🔥 USE THIS PLAYBOOK TO OUTPERFORM THE MARKET IN 2025 (1/2)

Crypto cycles will not last forever and we very well could be on our last one

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every Thursday, we share actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

We strongly believe crypto prices will likely top within the next 12 months.

However, crypto cycles will not last forever and we very well could be on our last one.

In today’s report, we’re going to share our full investing playbook for 2025:

Thesis & where we are in the cycle

The right mindset

Our asset allocation & picks

How to maximize your ROI ( + buy/sell indicators)

Let’s dive in!

Where We Are in the Cycle

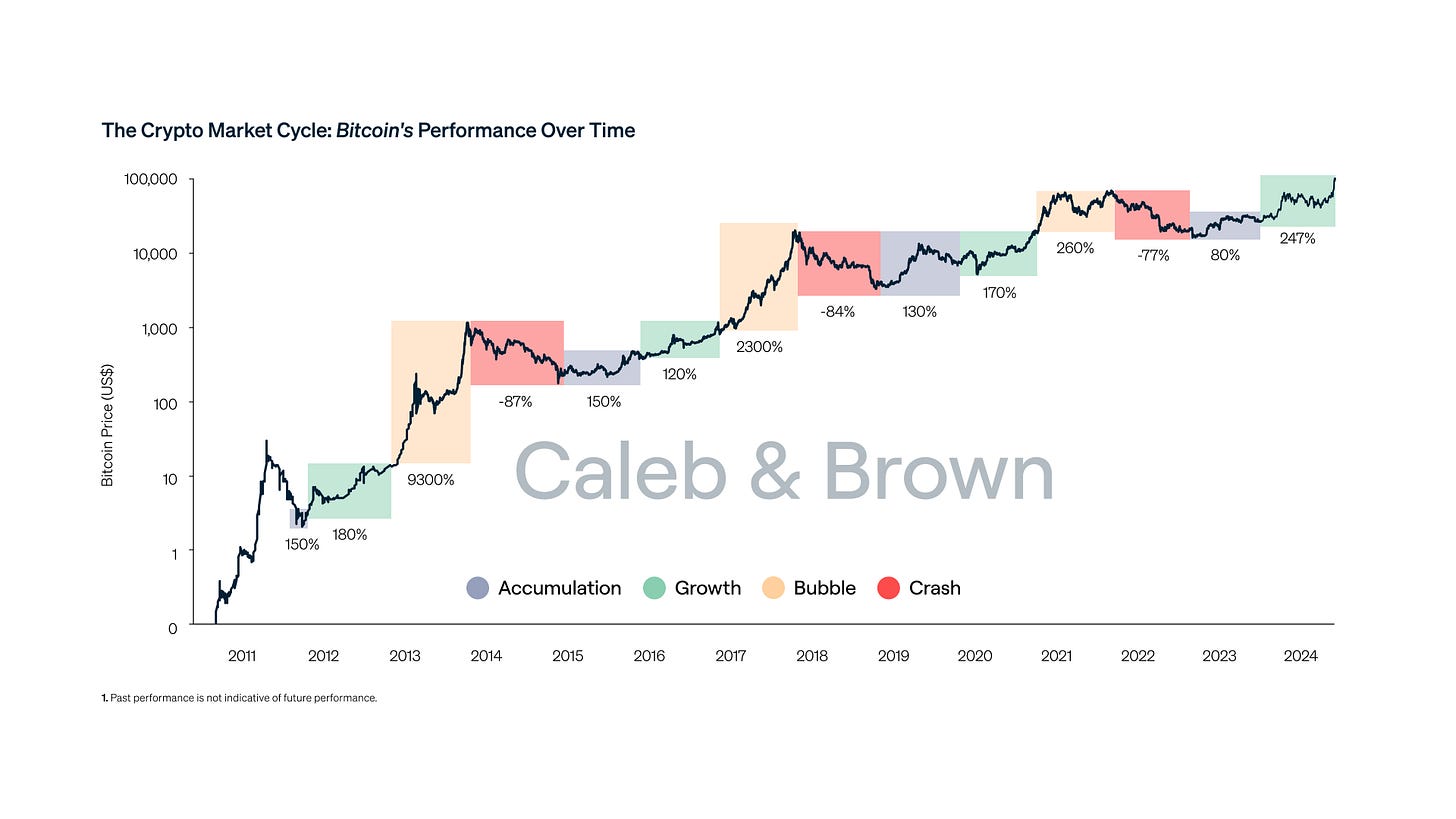

Just like traditional financial markets, crypto goes through its own cycles – and these price cycles are remarkably consistent, including their timing between peak-to-trough bottoms, price recoveries and subsequent rallies to new cycle highs.

Now we’re realistically entering a period that is neither the wild-west mania of early crypto, nor a fully saturated market.

There’s a balance of growing institutional interest, potential regulation, and ongoing innovation—making 2025 a pivotal year in the crypto cycle.

We strongly believe crypto prices will likely top within the next 12 months.

However, crypto cycles will not last forever and we very well could be on our last one.

Here are a few indicators that might help you navigate the current market situation:

Altcoin Season Index

According to this indicator, we’re in the altseason when 75% of the top 50 altcoins outperform Bitcoin over at least 90 days.

Altseason is usually the ending phase of a bull cycle:

So, according to the altseason thesis, this should be a great time to buy small & micro altcoins.

Stablecoins

Stablecoins just hit all-time highs!

They play a big role in the long-term adoption of blockchain technology.

Stables are used for:

Buying more crypto

Earning yield on dollars

Cheap international transfers

Getting out of weak local currencies

As the crypto market continues to evolve, maintaining a healthy stablecoin supply will be essential for supporting liquidity, fostering innovation, and ensuring overall market stability.

So, according to this data, crypto fundamentals are strong and the market is well-positioned to grow in 2025.

DeFi Activity

Decentralized Finance (DeFi) protocols have evolved into a pivotal force within the crypto market by offering innovative ways to generate revenue through lending, staking, and yield-farming mechanisms.

As more participants embrace DeFi revenue-making protocols, the demand for blockchain-powered solutions grows—propelling widespread acceptance and reinforcing crypto’s role as a driver of financial innovation.

Various DeFi protocols this year have generated large amounts of revenue, with many established protocols making revenue figures close to their 2021 highs (see below), while newer platforms have established themselves as critical contributors.

The Right Mindset

Historically, each cycle has produced outsized returns for those who position themselves early and correctly. Past cycles have showcased how smaller altcoins can produce exponential gains when the market gains momentum.

Each bull cycle tends to introduce new themes (e.g., DeFi summer, NFT boom). Identifying these narratives early can yield impressive returns.

Potential new narratives include Web3 Infrastructure projects, Real World Assets and more. Check out our latest article “Top Crypto Narratives for 2025”

Fear = Opportunity

Volatility is a feature of crypto, not a bug. If managed correctly, pullbacks can offer a strategic advantage.

Ride the Waves, Don’t Fear Them

It’s essential to mentally prepare for dramatic price swings. Pullbacks of 30-50% (or more) are not unusual in crypto.

Instead of panicking, see pullbacks as opportunities to buy strong assets at a discount.

The Role of Liquidity

Holding a portion of your portfolio in stablecoins or fiat ensures you have buying power during dips.

Maintaining liquidity gives you optionality. You can either deploy capital during market shocks or keep it safe if the market becomes overheated.

Emotional Discipline

Emotional reactions often lead to bad decisions (selling in fear, buying in euphoria).

Developing a plan ahead of time—knowing when and how much to buy or sell—helps remove emotion from the equation.

Think in Probabilities

Mastering the ability to “think in probabilities” is a superpower for investors, entrepreneurs, and anyone who has to make important decisions with clear eyes.

How to do it:

Prepare a list of potential outcomes for the decision at hand.

Assign a probability to each outcome.

Make a decision based on probabilistic thinking

For instance, last June, we shared this analysis on $BTC:

Asset Allocation and Picks

Trying to time the exact top or bottom is a fool’s errand.

Since the market is unpredictable, spreading your investments across different strategies and categories can mitigate risk.

Here are our top picks and strategies for 2025: