Are We Late-Cycle? What the Data Says

PLUS: Ethereum apps just hit $41.9M in daily revenue

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

📈 Signal

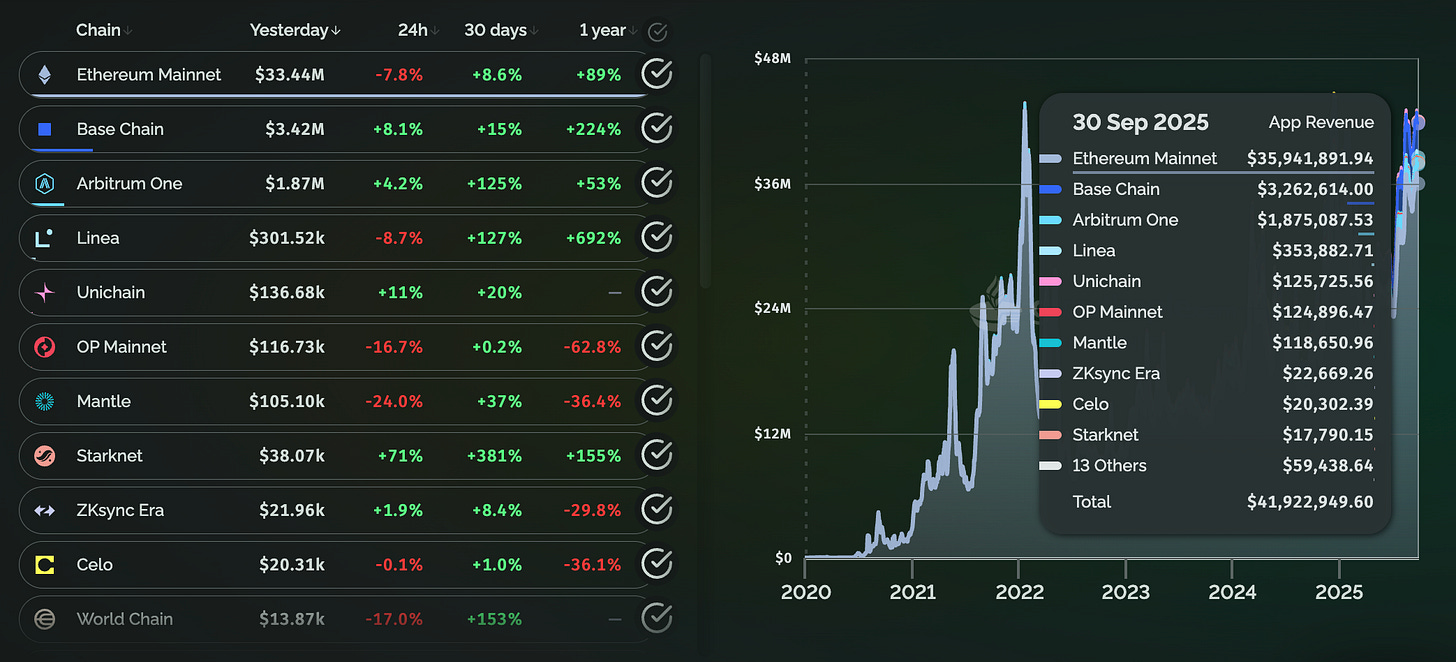

Ethereum apps just hit $41.9M in daily revenue

What’s driving it?

Layer 2s now account for 14% of total revenue — and their share is growing fast

Activity across DeFi, staking, and rollups is ramping up

The ETH economic flywheel — usage → fees → burn → value — is clearly accelerating

This isn’t just bullish for ETH itself — it’s a green light for the entire Ethereum ecosystem, including L2 tokens, DeFi protocols, and ETH-aligned infrastructure.

🔒 Premium

Are We Late-Cycle? What the Data Says

Many market participants believe we’re nearing the end of this cycle. And to be clear — some data supports that view.

We’re now 1,044 days into this expansion — almost identical to the ~1,060-day cycles of 2017 and 2021.

On-chain indicators reinforce this:

Realized profits are at 65% above 2021 levels

Coin days destroyed has already surpassed the last cycle by 15%

Long-term holders have begun distributing — a behavior that historically aligns with late-stage market conditions

MVRV-Z Score is at 2.28, meaning BTC is trading over 2 standard deviations above cost basis — elevated, but not euphoric

These are classic late-cycle signals.

But here’s where many investors make the mistake: They assume “late cycle” means no upside left.

In reality, this is often where the most explosive opportunities emerge — not because risk disappears, but because liquidity, positioning, and narrative converge into asymmetric setups.

For instance, in 2021 Bitcoin rose roughly 50% to finish the cycle with an MVRV-Z score of 3.49 → If MVRV-Z returns to previous peak levels, BTC could push toward $160K–$170K.

Let’s consider where we actually stand:

Bitcoin dominance is still elevated — meaning altseason hasn’t played out

ETH ETFs and institutional inflows continue to build slowly but consistently

Internal catalysts are emerging: Perp DEX innovation (Hyperliquid), new token launches (Plasma), and original DeFi builders (like Andre Cronje) returning with experimental products

Sentiment is cautious — which historically precedes upward repricing

So what’s the smart move here?

As investors, our goal isn’t to guess the exact top.

Our job is to position smartly across multiple plausible outcomes:

Q4 2025 Peak – the base case. BTC tops around the halving narrative with a final wave of retail & institutional inflows

Early Bear Case – cycle ends sooner than expected, and capital preservation becomes the priority

Extended Bull Through 2026 – reflexive momentum continues into late 2026, driven by macro easing and innovation cycles

Portfolio Strategy

This year, we closed several large core positions (ETH, BTC, SOL, TRX) so we can be “greedy” when others are “fearful”.

That move unlocked a fresh chunk of liquidity — capital to be rotated tactically into:

High-conviction tokens

Pullback entries on strong L1s

Crypto equities that follow BTC and ETH

Here’s our high-conviction watchlist across these three buckets — the tokens we’re monitoring weekly, ready to scale into on strong setups, narrative triggers, or pullbacks: