👀 Treasury Holdings Hit $218B — ETH Is Breaking Out

PLUS: The biggest liquidation since March

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Is HYPE the Most Undervalued Altcoin of 2025?”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Treasury Holdings Hit $218B — ETH Is Breaking Out

📣 Midas and Axelar launch mXRP, a tokenized XRP product, targeting up to 8% base yield

📈 The biggest liquidation since March

Let’s dive in!

💡 Insight

Treasury Holdings Hit $218B — ETH Is Breaking Out

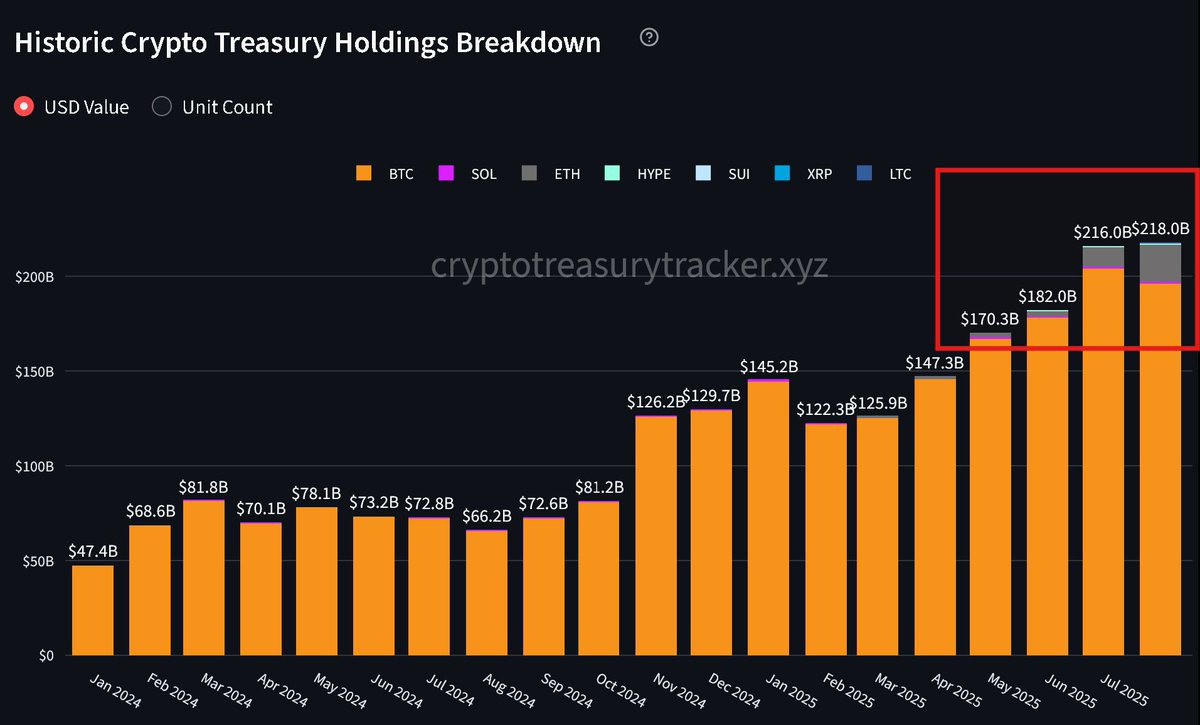

Crypto treasuries have surged from $47B to $218B since Jan 2024.

And while BTC remains dominant, ETH is the fastest-growing asset on corporate balance sheets.

Quick Breakdown

BTC: $216B held — still the top pick for most institutions

ETH: $20.9B held by 68 entities (4.1% of total supply)

→ up 10x in 2 months (!), from $2B in July

This growth is driven by companies, DAOs, and even governments using crypto for long-term reserves and staking yield.

Why It Matters

Much like MicroStrategy’s BTC play in 2020, we’re now seeing ETH become the next institutional blueprint — offering growth, yield, and long-term upside.

And these aren’t just crypto-native startups.

From gaming to infrastructure, these firms are quietly building multi-billion-dollar ETH positions.

Inside the Trend: Crypto Companies Accumulating ETH

We published a deep dive into one of the most overlooked investment trends right now:

Public companies buying, staking, and holding ETH on their balance sheets.

These aren’t small Web3 startups. We're talking about Nasdaq-listed firms, from gaming to infrastructure, with billions in capital and strategic treasury policies built around Ethereum.

In the meantime, crypto stocks are selling off hard in pre-market after BTC dropped to $112K.

That includes many ETH-heavy firms covered in our paid post.

This could be a rare entry point to get exposure to:

Public companies building ETH positions

Ethereum staking infrastructure

Crypto treasuries with long-term upside

Smart money is buying ETH. Now you can buy the buyers — at a discount

If you're looking for:

Tickers to watch

How much ETH they're holding

This report is for you:

📣 Update

Midas and Axelar launch mXRP, a tokenized XRP product, targeting up to 8% base yield

Tokenization platform Midas has partnered with Interop Labs, developer of the blockchain interoperability protocol Axelar, to launch mXRP — a tokenized product they describe as the first of its kind.

The product is currently targeting a base yield of 6-8%, paid out in XRP. Users can mint mXRP by depositing XRP collateral into a tokenized structure that tracks the performance of underlying yield strategies.

📈 Signal

The biggest liquidation since March

Crypto stocks tumbled as bitcoin and ether extended heavy overnight losses, fueling $1.6 billion in liquidations across derivatives exchanges.

This is the largest liquidation event since March — and over 95% of it came from long positions.

Events like this matter because they help reset overheated markets. When too many traders pile into leveraged longs, a sharp correction becomes inevitable.

A flush like this removes excess leverage and clears the way for healthier price action.

With Q4 around the corner, this reset could be exactly what the market needed to set up the next major move.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

4 Undervalued Crypto Protocols Generating Real Fees (link)

Best Buys August 2025 (link)

Value Investing Ratings - August '25 (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time