Wall Street Wants Your ETH

These are Nasdaq-listed firms raising billions to accumulate and stake ETH—and some of them are doing it faster than anyone expected

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

📈 Signal

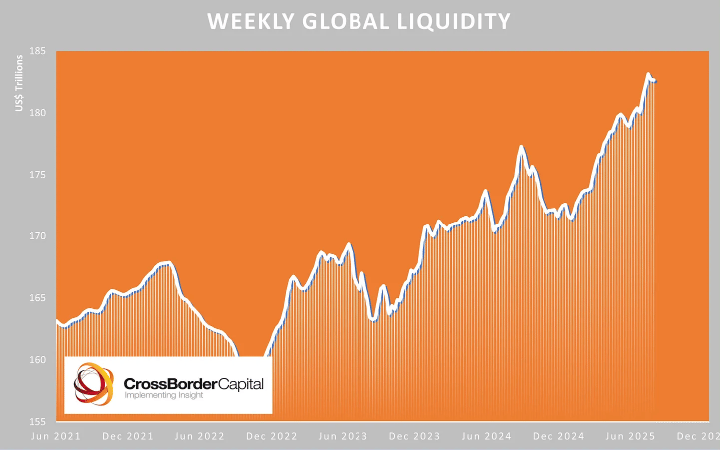

Global Liquidity Update

Liquidity growth is slowing, but the trend line is still up. The three-month annualized expansion rate slowed to 6.7% (down from 8.8% last mont).

🔒 Premium

Wall Street Wants Your ETH

Ethereum is no longer just “tech for devs.” It’s now a strategic asset—and publicly traded companies are going all-in.

Over $17 billion worth of ETH (3.1% of total supply) is now held in corporate treasuries. This is no coincidence. It’s a trend.

The same way MicroStrategy kicked off the Bitcoin treasury wave in 2020, we're now seeing Ethereum become the institutional playbook for growth, yield, and long-term upside.

These aren’t crypto-native startups. These are Nasdaq-listed firms raising billions to accumulate and stake ETH—and some of them are doing it faster than anyone expected: