BTC at $174k by 2026?

PLUS: Crypto Payments Are Quietly Going Mainstream

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Are Crypto Ecosystems Really Decentralizing?”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 BTC at $174k by 2026?

📣 Spot bitcoin ETFs report $697 million in net inflows, largest daily total since October

📈 Crypto Payments Are Quietly Going Mainstream

Let’s dive in!

💡 Insight

BTC at $174k by 2026?

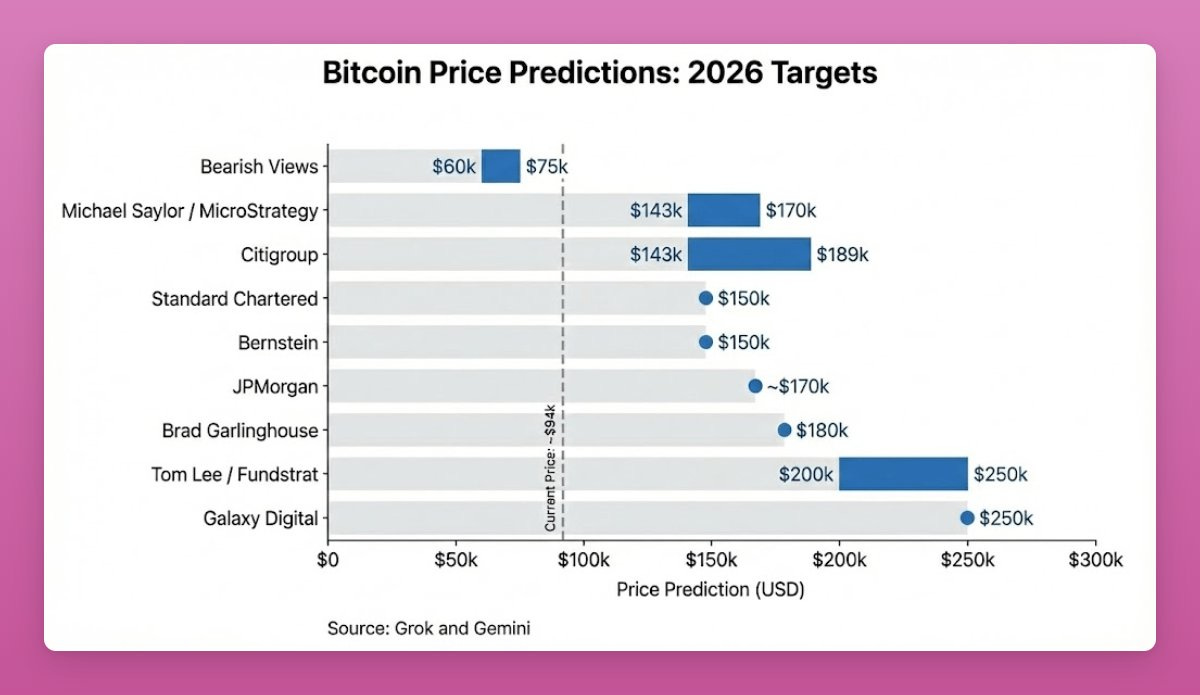

After last year’s missed calls, no one wants to make bold predictions.

But look closer and a quiet consensus emerges:

Most institutions cluster around $150k–$180k BTC by 2026.

The $174k case is surprisingly simple:

Bitcoin continues to behave like digital gold

Rate cuts push gold toward ~$5k

BTC only needs to reach 10% of gold’s market cap to hit ~$174k

No supercycle. No hype. Just relative value catching up.

Even more important:

OG whales and 4-year cycle traders already sold. The seller overhang is fading.

If supply dries up, BTC doesn’t grind higher — it reprices fast.

The real risk isn’t being wrong on the number.

It’s being underexposed if the catch-up trade happens.

📣 Update

Spot bitcoin ETFs report $697 million in net inflows, largest daily total since October

U.S. spot bitcoin ETFs saw $697 million in net inflows on Monday, which marks a three-month high in daily total inflows.

Analysts said inflows signal “cautious optimism” among crypto traders, with the medium-term outlook still contingent on macroeconomic conditions and regulatory stability.

📈 Signal

Crypto Payments Are Quietly Going Mainstream

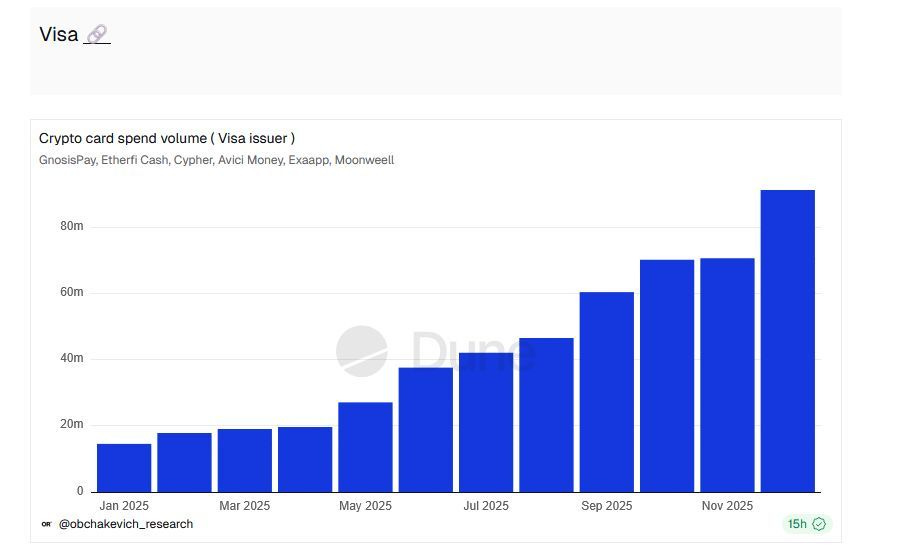

Crypto payments are scaling faster than most people realize.

In 2025 alone, Visa crypto card spending grew +525%, from $14.6M to $91.3M in net spend (Dune data).

But consumer cards are just the entry point.

The bigger shift is happening on the business side:

Companies managing payments onchain

Seamless crypto ↔ fiat movement

Onchain treasuries

Yield on idle balances

Programmable money flows

What the data already confirms:

Crypto is being used for real payments

Cards remove friction and hide complexity

Onchain balances increasingly behave like money, not assets

Crypto isn’t replacing the financial system overnight. It’s quietly becoming the infrastructure underneath it.

That’s the signal most people are still missing.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Value Investing Ratings - December ‘25 (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time

Solid take on the $174k target. The 10% of gold's market cap framework is cleaner than most macro models becuase it just assumes mean reversion rather than some explosive narrative. The supply side story is also critical, lots of OG hodlers already rotated out last cycle so the remaining supply is way stickier. If ETF flows stay consistent and we get those rate cuts the repricing could be pretty sudden.