📈 Market Trends - March 25

Actionable metrics highlighting the current trends of the crypto market and broader economy

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

If you haven’t yet, subscribe to get access to this post, and every post.

In today's newsletter we’ll track actionable metrics highlighting the current trends of the crypto market and broader economy.

This data is an educational resource to better understand market cycles. While these trends often correlate well with crypto performance, the analysis should not be used as a short-term trading strategy.

Let’s dive in!

Macro Trends

Interest Rates → 🟡

The Trump administration’s new policies are causing significant economic volatility in the U.S., making it difficult for the central bank to assess the situation clearly enough to adjust interest rates before late spring or summer.

GDP (U.S.) → 🟡

The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and in line with the advance estimate.

Inflation (U.S.) → 🟠

The annual inflation rate in the US edged up to 3% in January 2025, compared to 2.9% in December 2024, and above market forecasts of 2.9%, indicating stalled progress in curbing inflation.

Composite PMI (U.S.) → 🟡

The S&P Global US Composite PMI came in at 51.6 in February 2025, revised up from the preliminary estimate of 50.4 but down from the previous month's 52.7. This marked the slowest pace of expansion in the US private sector since April 2024, with service sector growth slowing to a 15-month low. In contrast, manufacturing output saw a significant increase. New orders rose, but at a slower rate, while employment declined for the first time in three months.

The index is based on data collected from a representative panel of over 800 companies and follows variables such as sales, new orders, employment, inventories and prices. A reading above 50 indicates expansion in business activity while below 50 points to contraction.

Unemployment Rate (U.S.) → 🟠

The U.S. unemployment rate rose to 4.1% in February 2025, up from 4.0% in January and slightly exceeding market expectations of 4.0%. The number of unemployed individuals increased by 203,000 to 7.05 million, while employment declined by 588,000 to 163.31 million.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

Crypto Trends

Stablecoin Market Cap → 🟢

The supply of stablecoins is a vital indicator of market confidence and functionality. As the crypto market continues to evolve, maintaining a healthy stablecoin supply will be essential for supporting liquidity, fostering innovation, and ensuring overall market stability.

Total Value Locked → 🟢

TVL represents the total value of all assets deposited, staked, or locked into DeFi protocols and smart contracts. Measured typically in U.S. dollars, it provides a clear snapshot of the amount of capital invested in DeFi platforms at any given time.

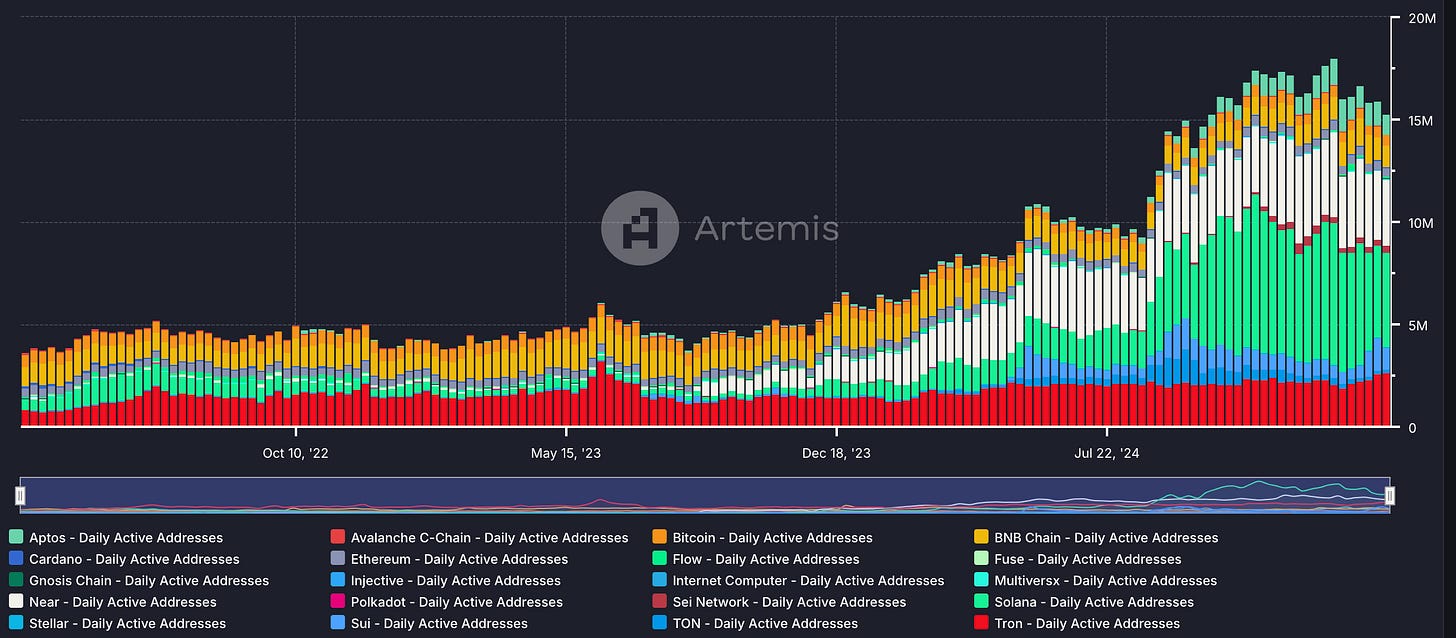

Active Addresses → 🟢

Active Addresses represents the number of unique blockchain addresses participating in transactions each day or month. Monitoring DAA offers valuable insights into user engagement, network activity, and overall market sentiment.

Bitcoin Dominance → 🔴

This metric represent the percentage of the total cryptocurrency market capitalization that is attributed to Bitcoin. A high dominance percentage suggests that investors prefer the relative stability of Bitcoin over more volatile altcoins, indicating a risk-averse environment.

BTC dominance is currently at 60.21%. It was closer to 40% when the previous cycle peaked out.

Transactions → 🟢

Daily Transactions represents the total number of transactions processed by a blockchain network within a 24-hour period. Understanding and monitoring daily transactions provide valuable insights into user engagement, network activity, and overall market dynamics.

That’s all for today!

Cheers

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

That’s all for today!

Cheers