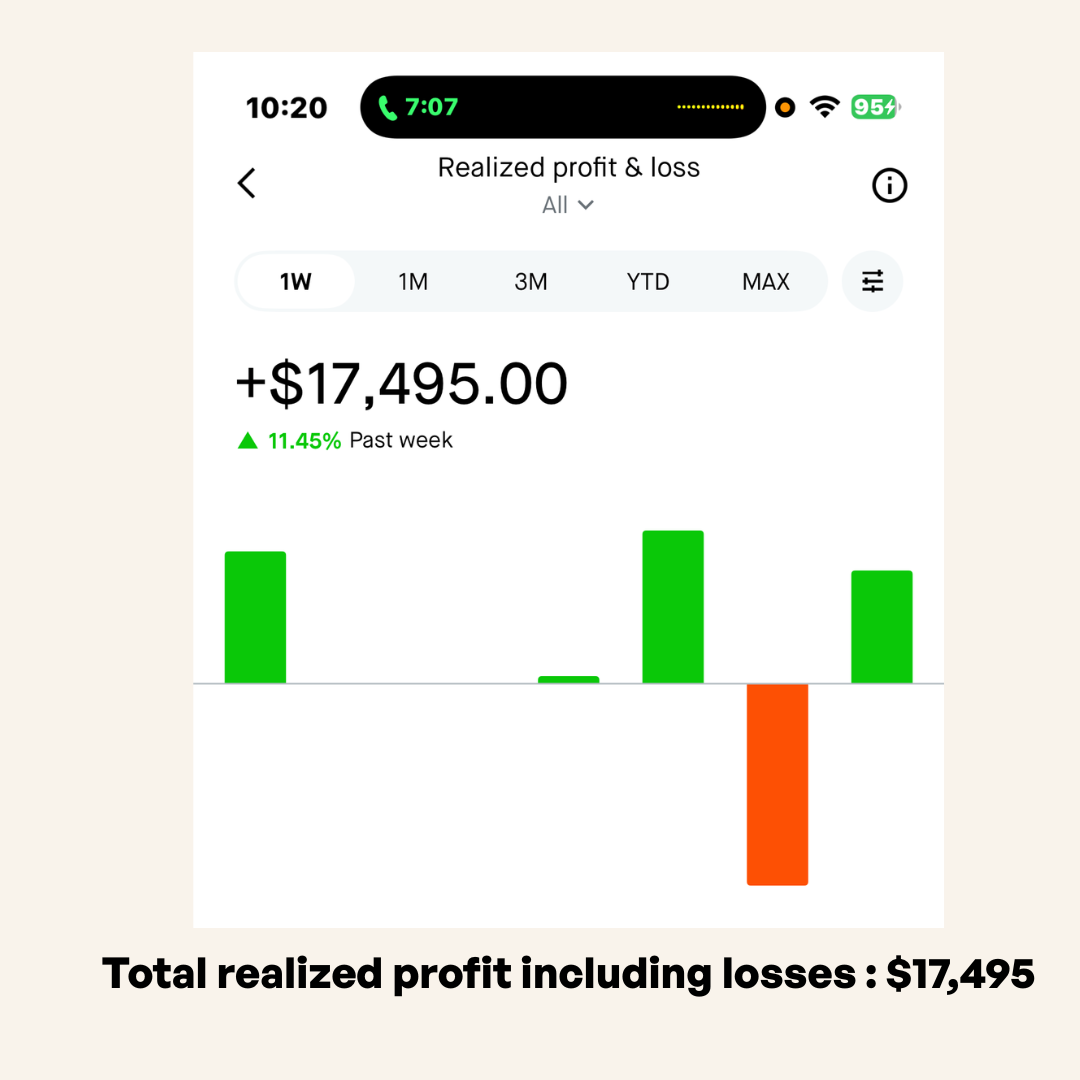

So here’s his P/L for the week (so far as of Thursday morning) …

Can’t win ‘em all.

But now you can see why I’m not all that concerned about my future!

Have a great weekend,

Luke Hodgens

Director of Publications

Alpha Edge Media