Top 10 Altcoins for 2025

PLUS: MicroStrategy acquires another 11,000 bitcoin

In partnership with

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “These Big Names Are Still a Mile Away From 2021 Highs”

If you haven’t yet, subscribe to get access to this post, and every post.

In today's newsletter:

💡 Top 10 Altcoins for 2025

📣 MicroStrategy acquires another 11,000 bitcoin for $1.1 billion

📈 DEX to CEX trade volume reached ATH of 19%

Let’s dive in!

💡 Insight

Top 10 Altcoins for 2025

Hey everyone, I’m Luca—crypto investor and writer of AIP.

I recently spent some time rebalancing my crypto portfolio, and I want to walk you through the thought process behind it.

I’m always on the lookout for ways to fine-tune my holdings—especially during a bull market that I believe still has plenty of room to run.

In this post, I’ll cover three main points: why I’ve just shuffled my positions around, why I’m still bullish on crypto, and which 10 altcoins I’m focusing on for 2025.

Rebalancing for Gains (and Tax Advantages)

I’ve been in crypto for a while now, and over time I’ve developed a balanced strategy that covers both long-term positioning and short-term opportunities.

Beyond my core holdings, I also keep a portion of my funds in cash, ready to deploy for tactical trades. These are shorter-term moves I make to capitalize on market swings. The average trade I aim for has an ROI of around 30% and typically closes within about 25 days. This approach lets me stay agile in a very volatile market.

Over the past few months, I’ve seen some impressive returns—particularly in meme coins. So, I decided to close out a few positions that were sitting on significant gains.

At the same time, I also exited a few underperforming coins. By realizing those losses, I will reduce my tax liability and free up funds to deploy in more promising projects.

The Bull Market Scenario

I’m pretty optimistic about where we stand in the current bull cycle.

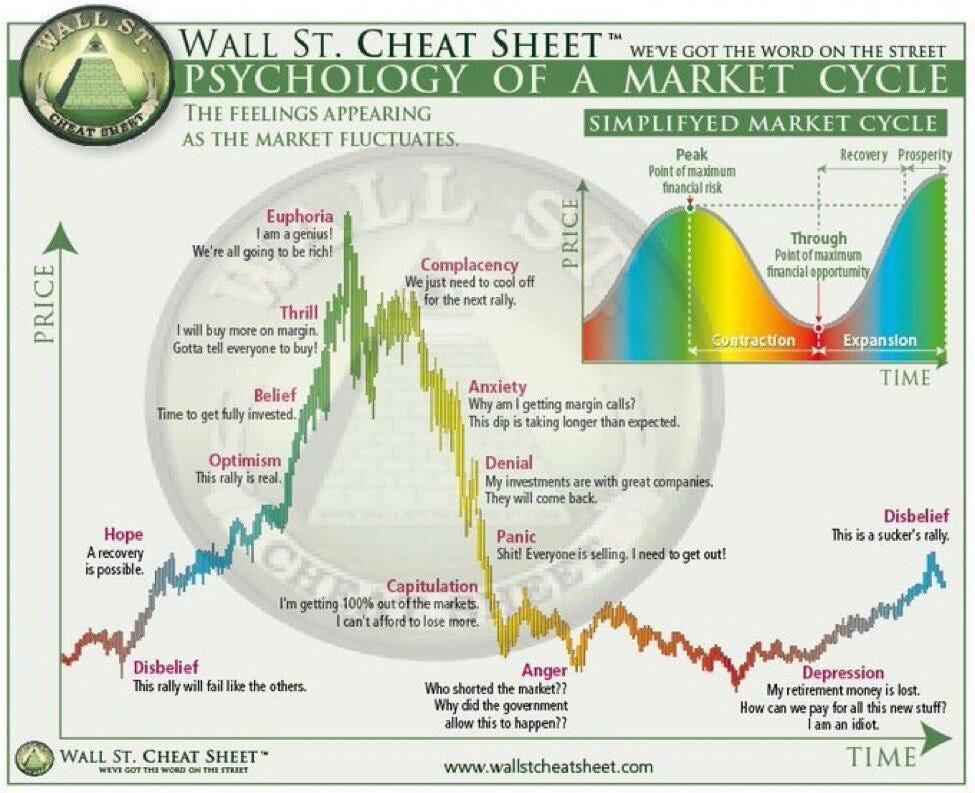

The maturation of the asset class continues but the market is not euphoric yet, which is a warning sign of the end of a cycle.

In particular, I believe we’re between Belief and Thrill:

Here are 3 charts supporting this thesis:

U.S. equities

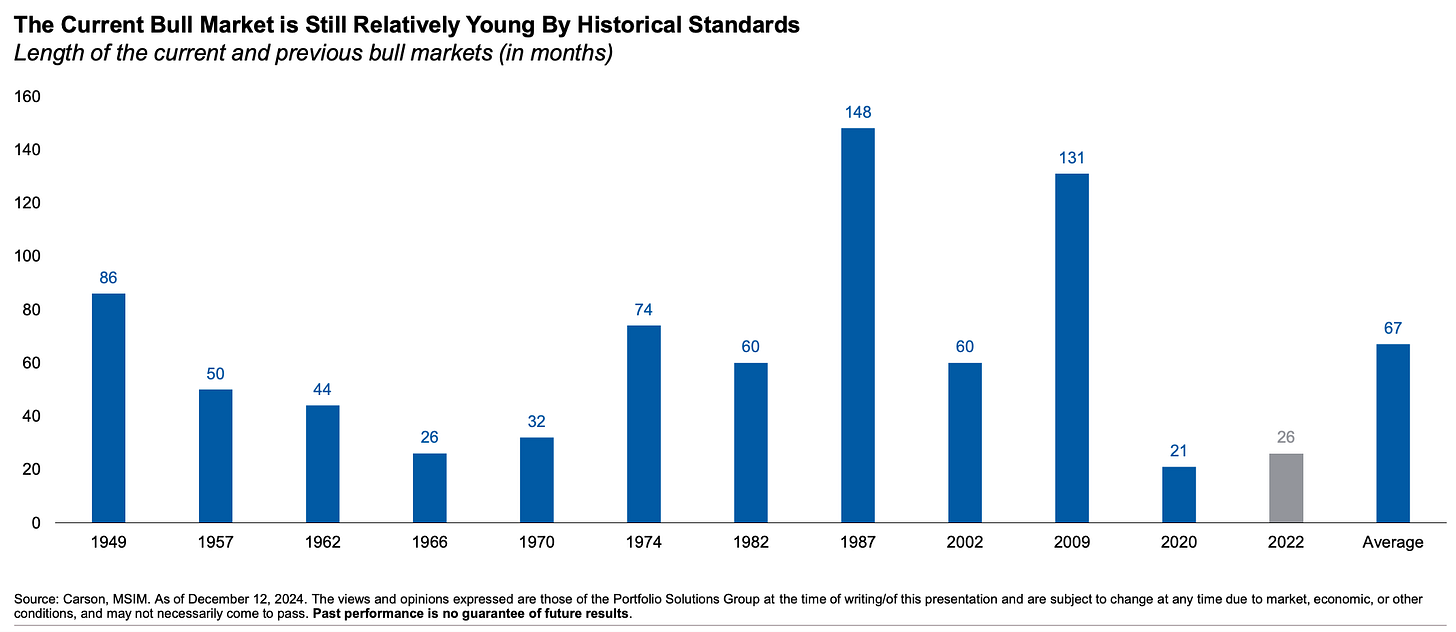

Historically, US equities (especially tech stocks) are highly correlated with cryptos.

The current bull market is still young relative to historical cycles and is still below the average age of previous bull market cycles by approximately 40 months.

The Tokenization Revolution

Institutions and and asset managers are putting real-world capital into blockchains.

Tokenization continued to make significant progress in 2024, as tokenized real world assets (RWA) grew over 60%.

Asset managers and traditional financial institutions have increasingly embraced the tokenization of government securities and other traditional assets on both permissioned and public blockchains, enabling near-instant cross-border settlements and 24/7 trading hours.

Stablecoins

Stables play a big role in the long-term adoption of blockchain technology and reflect the “real economy” behind the blockchain.

Stablecoins just hit all-time highs growing over 55% during the last 365 days.

10 altcoins I’m focusing on for 2025

Below are the 10 altcoins I’m most excited about for 2025.

Ethereum → digital money, RWA leader and high-performing scaling solutions (L2s)

Uniswap → DeFi leader far away from 2021 highs

Chainlink → DeFi and RWA infrastructure protocol far away from 2021 highs

Ethereum Name Service → web3 infrastructure token based on ETH, up 80% in the last 365 days

Clearpool → decentralized credit marketplace offering institutional-grade DeFi services

Jito →Solana liquid staking protocol with real fundamentals ($2b+ annualized fees)

Lido → Liquid staking protocol with real fundamentals ($1b+ annualized fees)

Raydium → Solana trading infrastructure with real fundamentals ($3b+ annualized fees)

Ondo → DeFi protocol with a mission to “make institutional-grade financial products and services available to everyone

FetchAI → technology company and platform designed for the AI economy down 65% from ATH

In partnership with

Small cap and micro cap stocks have been getting crushed over the last couple of years. There are a ton of gems that are trading at huge discounts.

Get under-the-radar stocks with huge growth potential. Every week in your inbox.

Free for now. Not forever.

📣 Update

MicroStrategy acquires another 11,000 bitcoin for $1.1 billion

MicroStrategy has purchased another 11,000 BTC for approximately $1.1 billion at an average price of $101,191 per bitcoin.

It follows the sale of a further 3,012,072 MicroStrategy shares during the same period for the same amount.

📈 Signal

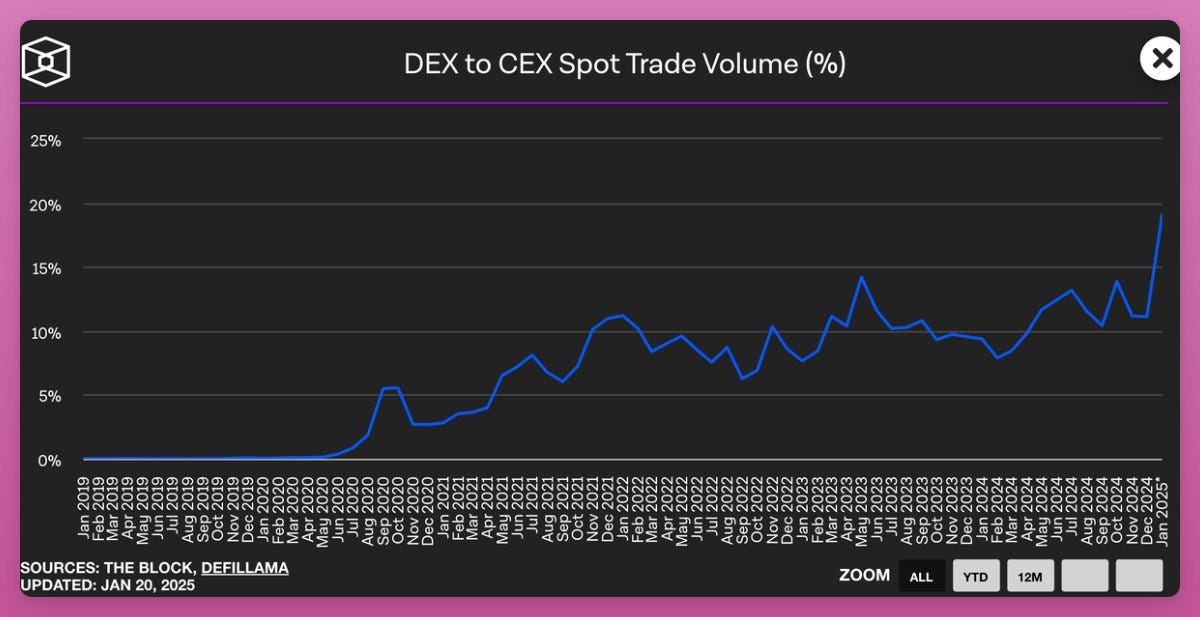

DEX to CEX trade volume reached ATH of 19%

The shift is clear, DeFi is gaining ground: price discovery now happens on DEXs, not CEXs.

About the chart

Monthly decentralized exchange volume divided by centralized exchange volume (as a percentage).

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

By upgrading to Premium, you get the following:

Three articles per week (Tuesdays, Thursdays & Saturdays)

Full access to our entire library of analysis, picks & portfolios

Access to the micro altcoin watchlist

Deep dive on micro altcoins with 10x+ potential

That’s all for today!

Cheers