This Q4 Crypto Report Is Full of Alpha

PLUS: US spot Solana ETFs report 10th consecutive day of net inflows

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Bull vs Bear – Who’s Winning?”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 This Q4 Crypto Report Is Full of Alpha

📣 US spot Solana ETFs report 10th consecutive day of net inflows

📈 Ethereum is now more scarce on centralized exchanges than Bitcoin

Let’s dive in!

💡 Insight

This Q4 Crypto Report Is Full of Alpha

Every quarter, the crypto world waits for one data-rich report: Charting Crypto by Coinbase Institutional and Glassnode. It’s the report that hedge funds and crypto-native funds read before making big moves.

We read all 50+ pages so you don’t have to. Here are the 5 biggest takeaways you can act on right now — especially if you’re holding altcoins or planning your next entry.

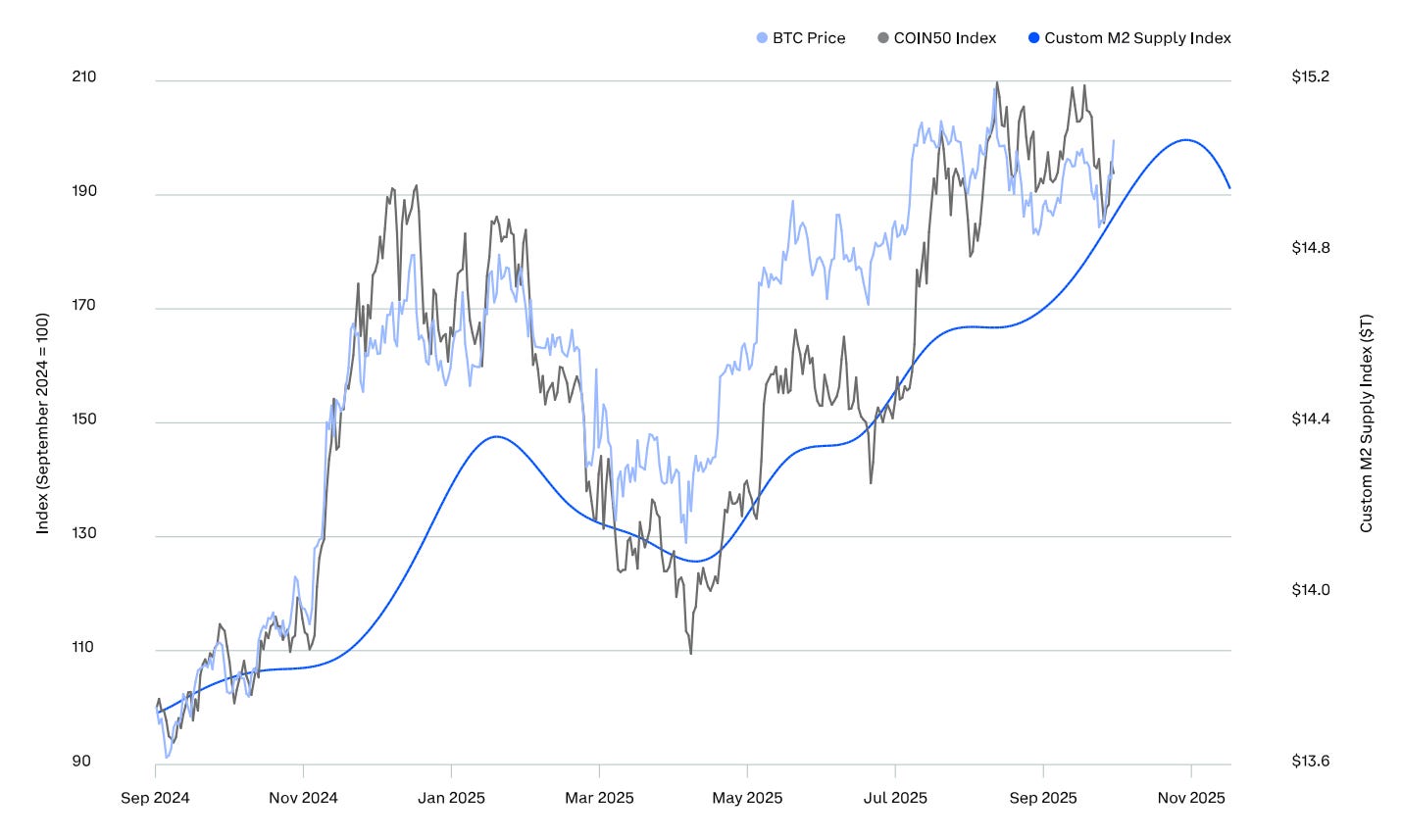

1. Market Outlook = Cautiously Bullish

The Q4 macro backdrop still favors risk assets. The Fed is likely to cut rates again.

There’s $7 trillion sitting in money market funds — even a small rotation could pump crypto.

Regulation is improving (GENIUS Act passed), with more clarity expected soon.

BUT: October’s leverage flush (Oct 10) spooked markets. Be nimble, not blind.

What this means for you:

Hold conviction, but take profits on spikes. Use dips to accumulate high-conviction altcoins with real fundamentals.

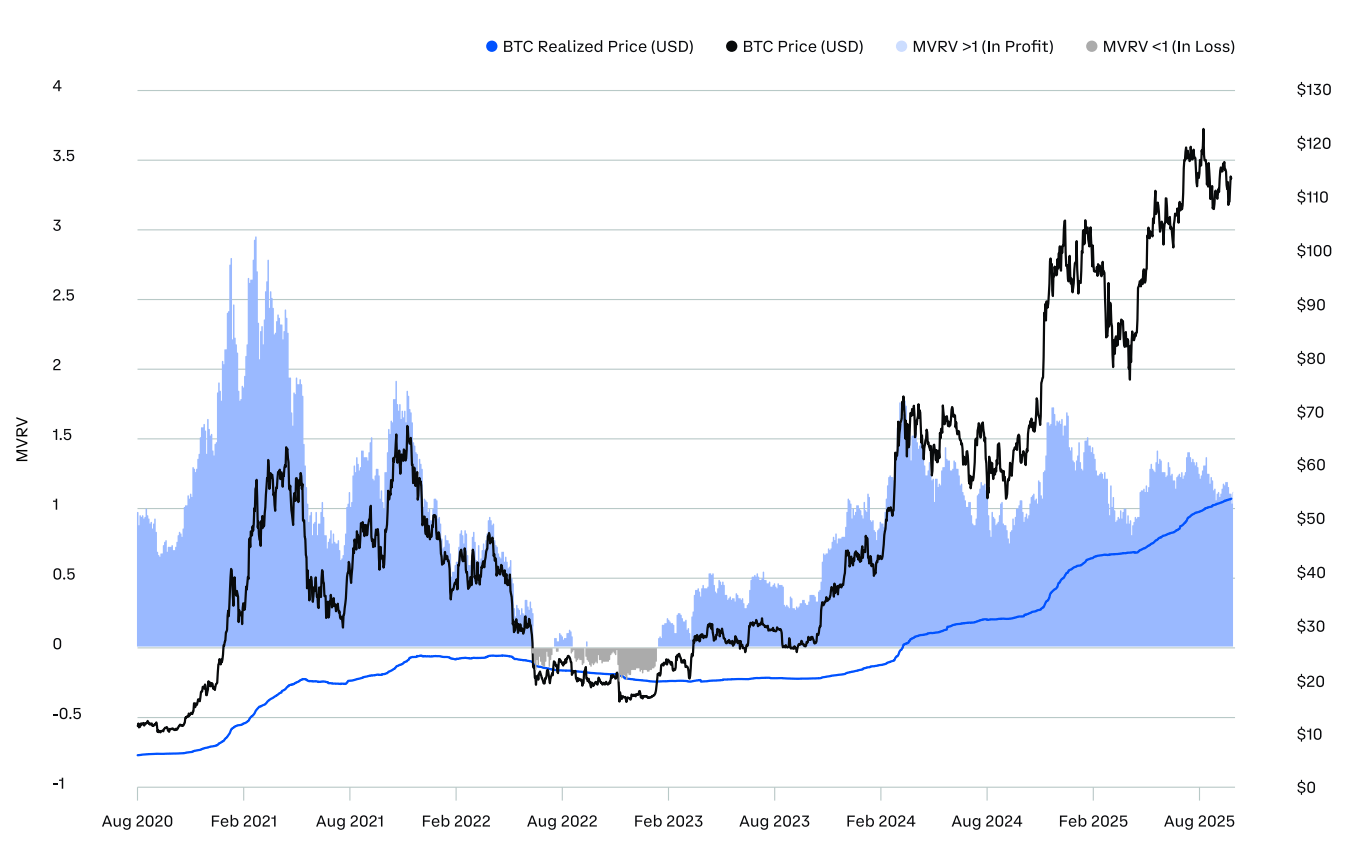

2. Bitcoin Is Back in Demand (But Altcoins Are Lagging)

BTC dominance dropped from 64% → 57% in Q3, but bounced hard at the end of September.

Long-term holders barely sold, even as BTC hit new highs.

Institutional demand is growing again — especially via spot ETFs.

Altcoin takeaway:

Altseason isn’t dead — but it’s delayed. Institutions are still treating BTC and ETH as safe havens. Until retail steps back in full force, stick to alts with volume, momentum, or narrative tailwinds.

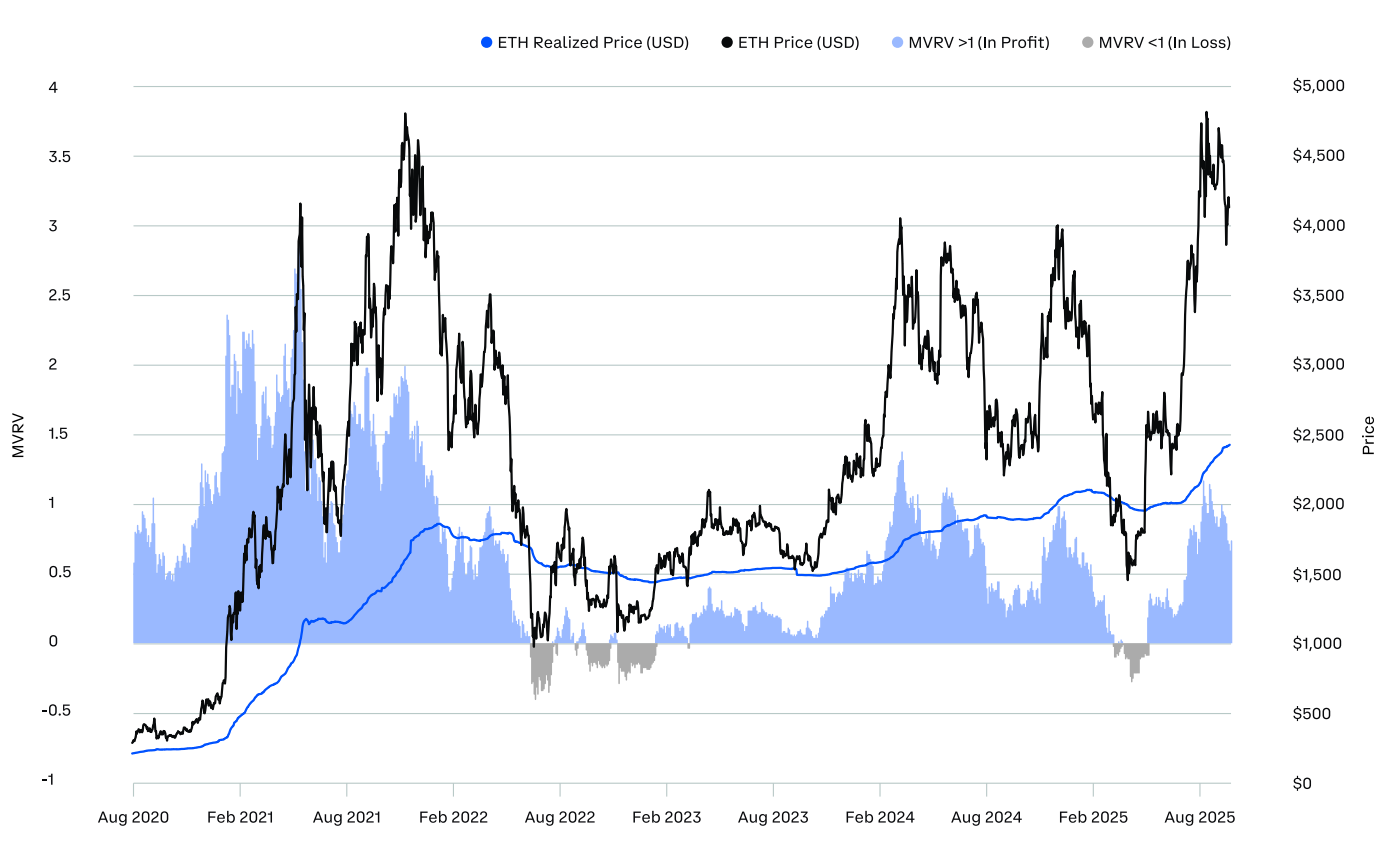

3. ETH Gaining Institutional Love

For the first time, ETH ETFs had more inflows than BTC ETFs: $9.4B vs. $8B.

ETH and L2 fees dropped to 2-year lows while usage hit all-time highs.

Liquid ETH supply rose 18% — suggesting some long-term holders are rotating into risk-on plays.

What to watch:

ETH-related ecosystems (L2s, staking protocols, rollups) could outperform if this trend continues.

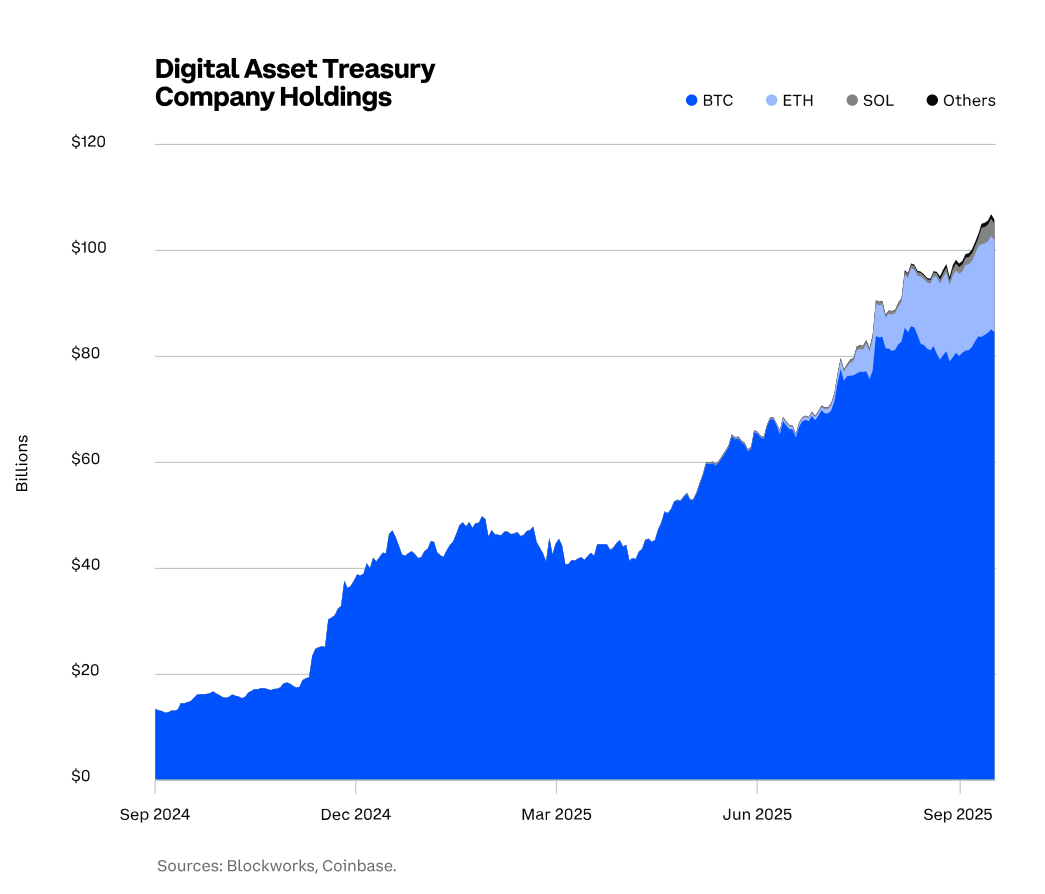

4. Big Bets Are on Treasury-Backed Crypto

“Digital Asset Treasuries” (DATs) — companies holding BTC/ETH on balance sheets — now own:

3.5% of BTC supply

3.7% of ETH supply

These DATs are behaving like long-term whales. Their influence on supply is growing fast.

How to play it:

Watch for DAT accumulation on-chain. When they move, markets follow. Expect more stable floor prices for BTC/ETH as corporate treasuries increase exposure.

5. Sectors Retail and Institutions Are Betting On

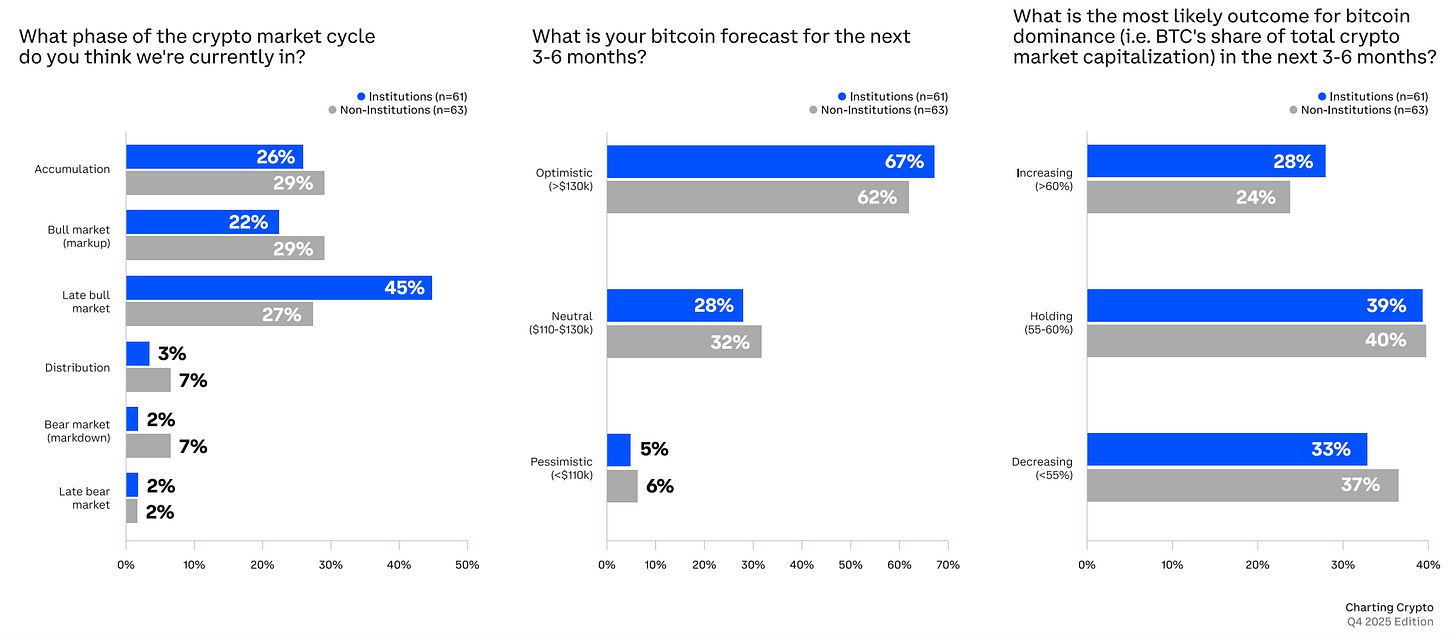

According to a survey of 120+ global investors:

Most bullish sector among institutions: Smart contract platforms

Most crowded trade: ETH L2s

Top tail risk: Macroeconomic conditions (not regulation)

Quick alpha:

Survey shows split cycle views — institutions think we’re in late-stage bull, retail thinks we’re in mid-stage. That gap is where alpha lives. Smart money is taking chips off the table, but retail still has room to run.

TL;DR (Too Lazy to Read?)

Be cautiously bullish.

BTC and ETH still lead — but watch for ETH momentum.

Alts need narratives + volume to break out.

DATs = silent whales to track.

Macro is still the biggest swing factor.

📣 Update

US spot Solana ETFs report 10th consecutive day of net inflows

Spot Solana ETFs recorded their 10th consecutive day of net inflows on Monday, totaling $6.78 million.

The two Solana funds have accumulated $342.48 million in net inflows since launch

📈 Signal

Ethereum is now more scarce on centralized exchanges than Bitcoin

Only ~10% of ETH’s total supply remains on exchanges — compared to ~14% for BTC.

This is a massive structural shift showing how much ETH has moved into staking, DeFi, and long-term custody.

Less ETH on exchanges means fewer coins ready to sell and more being used onchain.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Is the Bear Market Already Here? (link)

We’re buying this token (link)

This New Chain Could Kill Bridges Forever (link)

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time

kind of hope the bear market is here; it's always bringing the discount buys