Are Crypto Ecosystems Really Decentralizing?

PLUS: This historical trend says to expect a $160K+ BTC in 60 days

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “SEC Signals Onchain Stock Revolution (Here’s What It Really Means)”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Are Crypto Ecosystems Really Decentralizing?

📣 Why Tom Lee Just Bought $421M in Ethereum

📈 This historical trend says to expect a $160K+ BTC in 60 days

Let’s dive in!

💡 Insight

Are Crypto Ecosystems Really Decentralizing?

Despite crypto’s promise of decentralization, many critical subsystems — like Bitcoin’s consensus layer, NFT marketplaces, and developer networks — are trending toward centralization.

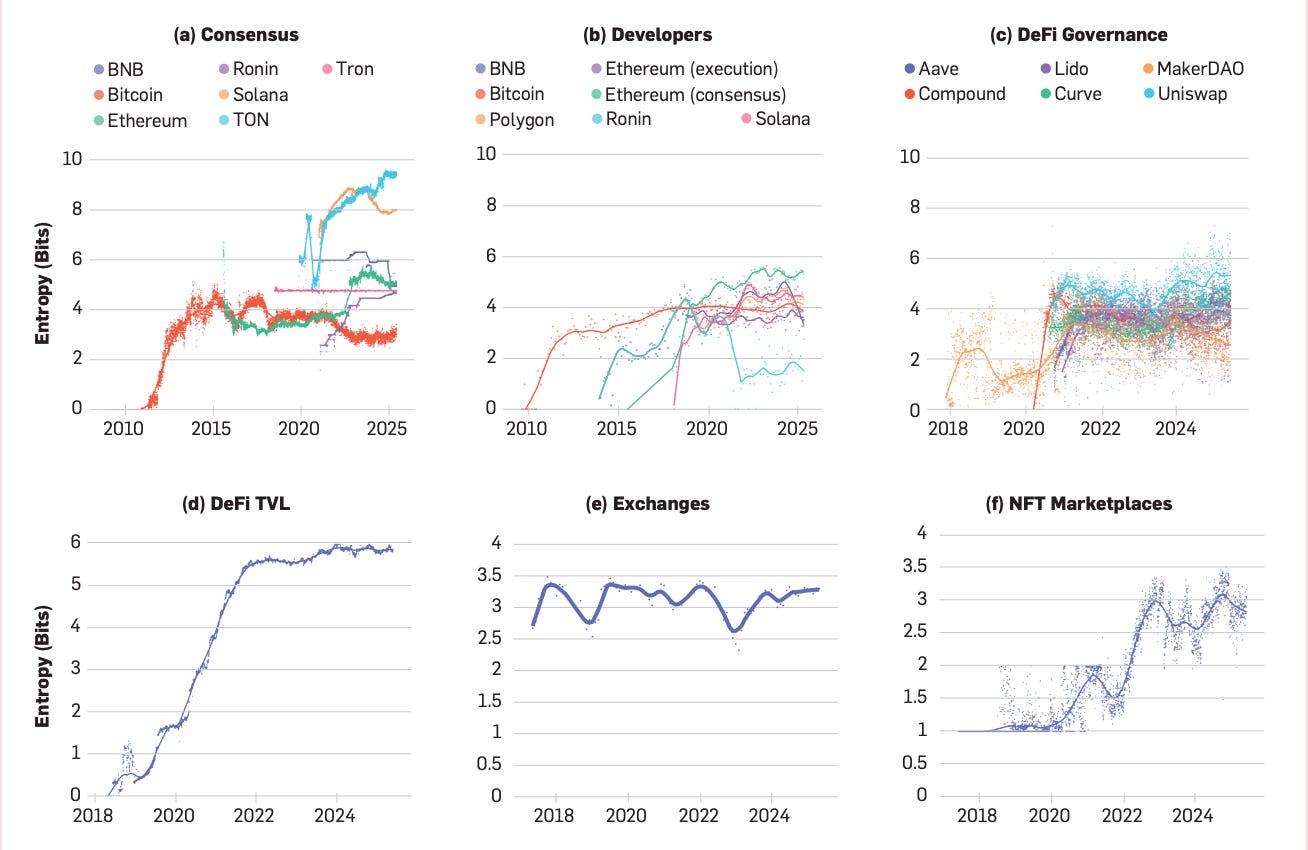

A new study tracked decentralization over time across major blockchains using real metrics (like entropy).

Researchers analyzed 7 major blockchains (Bitcoin, Ethereum, Solana, BNB, Tron, TON, Ronin) using a novel framework to track decentralization trends across time, including:

Consensus layer

Developer activity

DeFi protocols

Exchanges

NFT marketplaces

They used Shannon entropy — a mathematical way to measure how spread out power or participation is. The higher the entropy, the more decentralized.

Key Findings

1. Bitcoin’s Consensus Layer Is Becoming MORE Centralized

Despite its branding as decentralized, Bitcoin’s validator set has become more concentrated since 2021. Centralization = more risk of manipulation or collusion.

👉 Investor takeaway: Don’t assume decentralization is static. BTC’s decentralization “brand” might not match reality.

2. Ethereum & Solana Are Becoming More Decentralized

Their validator networks and client development show increased decentralization over time.

👉 Investor takeaway: These are blockchains actively working to stay decentralized — often through client diversity and active governance.

3. DeFi Was Decentralizing Fast… Until It Plateaued

From 2018 to 2021, DeFi saw an explosion of decentralization. But now? Most value is concentrated in a few dominant protocols (e.g., Uniswap, Aave, MakerDAO).

👉 Investor takeaway: Newer protocols with less TVL but more evenly distributed governance tokens may offer better long-term upside.

4. NFT Marketplaces Were a Monopoly — Until Blur Disrupted OpenSea

Before 2022, OpenSea was almost a monopoly. Entropy (i.e., decentralization) was near zero. After Blur launched, competition surged — entropy doubled.

👉 Investor takeaway: Watch for new NFT marketplaces with fresh tokenomics or community-driven curation. First-mover monopolies can be unseated.

5. Crypto Exchanges: Stuck in a Centralization Deadlock

Despite more exchanges launching, centralized volume remains controlled by a few major players (Binance, Coinbase, etc.). Entropy barely moved since 2018.

👉 Investor takeaway: Be cautious about tokens overly reliant on single exchanges for liquidity or listings.

Altcoins Worth Watching

Here are 3 altcoins that might benefit from decentralization trends:

Celestia (TIA) – Modular blockchain with growing validator diversity

Jito (JTO) – Solana-native staking protocol increasing validator decentralization

Blur (BLUR) – Disrupting NFT marketplace monopolies with incentives and liquidity

📣 Update

Why Tom Lee Just Bought $421M in Ethereum

Despite Ethereum trading ~40% below its all-time high, crypto bull Tom Lee just dropped $421 million into ETH — bringing Bitmine Capital’s holdings to 3.4% of the entire ETH supply.

Here’s what you need to know 👇

Ethereum is powering the tokenization of government bonds, private equity, and real estate.

Bitmine believes Ethereum is becoming the “settlement layer of the new internet”.

Their internal thesis? ETH below $3K is “like buying AWS stock in 2006.”

📈 Signal

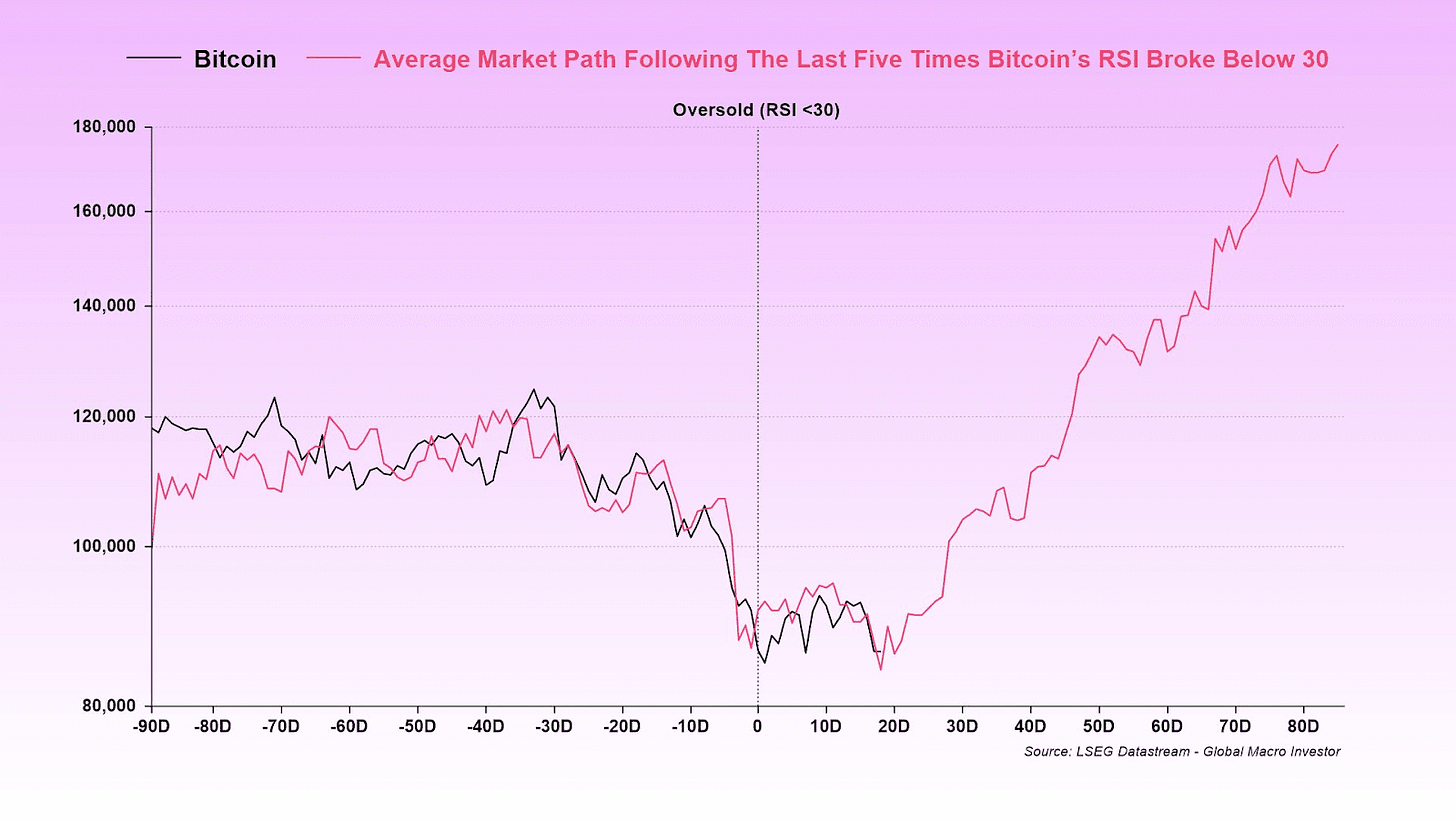

This historical trend says to expect a $160K+ BTC in 60 days

Julien Bittel from Global Macro Investor (GMI / Real Vision), just dropped a chart that might make you FOMO into your cold wallet again.

Every time Bitcoin’s RSI dips below 30, it signals the market is oversold — meaning the pain sellers are mostly out, and buyers could soon take over.

Quick RSI Refresher:

RSI (Relative Strength Index) is a momentum indicator from 0 to 100

Above 70 = Overbought → Rally may be overheated

Below 30 = Oversold → Capitulation might be complete

👉 Right now, BTC is at the ~20-day mark post-RSI breakdown — historically the point where the grind ends and the moon mission begins.

If the pattern repeats — like it did after the last 5 RSI <30 events — then we’re potentially looking at BTC surging toward $160K–180K over the next 60 days.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Value Investing Ratings - December ‘25 (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time