Where It’s All Going: Market Pump, Fundamentals, Trend Indicators

PLUS: two complementary trade ideas 📈 📉

The recent market pump has been insane.

But the question is, is it sustained by fundamentals?

To answer this, here are 3 charts to better understand the current market situation.

1. Stablecoin Market Cap 🟡

For the first time in almost 2 years, stables market cap has started to increase significantly.

This is obviously a bearish signal.

But we can’t be sure that this growth is sustained by real crypto demand.

If we go back to December 2020, at the beginning of the greatest bull market in the crypto history, we’ve had a 5x stables market cap growth year over year (todays we are at -12%).

2. Active Developers 🔴

We can measure the supply of cryptos by the number of developers building in the space.

When is declining, is not something great to see.

3. TVL of all Chains 🟡

TVL has started to increase significantly as well as the stables for the first time in almost 2 years.

But, going back to December 2020, we’ve experienced a 20x TVL growth year over year while today we are only at +7%.

And this is our detailed trend dashboard with more metrics:

So, where it’s all going?

We can’t deny that the crypto market is hot right know.

Google search traffic for “crypto” has increased by almost 50% in the last month but we are still far away from the 2020-2021 market metrics.

Our View

With so much uncertainty in the fundamentals, we believe there are some profitable opportunities in a bull and in a bear scenario.

So…

Here are two complementary tactical trade ideas to take advantage of the current market situation and get a significant ROI in the next weeks/months.

A quick reminder: as digital asset investor, we are long-term bullish on altcoins, DeFi and the crypto industry in general. In this issue, we are just sharing some reasonable ideas that could be high profitable in the short-term.

If you like these ideas, be responsible. This is our view, not a financial advice. We are taking these bets, as well as all the other trades we share with our premium subscribers.

Let’s dive in!

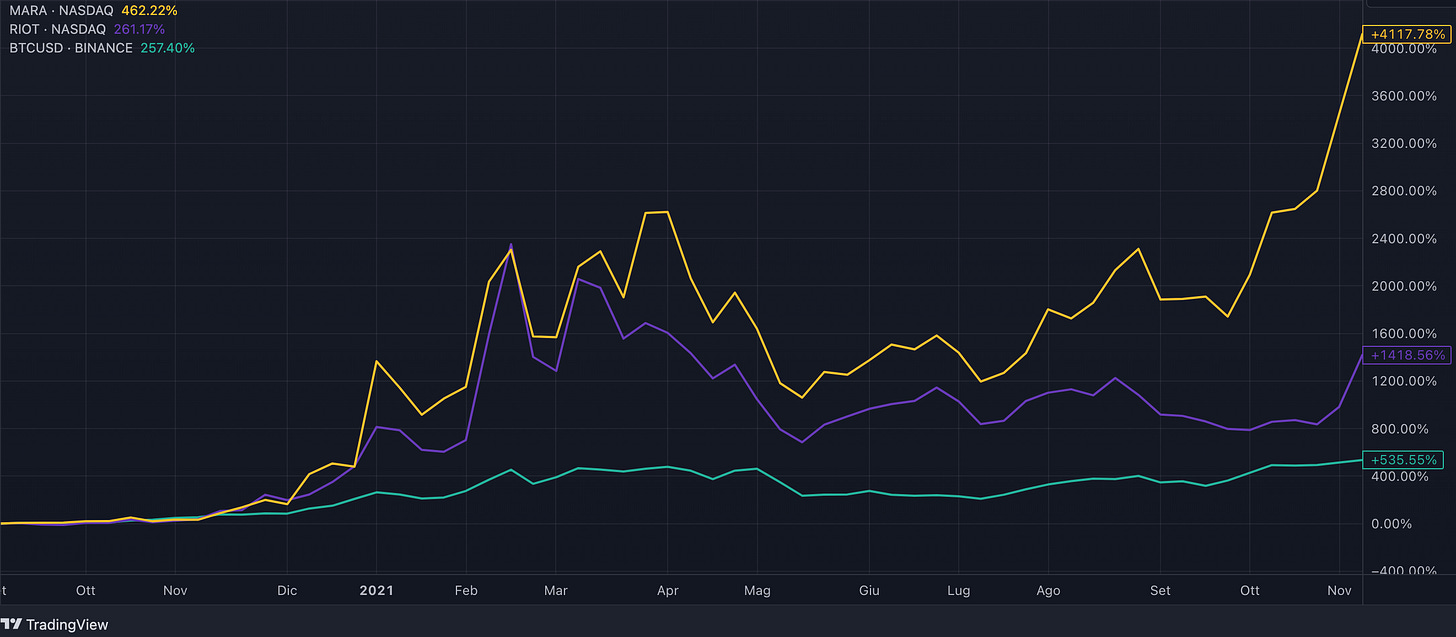

📈 BULL BET: Outperforming bitcoin with mining companies

As well as gold miners, also bitcoin mining companies amplify the market trend, for better or for worse.

Historically mining companies get leveraged exposure to the price of bitcoin. In other words,

If Bitcoin goes up, Bitcoin miners go 3x+ up.

If Bitcoin goes down, Bitcoin miners go 90% down.

In the last bull market, RIOT and MARA (bitcoin mining stocks*),* outperformed bitcoin by 3x and 9x respectively.