Where Are We in the Economic Cycle?

What That Means for Stocks & Crypto in Q4 2025

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

🔒 Premium

Where Are We in the Economic Cycle

In a market driven by macro forces, timing matters as much as conviction.

Too many investors are still reacting to price action or social media sentiment — without a clear framework for understanding where we are in the cycle and what comes next.

That’s exactly what this report is designed to fix.

Inside, you’ll find a concise, data-backed breakdown of:

The current macro environment

US Equities valuations

Where crypto stands in its market cycle

Let’s dive in!

Macro Conditions

The U.S. economy is holding up, but cracks are visible beneath the surface.

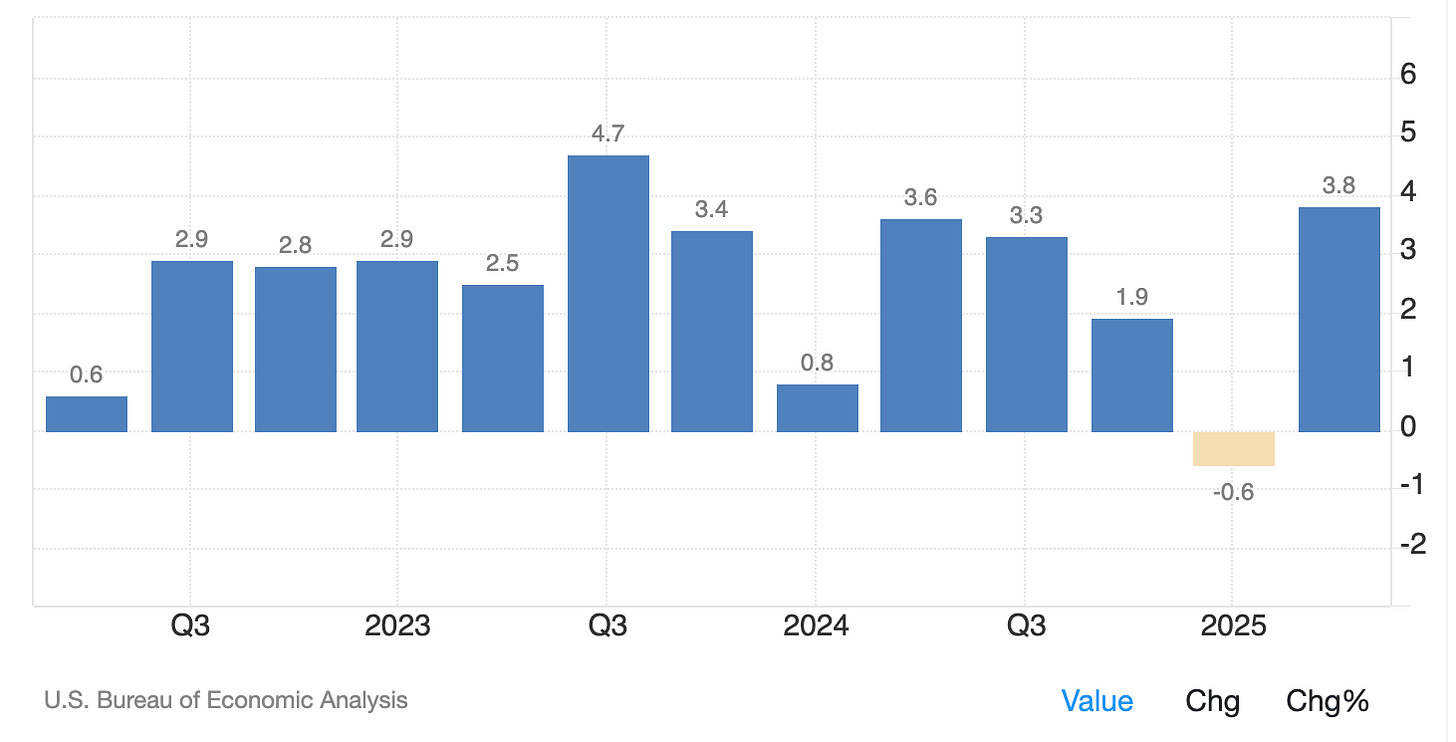

Q2 2025 GDP growth came in strong at +3.8% quarter-over-quarter, rebounding from a brief dip in Q1 (-0.6%). On a year-over-year basis, the economy grew at +2.1%, signaling ongoing resilience.

But inflation is re-accelerating slightly. The headline inflation rate rose to 2.9% in August, up from 2.7%. On a monthly basis, CPI increased 0.4%, doubling the previous month’s rate. While these levels aren’t alarming, they are enough to delay any imminent Fed pivot.

The labor market is also showing early signs of stress. Unemployment rose to 4.3%, and non-farm payrolls increased by just 22,000 jobs in August — a major slowdown from previous months. While not recessionary, this is a clear deceleration.

On the sentiment side, consumer confidence dropped to 55.1, down from 58.2, and is now at its lowest level since early 2023. Households are feeling the squeeze from inflation, high rates, and slowing wage growth.

On the business side, the Manufacturing PMI slipped to 52, and Non-Manufacturing PMI fell to 50, barely holding in expansion territory. Business confidence is at 49.1.

The 10Y–2Y yield curve has turned positive again (around +0.55%): it’s a less negative signal, but after a prolonged period of inversion, it’s wise to remain selective, as the economy could still cool in the coming quarters:

In short:

GDP Growth (QoQ): +3.8% → Resilient but could fade

Inflation Rate: 2.9% YoY | 0.4% MoM → Disinflation paused

Unemployment Rate: 4.3% → Labor market softening

Non-Farm Payrolls: +22k → Hiring slowdown

Consumer Confidence: 55.1 → Households are worried

Manufacturing PMI: 52 | Non-Manufacturing: 50 → Slowing business activity

Yield Curve: started inverting→ less recession risk

🔎 Takeaway:

The U.S. economy is in late-cycle territory. Growth is holding, but forward indicators are flashing caution. Inflation is stickier than markets want, and the labor market is starting to crack.

The Fed won’t pivot soon — and investors should stay selective.

Liquidity, Rates & the Dollar

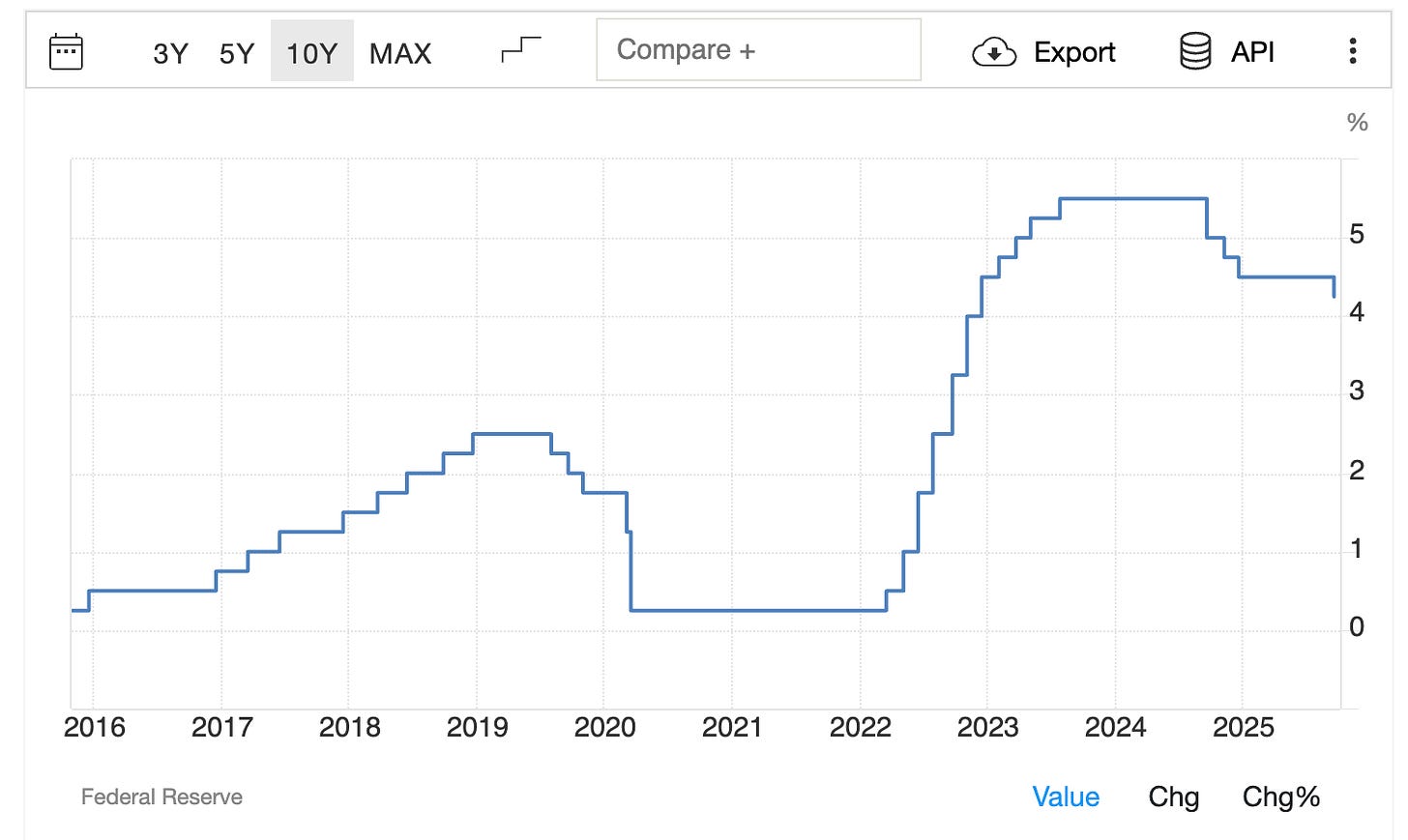

The Fed made a small but symbolic move recently, reducing its benchmark interest rate from 4.5% to 4.25%. While this has been interpreted by some as a pivot, the underlying data — particularly inflation — doesn’t yet justify a full easing cycle. This was likely a calibration, not a trend reversal.

Meanwhile, the U.S. Dollar Index (DXY) has weakened to around 99, its lowest level in two months. This shift marks a clear change in trend after months of dollar resilience.

The move isn’t driven by U.S. data alone — it reflects weakness in other major currencies as well.

The yen sold off after the Japanese leadership election pointed to more fiscal stimulus, and the euro fell nearly 1% following political uncertainty in France.

Together, these flows created a temporary bid for the dollar, but overall, the greenback is softening, not strengthening.

This matters for crypto: historically, a declining DXY correlates with rising Bitcoin and altcoin performance. A weaker dollar often translates to easier global liquidity, stronger risk appetite, and capital rotation into non-USD assets.

At the same time, the U.S. government shutdown has added a short-term “safe haven” bid for the dollar and Treasuries — but that demand is more defensive than structural.

In short:

Fed Rate: 4.25% → Slight easing, no pivot yet

Dollar Index (DXY): 99 → Two-month low, trend softening

Global context: weaker yen, volatile euro, U.S. shutdown risk

Liquidity tone: improving slightly, still cautious

🔎 Takeaway:

The dollar is losing strength, and that’s a subtle but meaningful tailwind for crypto.

If this trend continues and DXY stays below 100, it opens the door for a broader risk-on rotation — potentially the setup for altseason in early 2026.

For now, it’s a green light — but a cautious one.