The Financial System Is Being Rebuilt On-Chain

PLUS: Tom Lee's 'BitMine' buys 40,302 ETH worth $117 million

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Bitmine Goes Beast Mode: $200M Bet on MrBeast & DeFi”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 The Financial System Is Being Rebuilt On-Chain

📣 Tom Lee’s ‘BitMine’ buys 40,302 ETH worth $117 million

📈 Ethereum Dominates Tokenized Assets

Let’s dive in!

💡 Insight

The Financial System Is Being Rebuilt—On-Chain

We’re entering a new era—where public blockchains are becoming the financial layer of the internet, and Bitcoin is emerging as a macro asset class with institutional legs.

ARK Invest’s Big Ideas 2026 dropped this month, and here’s what matters most for crypto investors like us.

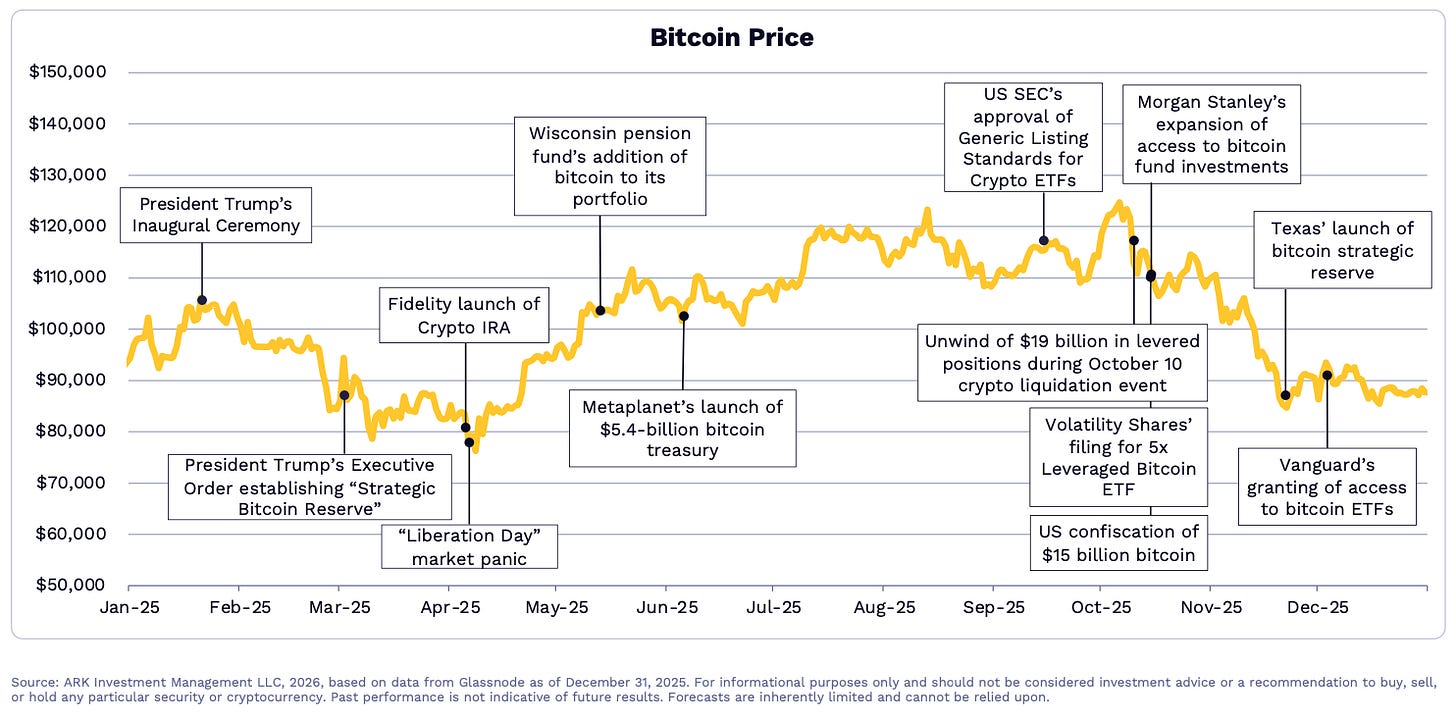

1. Bitcoin: From Speculative Asset to Strategic Reserve

“Bitcoin is leading the movement into a new institutional asset class.”

Bitcoin is no longer just “digital gold.” In 2025 alone:

U.S. ETFs and public companies grew their BTC holdings to 12% of total supply

Institutions like Morgan Stanley and Fidelity expanded access to BTC via IRAs and treasury strategies

Bitcoin’s Sharpe ratio outperformed ETH, SOL, and the CoinDesk 10 index, signaling strong risk-adjusted returns

ARK’s updated forecast puts BTC’s 2030 market cap between $5T–$10T, factoring in:

Institutional portfolios (1–6.5% allocation)

Gold replacement

Emerging market safe-haven flows

Nation-state and corporate treasuries

What This Means for You

BTC is maturing into a core allocation, not a trade. If this trend continues, owning BTC is like owning early-stage exposure to a future central bank reserve asset.

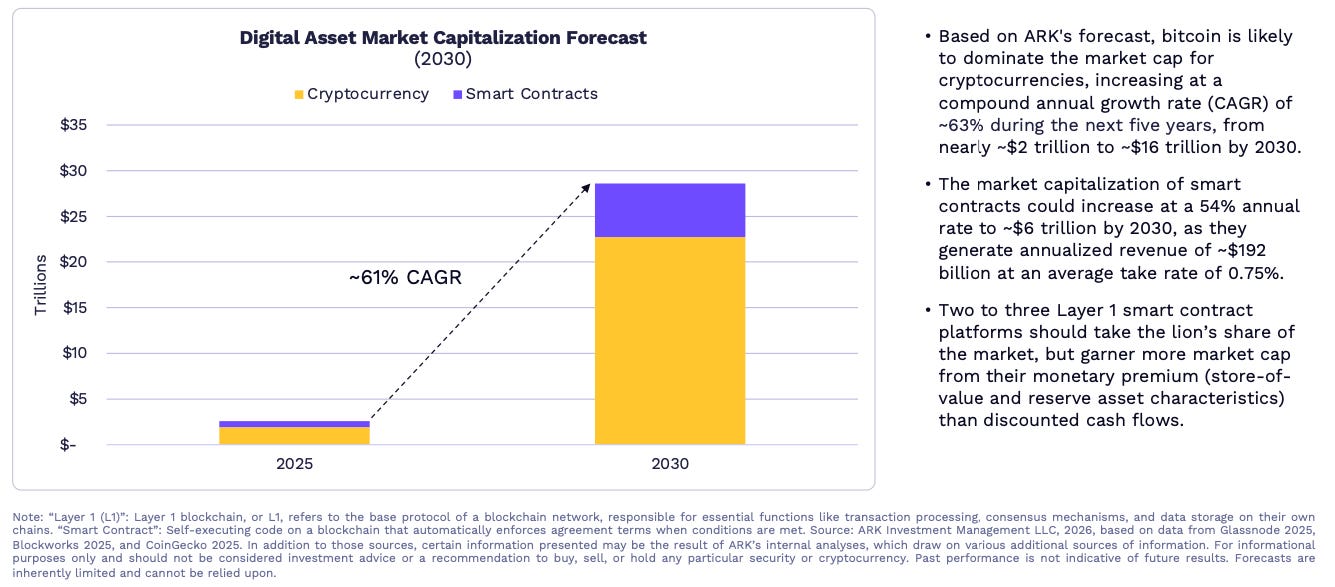

2. Public Blockchains: Rewiring Finance

ARK projects that in the next cycle:

“All money and contracts could migrate onto public blockchains.”

Why? Because they:

Enable digital scarcity and proof of ownership

Collapse the cost of executing contracts via smart contracts

Reduce reliance on capital and regulatory intermediaries

Power the next wave of AI-driven digital wallets as autonomous financial agents

The convergence of stablecoins, Layer 2s, and smart contracts could restructure global finance from the ground up.

Example Play

Track adoption of smart contract platforms like Ethereum, Solana, or emerging chains with strong developer traction and Layer 2 scaling:

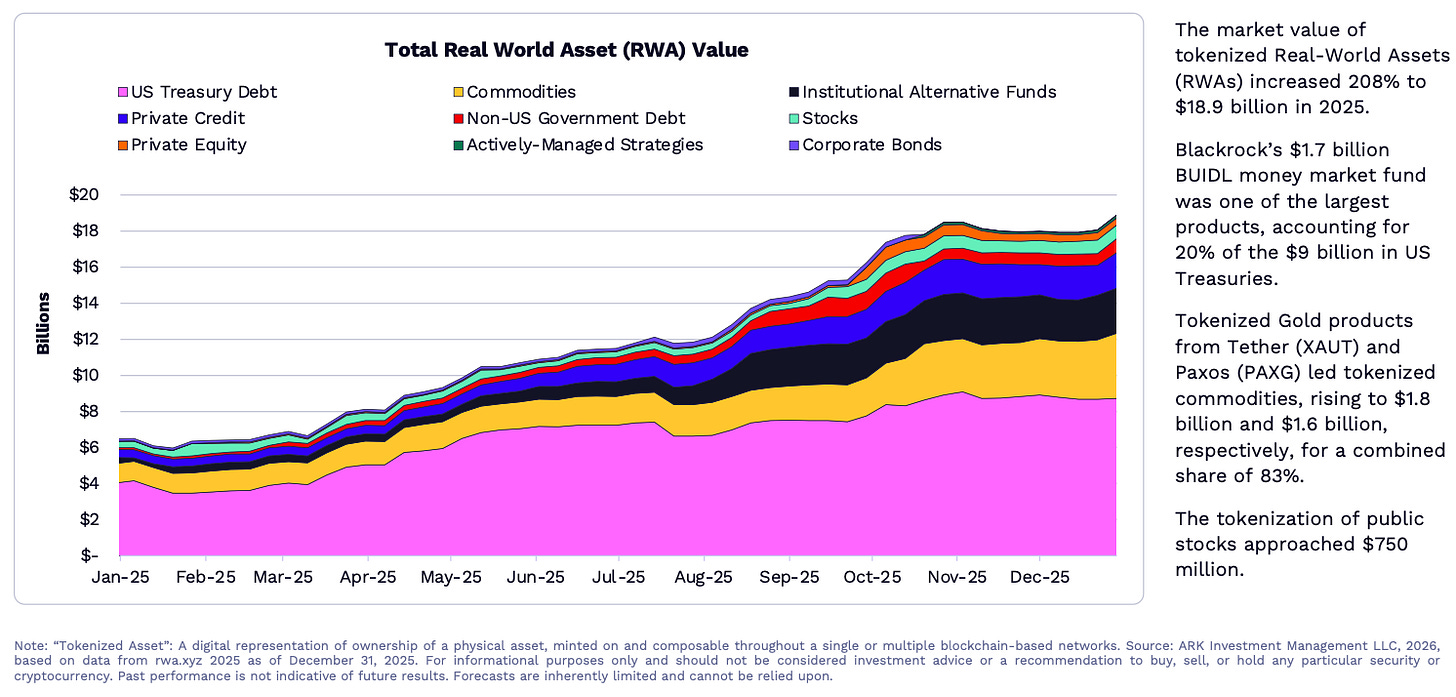

3. Tokenized Assets: Real-World Value, On-Chain

“Tokenized assets could transform the $260 trillion global asset base into programmable financial instruments.” – ARK

Tokenization is the bridge between TradFi and DeFi—and it’s just getting started.

Key unlocks:

24/7 liquidity for previously illiquid assets

Automated yields from tokenized T-bills and treasuries

Composability across financial products and smart contracts

ARK forecasts explosive growth in tokenized RWAs, with Ethereum and EVM-compatible chains likely benefiting the most.

📣 Update

Tom Lee's 'BitMine' buys 40,302 ETH worth $117 million

BitMine Immersion Technologies just made a massive move—accumulating 40,302 ETH in a single transaction.

That brings their total holdings to 4.24 million ETH, worth over $12.3B at today’s prices.

Why it matters

This kind of institutional-scale accumulation helps create a long-term price floor for ETH

It reinforces Ethereum’s position as yield-generating infrastructure, not just “smart contract gas”

And it’s the kind of consistent buying pressure that pulls ETH back into its bullish channel after macro sell-offs

📈 Signal

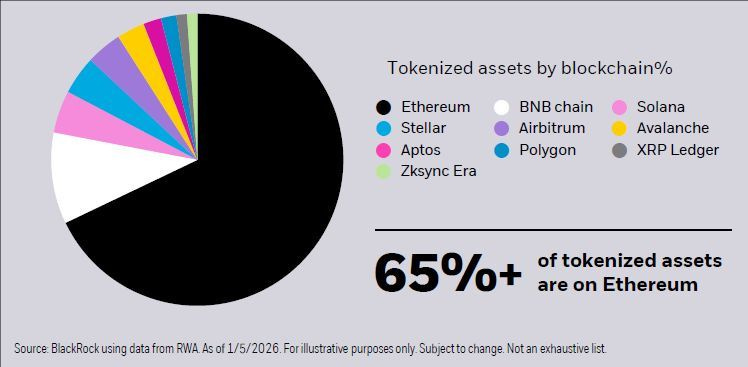

Ethereum Dominates Tokenized Assets

BlackRock just dropped this chart—and it’s a major validation for Ethereum’s long-term positioning in the tokenization space.

65%+ of all tokenized assets now live on Ethereum Mainnet

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Value Investing Ratings - January ‘26 (link)

A Treasury Bigger Than ETH ETFs (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time

Really intreseting piece on institutional adoption of on-chain infrastucture. The convergence between smart contracts, stablecoins, and L2s is setting up the rails for something much bigger than just DeFi. Saw similar patterns last year when tokenized T-bills started gaining traction but the programability angle is what actually differentiates this from traditional securities infrastructure.