Bitcoin or Ethereum: Which Is Winning the Store of Value Game?

PLUS: Starknet is quietly the most Ethereum-aligned L2

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “This Q4 Crypto Report Is Full of Alpha”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Bitcoin or Ethereum: Which Is Winning the Store of Value Game?

📣 Tether Invests in Ledn to Expand Bitcoin-Backed Lending

📈 Starknet is quietly the most Ethereum-aligned L2

Let’s dive in!

💡 Insight

Bitcoin or Ethereum: Which Is Winning the Store of Value Game?

Big institutional money is rewriting the playbook for BTC and ETH — and we just got the clearest snapshot yet of how.

A fresh report from Keyrock and Glassnode breaks down on-chain behavior across five metrics to answer one question:

👉 Are Bitcoin and Ethereum being used as stores of value (SoV), or something else entirely?

Here’s the TL;DR for investors who want the alpha without the fluff:

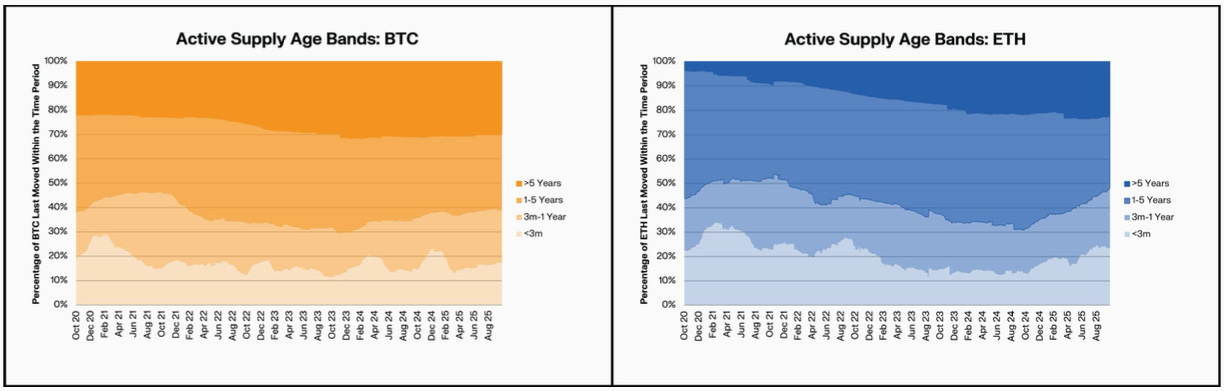

Bitcoin = Digital Gold (Still)

61% of BTC hasn’t moved in over a year.

Turnover is just 0.61% per day — one of the lowest of any global asset, only 2x gold.

BTC on exchanges is down to 14.3%, while ETF holdings now represent 6.7% of supply.

Anchored float (sticky supply) has doubled to 6.7% thanks to ETFs.

Only ~4.7% of BTC is “productive float”, meaning used in lending, LPs, or rehypothecation.

Takeaway: Institutions and OG holders are hoarding BTC like digital savings. It’s not being used — it’s being parked. That’s bullish for long-term price floor narratives.

Ethereum = Digital Oil + Reserve Collateral

ETH turnover is 1.34% per day — 2x BTC, but still far below fiat-like velocity.

ETH’s 1+ year dormancy dropped to 51.7%, meaning old coins are moving more.

Staking + ETFs = 25.1% of ETH supply locked in sticky contracts.

Productive float is a massive 16% — ETH is powering DeFi, staking, LPs, and being used as working capital.

Exchange balances plunged from 29% to 11.3%, as ETH flows into institutional wrappers and on-chain finance.

Takeaway: ETH behaves like a hybrid asset — it’s a reserve for the crypto economy and a tool to earn yield and secure networks. That’s more dynamic than BTC, but also more complex.

Why This Matters for Investors

Narratives drive flows. BTC is increasingly a “buy, hold, forget” play. ETH is a “deploy, earn, repeat” engine.

ETH’s role in the on-chain economy is growing. If you believe crypto infra will keep expanding, ETH is the fuel.

Both assets are institutionalizing. ETF and DAT adoption shows real-world demand for long-term custody, not just trading.

What to Watch Next

ETH’s productive float keeps rising → bullish for liquid staking, LRTs, and collateralized altcoins.

BTC’s growing role as pristine collateral → bullish for tokenized treasuries, ETF yield curves, and OTC lending platforms.

📣 Update

Tether Invests in Ledn to Expand Bitcoin-Backed Lending

Tether has made a strategic investment in bitcoin-backed lender Ledn to expand access to credit secured by BTC.

Ledn has originated more than $2.8 billion in BTC-backed loans to date, including over $1 billion in 2025 alone.

The crypto-backed lending market is forecast to grow nearly eightfold by 2033, driven by demand for liquidity without selling digital assets.

📈 Signal

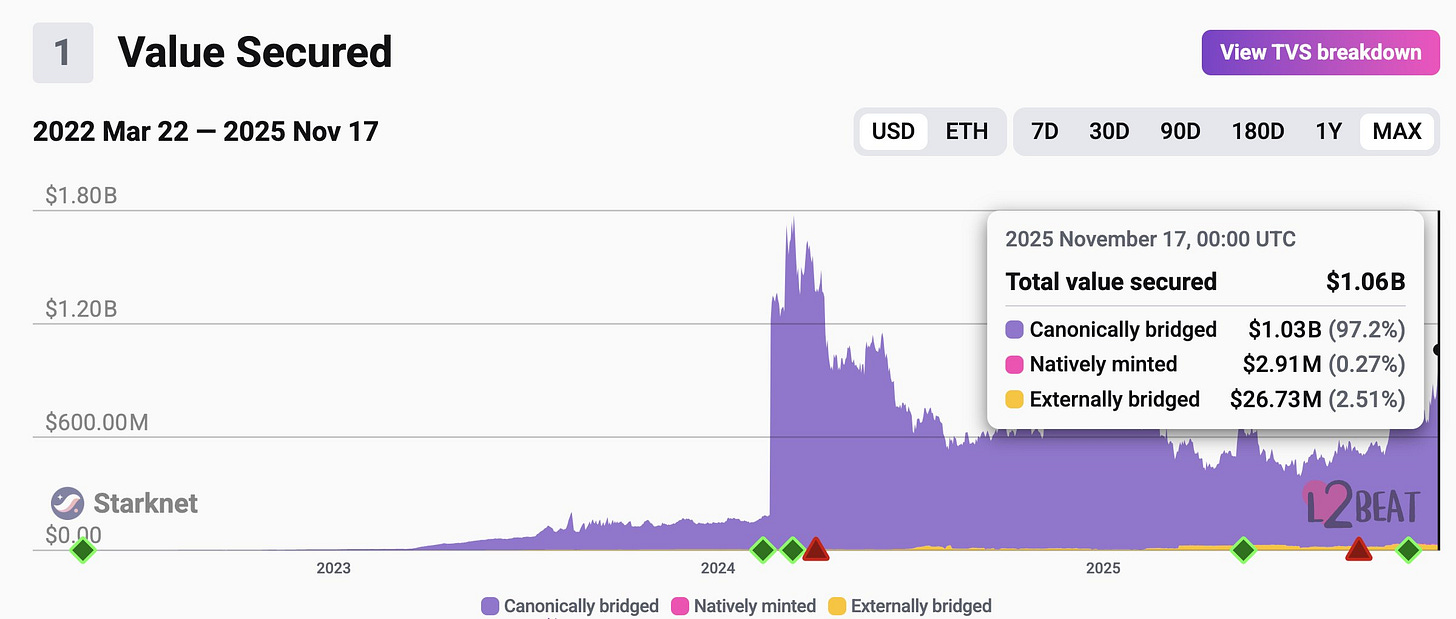

Starknet is quietly the most Ethereum-aligned L2

While Base, Arbitrum, and Optimism have grown fast, only a fraction of their assets actually originate from Ethereum L1:

Base: 24% of assets are Ethereum-native

Arbitrum: 28%

Optimism: 48%

Starknet: a staggering 97%

That means Starknet isn’t just compatible with Ethereum — it’s composed of Ethereum.

For investors who care about ETH security, L1 guarantees, and real property rights, Starknet is behaving more like an Ethereum extension than a sidecar.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Is the Bear Market Already Here? (link)

We’re buying this token (link)

This New Chain Could Kill Bridges Forever (link)

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time