Where It’s All Going?

Market Fundamentals, Trends & Catalysts

Hey everyone,

welcome to Investing Tuesday—our free weekly newsletter where we share crypto tactics, trends and ideas.

I hope you enjoyed last week’s issue “How to profit from the rise of $BTC (🔥 4th Halving is coming)”

The past month has been rough for the crypto market.

Now the main question is, where is it heading next?

To answer this, today I’ll share 6 charts & insights that illustrate the current levels of institutional & retail interest in crypto, market fundamentals, trends and more.

Let’s dive in👇

1. Bitcoin Overtakes Silver As Second Largest ETF Commodity

Silver has existed since dying stars started spewing the metal out billions of years ago. Bitcoin is 15 – but it’s already a bigger deal in the U.S. ETF market.

Bitcoin ETFs have marked a significant milestone, surpassing the market capitalization of traditional silver ETFs in a remarkably short timeframe. This highlights the growing interest and acceptance of bitcoin as a legitimate asset class in the global financial market

2. Stablecoin market cap is holding steady

Since the beginning of the year, the total stablecoin market cap increased by almost $4 billions.

If growth continues at this rate, stablecoin market cap could reach the levels of a year ago by the end of 2024.

3. Solana is processing as much trading volume as Ethereum

The total DEX trading volume is one of the most important metrics that I’m looking at when researching a blockchain as it’s typically very hard to fake the trading volume due to the swap fees that have to be paid for each swap.

Solana is now regularly surpassing Ethereum L1 in trading volume, which is certainly a great sign for the network and for the alt-L1’s narrative.

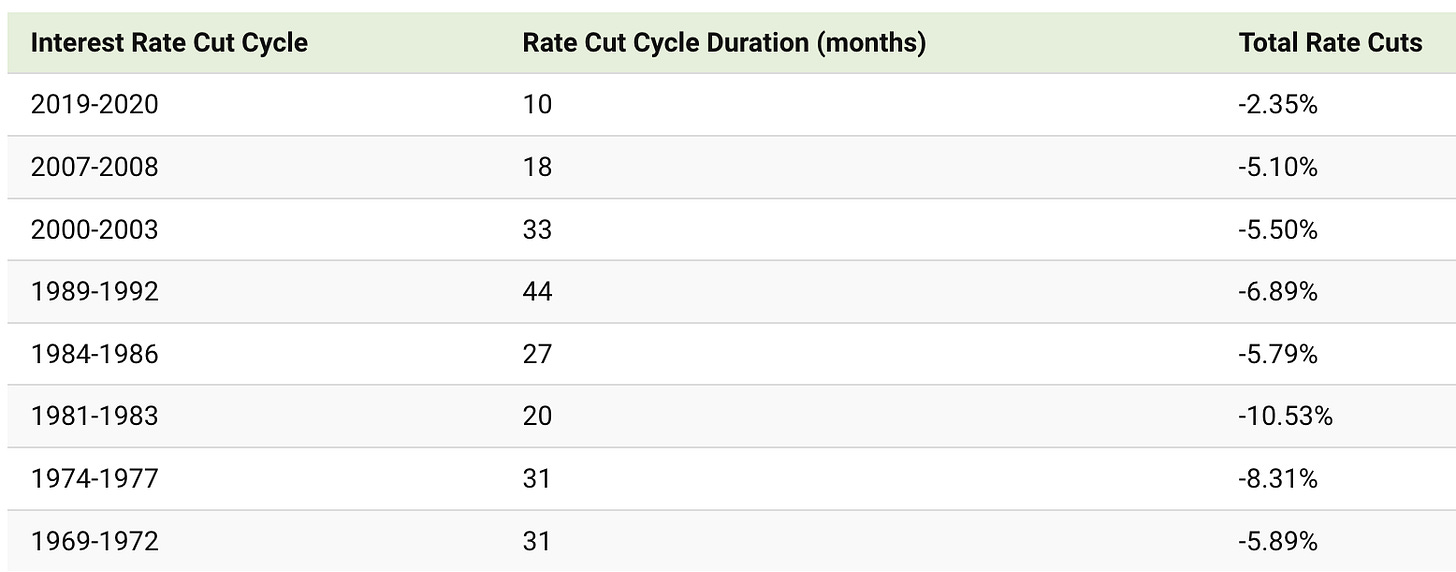

4. Economy & Interest Rates

The S&P500 and the Nasdaq are both at all time highs – this indicates that there’s a good momentum for risk assets.

A key question mark for the U.S. and global economy is around when the Federal Reserve will cut interest rates in 2024 and by how much.

After a rapid set of rate hikes throughout 2022, the U.S. Federal Reserve now faces the challenge of timing its easing of monetary policy to ensure a soft landing for the economy.

After some of the most rapid rate hikes in history kicked off this latest interest rate cycle in 2022, market participants and banks are leaning towards similarly rapid set of rate cuts in 2024.

Most institutions, including J.P. Morgan, Deutsche Bank, and Morgan Stanley, are expecting the Fed’s first rate cut to occur at the mid-point of the year in June. There is a group of outliers which includes UBS, Bank of America, and Goldman Sachs, that are expecting the first rate cut as early as March.

5. Low retail investors’ attention

The chart below represents the volume of queries for the term "crypto" over the past 5 years: we’re far below 2021 levels.

This means that even though the prices of many tokens skyrocketed over the past few months, this wasn’t enough to draw retail investors’ attention to crypto.

If retail interest increases later in 2024, we're likely to see a massive bull run given how much BTC has increased in price recently, despite how little attention crypto is now receiving from retailers.

6. Many Bullish Catalysts

Here’s a list of critical events (catalysts) that could trigger the bull market in 2024:

Bitcoin Halving

ETF approvals (e.g. ETH, BTC in China)

Rate cuts

US elections

Regulatory framework for cryptocurrencies

Institutional acceptance of BTC

Whenever you’re ready

If you want to level up you crypto strategy and take advantage of the latest opportunities, here’s how we can help you:

1/ Premium Analysis

Upgrade your subscription with more analysis & picks:

4x+ Micro Altcoin Picks: micro projects we think are willing to be tomorrow's market leaders.

2x+ Tactical Trade Ideas: short-term bets to make profits from narratives and trends.

1x Value Investing Analysis: undervalued blockchains we think will outperform the market.

1x Monthly Market Analysis: our view on the current market situation supported by data-driven analysis.

2/ The Altcoin Investing Course (🔥Pre-Sale)

Everything you need to know to discover, analyze, invest and trade altcoins.

By the end of the course, you'll have a deep understanding of how the crypto ecosystem works and how to invest & trade independently.

Part 1: Crypto Investing Fundamentals

Part 2: Portfolio Management

Part 3: Value Investing Analysis

Part 4: Tactical Trading

Part 5: Micro Altcoin Investing

Save €60 when you purchase with this offer.

Use code GET40OFF to apply the discount