How to analyze Ethereum L2s

This current pullback is not extraordinary

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 How to analyze Ethereum L2s

📣 Arbitrum developers launch a new incubator-style program

📈 This current pullback is not extraordinary

Let’s dive in!

💡 Insight

How to analyze Ethereum L2s

Part of the reason that Ethereum L1 struggled so much last year is due to the EIP4844 network upgrade — which introduced a new type of data on Ethereum called “blobs.” These “blobs” allow L2s to store transaction data on the L1 at very low cost.

→ Users are moving to L2s (short-term bearish, long-term bullish for ETH)

Base is currently dominating the L2 space in terms of user fees and active addresses. Arbitrum is number two, with Soneium the 3rd best L2 in terms of user fees.

Where can you track all this activity?

You can use growthepie.xyz, an easy-to-use crypto tool built specifically for providing up-to-date metrics on Ethereum L2s.

Main features

Aggregated metrics across all tracked L2s

Foundamental metrics dashboards (TVL, stablecoin market cap, daily users, revenue, etc.)

Dapps: most used applications across the Ethereum ecosystem

📣 Update

Arbitrum developers launch a new incubator-style program

Offchain Labs, the developers of Ethereum layer-2 network Arbitrum, have announced a partnership with the Arbitrum Foundation to launch a new incubator-style program called Onchain Labs.

According to a March 17 post by Offchain Labs, the new incubator is aimed at rapidly adding to Arbitrum’s existing decentralized application (DApp) offerings with a particular focus on supporting “innovative and experimental” projects.

Offchain Labs said the continued development of Arbitrum over the past few years has seen it grow to become one of the “most performant ecosystems in the space.” But now, with the launch of Onchain Labs, the focus will shift to building out the network’s application landscape.

📈 Signal

This current pullback is not extraordinary

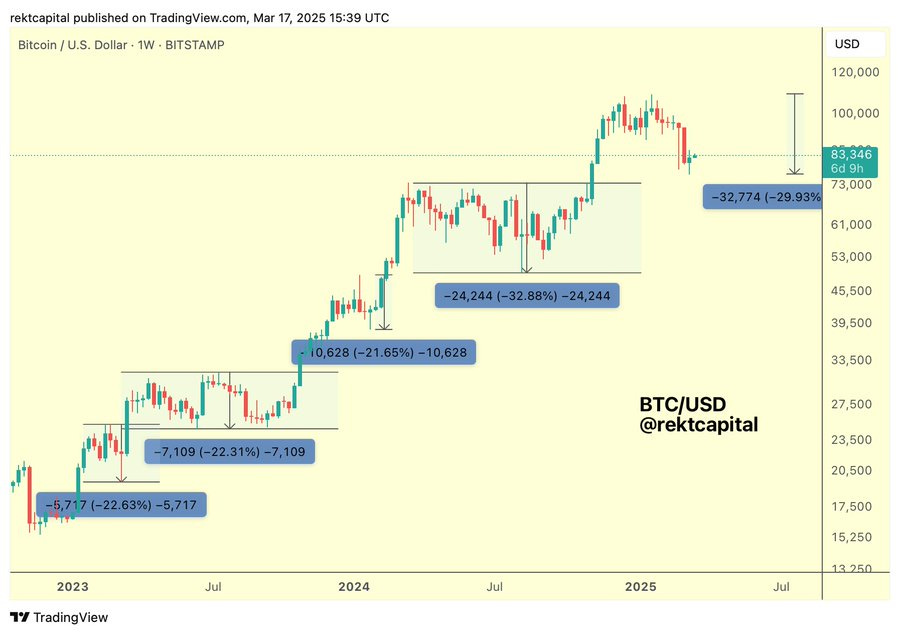

This current pullback (-29%) is one of the deeper retraces in the cycle but it's not extraordinary.

Here are the other major pullbacks in previous cycles:

2021 corrections: 31%, -55%, -25%

2017 corrections: -34%, -34%, -38%, -40%, -29%

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

Thanks for reading!

See you next time