This Is When We’d Exit the Market (And Why)

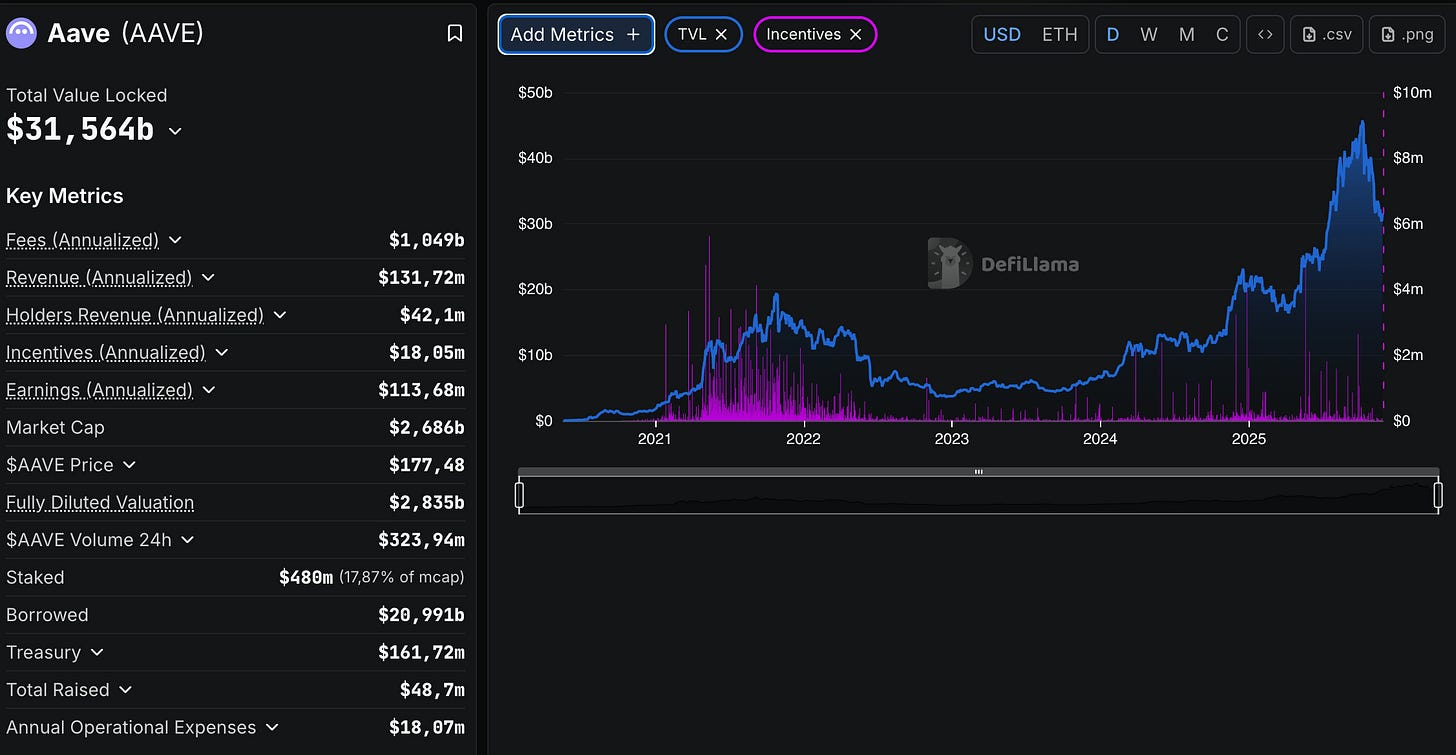

PLUS: AAVE is generating $131M in annualized revenue — with almost no token incentives

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Bitcoin or Ethereum: Which Is Winning the Store of Value Game?”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 This Is When We’d Exit the Market (And Why)

📣 Private Equity Firm Bridgepoint to Buy Majority of Crypto Audit Specialist ht.digital

📈 AAVE is generating $131M in annualized revenue — with almost no token incentives

Let’s dive in!

💡 Insight

This Is When We’d Exit the Market (And Why)

Over the last few weeks, we talked about the importance of sticking to your investment thesis.

Today, let’s talk about the other side:

Every thesis should have a clear exit plan—a set of signals that tell you when it’s time to reduce exposure or sell.

Here are 4 macro signals we are watching closely. If these turn in the wrong direction, we reassess our positions in crypto:

1. Inflation Starts Rising Again

Why it matters: Higher inflation often leads to higher interest rates, which reduces liquidity and puts pressure on risk assets like crypto.

→ U.S. inflation has been slowly climbing since April, according to Truflation, but it’s not alarming—yet.

What to watch: If inflation goes above 4% and holds, it could signal trouble ahead.

2. Interest Rate Cuts Get Delayed or Cancelled

Why it matters: Markets (including crypto) often price in future interest rate cuts. If cuts are delayed or canceled, it removes one source of optimism.

→ Recently, the odds of a December rate cut flipped multiple times, based on data from Polymarket.

What to watch: If markets expect no cuts in the near term, crypto prices could struggle.

3. Quantitative Tightening (QT) Resumes

Why it matters: QT is when the Federal Reserve removes money from the financial system. Less liquidity usually means more pressure on markets.

→ The Fed can either reinvest in U.S. treasury bills or let them expire. If they stop reinvesting, that’s QT.

What to watch: If QT picks up again, it could reduce demand for risk assets.

4. The U.S. Dollar Strengthens Sharply

Why it matters: A stronger dollar makes investors less likely to move into riskier assets like crypto.

→ The U.S. Dollar Index (DXY) has been ticking up recently, which isn’t great for altcoins—but not yet a major concern.

What to watch: If DXY rises above 108, it may signal a risk-off environment.

📣 Update

Private Equity Firm Bridgepoint to Buy Majority of Crypto Audit Specialist ht.digital

Bridgepoint agreed to buy a majority stake in ht.digital, a London-based specialist provider of audit, accounting and assurance to the digital asset industry.

Ht.digital has delivered organic revenue growth of c.100% over the last two years.

Sky News reported the deal was worth 200 million pounds ($262 million).

📈 Signal

AAVE is generating $131M in annualized revenue — with almost no token incentives

In a market flooded with projects burning money to attract users, AAVE stands out: it’s quietly becoming one of the most profitable DeFi protocols without relying on heavy token emissions.

This is what some are calling the “revenue meta” — where real usage and protocol fees matter more than hype or yield farming.

As capital gets smarter, investors are starting to favor projects with sustainable business models and actual cash flow — not just incentives.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Value Investing Ratings - November ‘25 (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

Is the Bear Market Already Here? (link)

We’re buying this token (link)

This New Chain Could Kill Bridges Forever (link)

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time