👀 Bitcoin Hits ATH: Here’s What Happens Next

PLUS: DeFi Comeback: Fees Up 76%

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Retail Rotation: Utility > Memes”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Bitcoin Hits ATH: Here’s What Happens Next

📣 Ondo Finance finalizes Oasis Pro acquisition

📈 DeFi Comeback: Fees Up 76%

Let’s dive in!

💡 Insight

Bitcoin Hits ATH: Here’s What Happens Next

Bitcoin just ripped above $125K setting a new all-time high over the weekend. Internet is screaming “Uptober,” but under the hood… things aren’t that simple.

BTC Hit ~$126K… But It Wasn’t “Real”

Most of the ATH push came over the weekend via perpetual futures, not spot demand.

Without TradFi liquidity, this move needs confirmation. Watch to see if buying power returns now that US markets are open again.

Smart Money Sees a Dip Before the Next Leg

Retail’s screaming $150K, but most pro traders expect a pullback or sideways range before BTC makes a clean breakout.

What to watch:

Support: $118K

Resistance: $124K–$126K

No Macro Data = Higher Volatility

Thanks to the US government shutdown, we’ll see no fresh labor or inflation data this week. That means more volatility driven by headlines and speculation — not fundamentals.

The next Fed rate decision is Oct 29. A rate cut is 90% priced in, which could favor risk assets (aka crypto).

Fear to Greed in 10 Days — A Warning Sign?

Crypto Fear & Greed Index just jumped from Fear to Extreme Greed in under 2 weeks.

That kind of sentiment spike usually means short-term top, especially with price already at ATH.

So what’s the smart move here?

Whether Bitcoin chills or rips this Uptober, one thing’s certain: the biggest ROI often comes from knowing what to watch next.

As investors, our goal isn’t to guess the exact top.

Our job is to position smartly across multiple plausible outcomes:

Q4 2025 Peak – the base case. BTC tops around the halving narrative with a final wave of retail & institutional inflows

Early Bear Case – cycle ends sooner than expected, and capital preservation becomes the priority

Extended Bull Through 2026 – reflexive momentum continues into late 2026, driven by macro easing and innovation cycles

📣 Update

Ondo Finance finalizes Oasis Pro acquisition

Ondo Finance has completed its acquisition of Oasis Pro, a regulated digital asset broker-dealer and alternative trading system (ATS).

The deal, announced in October 2025, provides Ondo with SEC-registered broker-dealer, ATS, and transfer agent designations. This will enable it to operate compliant markets for tokenized securities within the United States.

Founded in 2019, Oasis Pro operates as a FINRA-member broker-dealer and SEC-registered transfer agent, and was among the first firms authorized to support digital securities settlement in both fiat and stablecoins such as USDC and DAI

📈 Signal

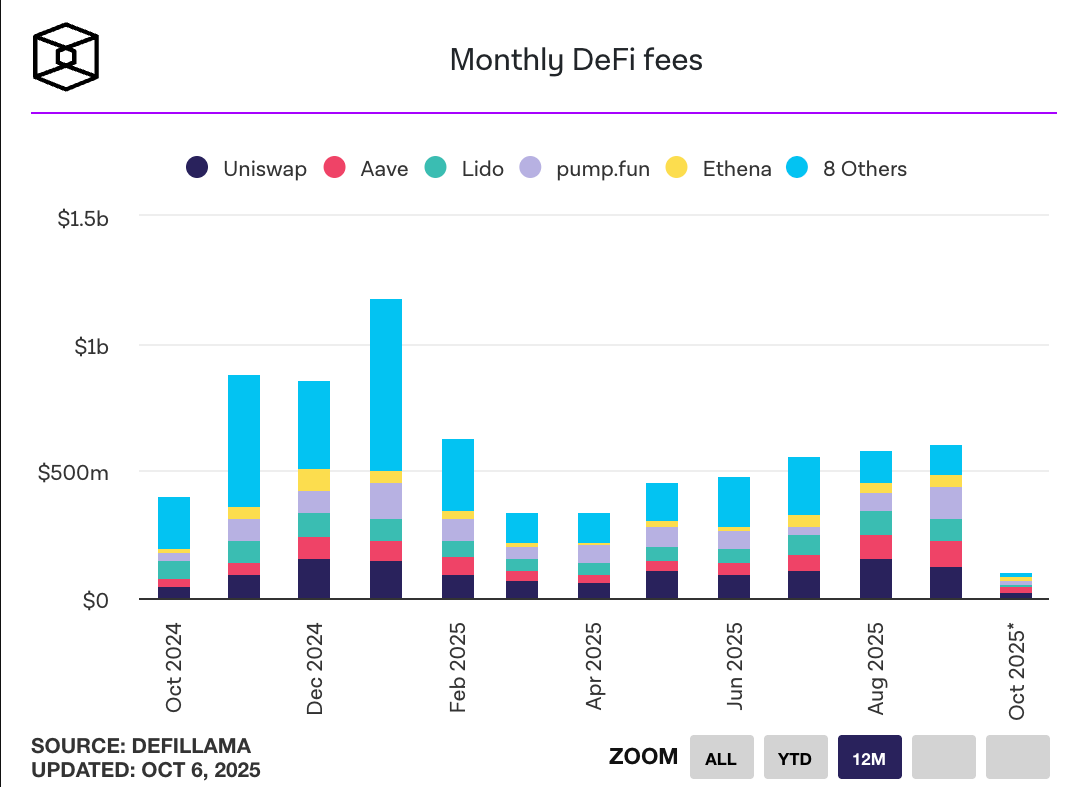

DeFi Comeback: Fees Up 76%

Protocols raked in $600M in fees in September, up from $340M in March.

Top protocols like Uniswap, Aave, and Ethena are leading a return to real revenue and financial fundamentals — moving away from “memeable” tokenomics toward buybacks, fee splits, and protocol-owned liquidity.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Best Buys September 2025 (link)

Value Investing Ratings - September 2025 (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time