👀 Retail Rotation: Utility > Memes

PLUS: BitMine Stock Climbs

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Treasury Holdings Hit $218B — ETH Is Breaking Out”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Retail Rotation: Utility > Memes

📣 BitMine Stock Climbs as Tom Lee’s Firm Boosts Ethereum Holdings to $11 Billion

📈 Ethereum still dominates crypto

Let’s dive in!

💡 Insight

Retail Rotation: Utility > Memes

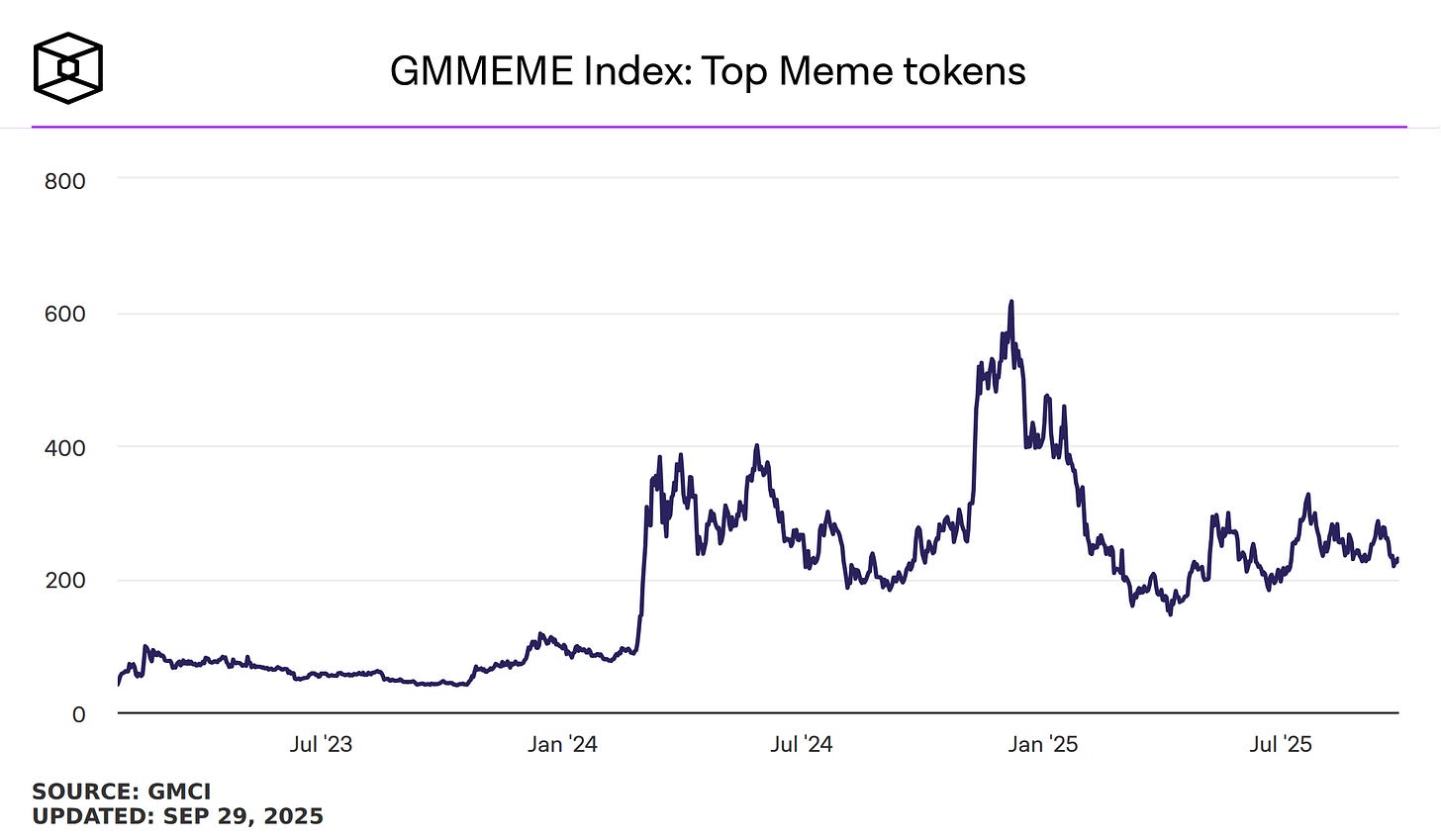

The GMCI Memecoin Index has crashed from 600 to 220 — a brutal 63% drawdown from last cycle’s top, when tokens like $BONK and $WIF were dominating retail flows.

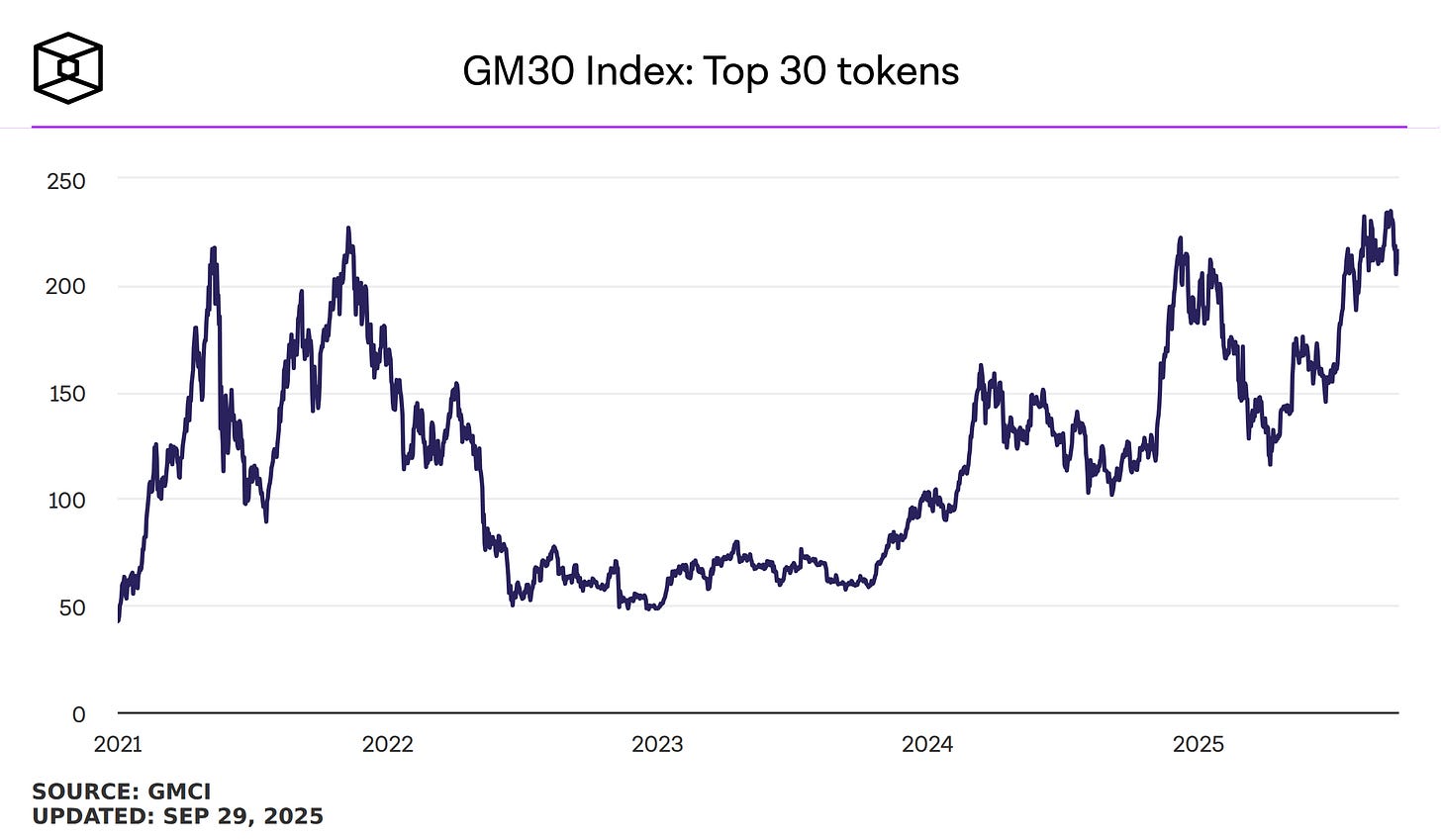

Meanwhile, the GMCI Top 30 Altcoin Index — which tracks high-cap, fundamentally strong altcoins — has been setting new all-time highs since November.

What’s Replacing Memecoins?

During the previous market cycle, memecoins played a prominent role in attracting retail investors to the crypto space. Their viral appeal, community-driven growth, and low entry barriers made them a popular choice — particularly for newcomers seeking high-risk, high-reward opportunities.

However, retail attention is rotating — and it’s going somewhere very specific:

✅ Protocols with actual utility

✅ Tokens that generate real fees

✅ Projects that are actively building (and shipping)

So where is the money flowing?

It’s rotating into projects that are building things:

Real-world asset (RWA) tokenization

Stablecoin ecosystems

DeFi infrastructure

Tokens like $ASTER (decentralized perpetual exchange) launched recently and immediately found market demand — because they come with roadmaps, utility, and credible use cases.

This lines up with what we covered in:

🧠 Best Buys – September 2025 – high-conviction tokens for this cycle

💸 4 Undervalued Protocols Generating Real Fees – real revenue + asymmetric upside

📈 Value Investing Ratings – September ‘25 – our monthly breakdown of the most fundamentally sound projects

What This Means for You

If your portfolio is still overweight memecoins, it might be time to rebalance. The market is clearly rewarding fundamentals over fun right now.

That doesn’t mean memecoins are dead forever — but it does mean this isn’t their moment.

Now’s the time to:

Look for real revenue models

Follow developer activity

Prioritize tokens that are solving big problems

📣 Update

BitMine Stock Climbs as Tom Lee’s Firm Boosts Ethereum Holdings to $11 Billion

BitMine Immersion Technologies stock rose Monday morning after the company announced that it purchased nearly $1 billion worth of Ethereum over the last week, pushing the valuation of its total ETH treasury to $11 billion.

The Ethereum treasury firm’s stock rose more than 6% to a recent price of $53.60, following the announcement.

📈 Signal

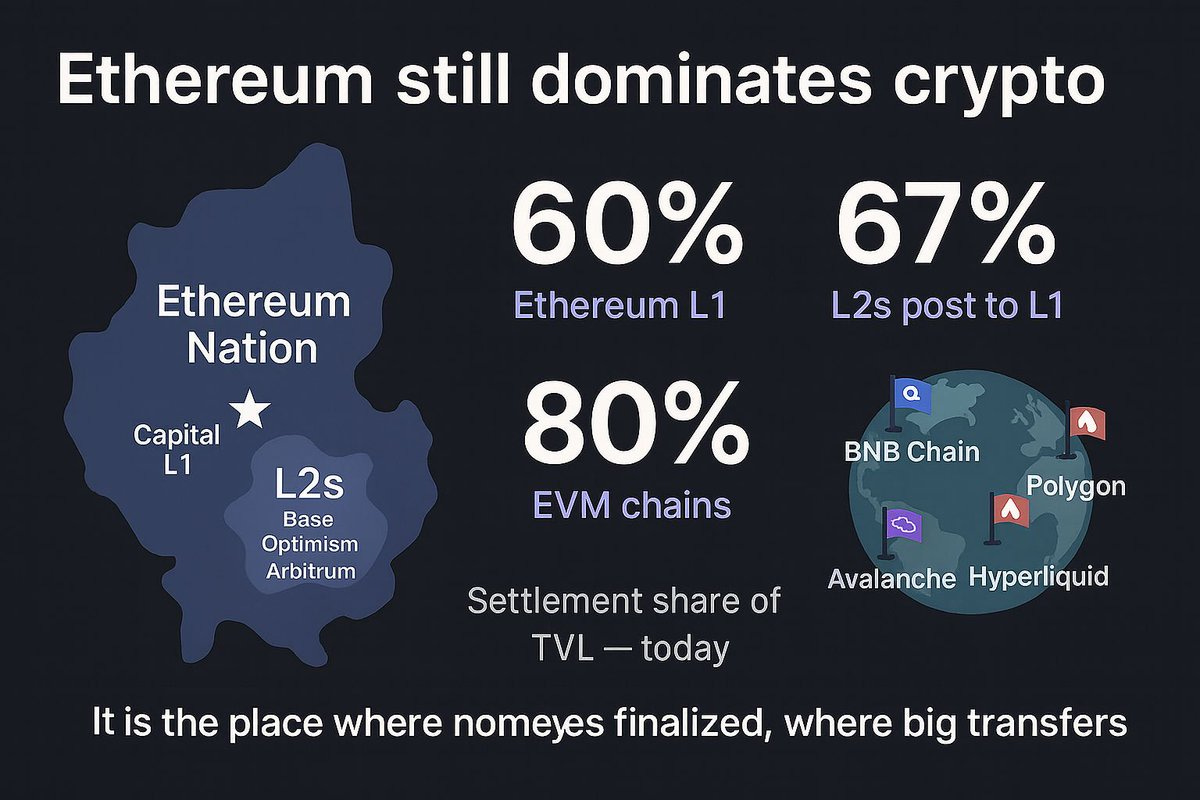

Ethereum still dominates crypto

60% of all value in DeFi settles on Ethereum L1

67% when you add L2s like Arbitrum, Optimism, Base

Around 80% when you count other EVM chains like BNB, Polygon, Avalanche

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Best Buys September 2025 (link)

Value Investing Ratings - September 2025 (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time