SEC Signals Onchain Stock Revolution (Here’s What It Really Means)

PLUS: Jupiter’s JupUSD Stablecoin Goes Live Next Week

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Why Altcoins Are Losing to Bitcoin in the Most Institutional Cycle Ever”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 SEC Signals Onchain Stock Revolution

📣 Jupiter’s JupUSD Stablecoin Goes Live Next Week

📈 Tokenized Assets Hit $330B+ ATH

Let’s dive in!

💡 Insight

SEC Signals Onchain Stock Revolution

Big news this week: SEC Commissioner Paul Atkins says all U.S. markets will be onchain within two years.

This isn’t just bullish for crypto — it’s a seismic shift that could open the floodgates for tokenized assets… if you understand what’s really going on behind the scenes.

Let’s break it down.

1. Why This Matters

Behind every stock trade is a massive infrastructure of middlemen. One of the biggest? The DTCC — the hidden plumbing of Wall Street.

They handle $2+ quadrillion in transactions per year.

If stocks were cars, the DTCC builds the highways.

For decades, it’s been all paper trails, legacy systems, and settlement delays. But that’s changing…

2. Wrapped Stocks vs. Real Onchain Stocks

Until now, most “tokenized stocks” in crypto have been wrapped:

A custodian buys the stock

Issues a token that represents it

You trade the token, but don’t own the actual stock

Problems:

No legal clarity

No voting rights

Dividends? Maybe.

Regulatory gray zones everywhere

That’s why TradFi never took it seriously.

3. Enter: DTCC-Issued Onchain Stocks

This new move means actual stocks — issued directly onchain by the DTCC — are coming.

No wrappers. No middlemen. No legal murkiness.

Just real equities, tokenized with full rights.

✅ You own the legal title

✅ You get voting rights

✅ You receive dividends

This is not a DeFi experiment. It’s Wall Street going onchain — and it’s coming fast.

4. The Bigger Picture: What This Unlocks

This changes the game for:

Global 24/7 trading (no more “market hours”)

Instant settlement (goodbye T+2 delays)

Programmable finance (imagine automated dividends, airdrops, or even DAO voting tied to your stock)

And it puts real pressure on lagging institutions to adapt — or get left behind.

📣 Update

Jupiter’s JupUSD Stablecoin Goes Live Next Week

Solana’s top DEX aggregator Jupiter is rolling out its own stablecoin — JupUSD — with live trading and yield features at launch.

Unlike wrapped or third-party stablecoins, JupUSD will be deeply integrated into Jupiter’s DeFi stack, powering limit orders, DCA, prediction markets, and more.

📌 Why it matters:

Gives Solana a native liquidity layer inside its biggest DeFi app

Adds a new revenue and growth vector for $JUP

Signals a broader trend of protocols launching ecosystem-native stablecoins

📈 Signal

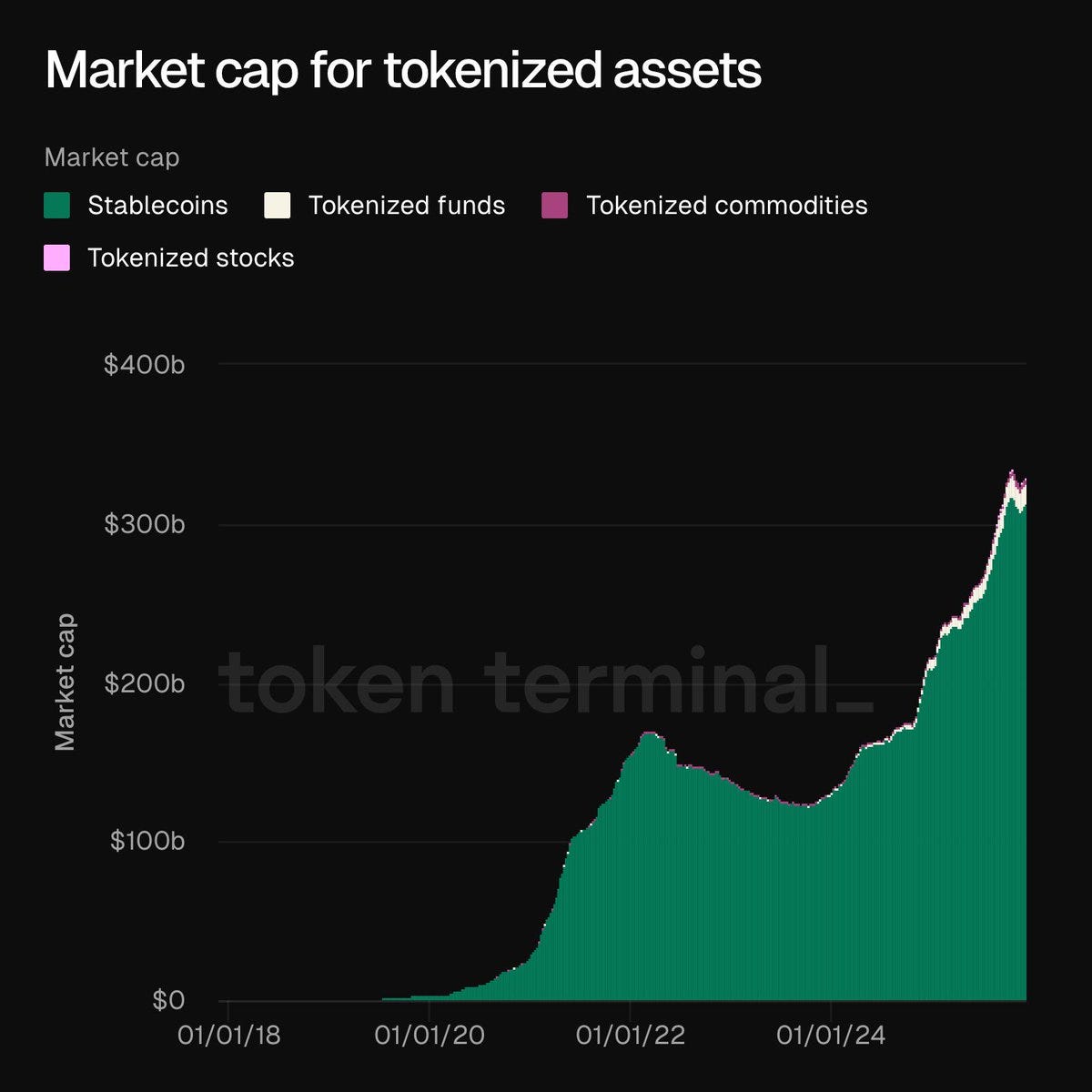

Tokenized Assets Hit $330B+ ATH

The total market cap of tokenized real-world assets (RWAs) has just hit an all-time high of $330B+.

This includes:

💵 Stablecoins (USDC, USDT, etc.)

📊 Tokenized funds (BlackRock’s BUIDL)

🪙 Tokenized commodities (like gold)

📈 Tokenized stocks (soon: DTCC-backed)

🧠 Why this matters:

RWAs aren’t just a niche trend — they’re quietly becoming crypto’s biggest use case by market cap.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time