Every ETH Crash Sets Up a Massive Run. This One Is No Different.

PLUS: ETH Stakers Aren’t Flinching

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “This Is When We’d Exit the Market (And Why)”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Every ETH Crash Sets Up a Massive Run. This One Is No Different

📣 Vanguard to Allow Bitcoin, Ethereum and XRP ETF Trading

📈 ETH Stakers Aren’t Flinching

Let’s dive in!

💡 Insight

Every ETH Crash Sets Up a Massive Run. This One Is No Different

Ethereum just printed its second worst November return in history at -22.38% — only surpassed by the brutal -42.79% crash in 2018.

But here’s the kicker:

Historically, every nasty November has triggered a major trend shift.

Let’s break it down:

📉 November 2018: ETH nuked -42.79%. Sentiment was dead. But that flush reset the entire market. What came next? A 10x from the lows over the next cycle.

📉 November 2022: ETH dumped -17.67% during the FTX blow-up. Forced sellers got wiped out. ETH doubled in 90 days.

📉 November 2025: We just closed at -22.38%. Same story. Same setup?

🚨 What Red Novembers Actually Do

Every major drawdown in November has:

✅ Flushed out over-leveraged traders

✅ Reset positioning for institutions

✅ Created asymmetric upside heading into Q1 when liquidity returns

💡 How to Position for What’s Coming

November just flushed the weak hands. Here’s how smart money gets positioned before the next leg:

DCA into ETH and Top L2s

ETH is the core bet — it leads every major alt season.

DCA weekly through December while volatility is high.

Pair with high-conviction L2s for asymmetry.

Exposure to ETH-Linked Crypto Stocks

Crypto stocks offer leveraged exposure to crypto upside — but they’re tradable in retirement accounts and legacy systems.

They’re often first to bounce when institutional money rotates back in.

→ This company aims to become Wall Street’s most aggressive Ethereum accumulator, combining DeFi leverage, MEV block-building, and validator income into one public stock.

📣 Update

Vanguard to Allow Bitcoin, Ethereum and XRP ETF Trading

Vanguard is opening its brokerage platform to crypto-focused ETFs and mutual funds, abandoning a stance that had kept digital-asset products off its shelves for years.

Beginning Tuesday, the firm will permit trading in funds that hold Bitcoin, Ethereum, XRP, and Solana, putting crypto exposure on the same footing as other non-core assets it already accommodates, such as gold, Bloomberg reported.

📈 Signal

ETH Stakers Aren’t Flinching

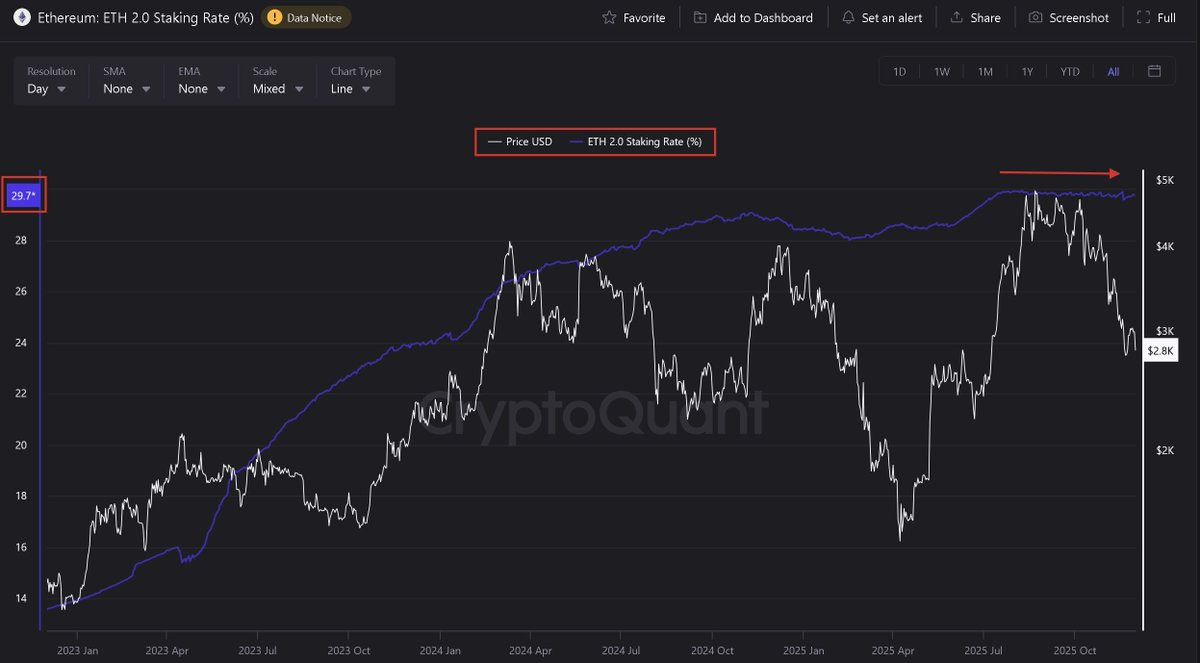

Ethereum is down ~50% from its 2025 highs.

But here’s the alpha 👇

ETH 2.0 staking rate is holding steady at 29.7% — near all-time highs.

🔍 What This Tells Us

Speculators are selling.

The core base layer (stakers, validators, long-term holders) — aren’t moving.

ETH’s staking behavior is sticky, slow, and capital-intensive. These are not tourists — they’re infrastructure-level investors.

When ETH collapsed in 2022, staking adoption was still early.

Now? Nearly 1 in 3 ETH is staked and untouched — even in a -50% drawdown.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

The Long-Term Crypto Investor Playbook (link)

Value Investing Ratings - November ‘25 (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

Is the Bear Market Already Here? (link)

We’re buying this token (link)

This New Chain Could Kill Bridges Forever (link)

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time