Hyperliquid Is Quietly Eating Coinbase’s Lunch

PLUS: Ethereum Usage Is Breaking Records

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “The Case for Lido (LDO) Comeback”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Hyperliquid Is Quietly Eating Coinbase’s Lunch

📣 Cathie Wood’s Ark Invest buys more Bullish as stock jumps over 16%

📈 Ethereum Usage Is Breaking Records

Let’s dive in!

💡 Insight

Hyperliquid Is Quietly Eating Coinbase’s Lunch

Most people still think centralized exchanges dominate crypto trading.

That assumption is now wrong.

The data you haven’t seen yet 👇

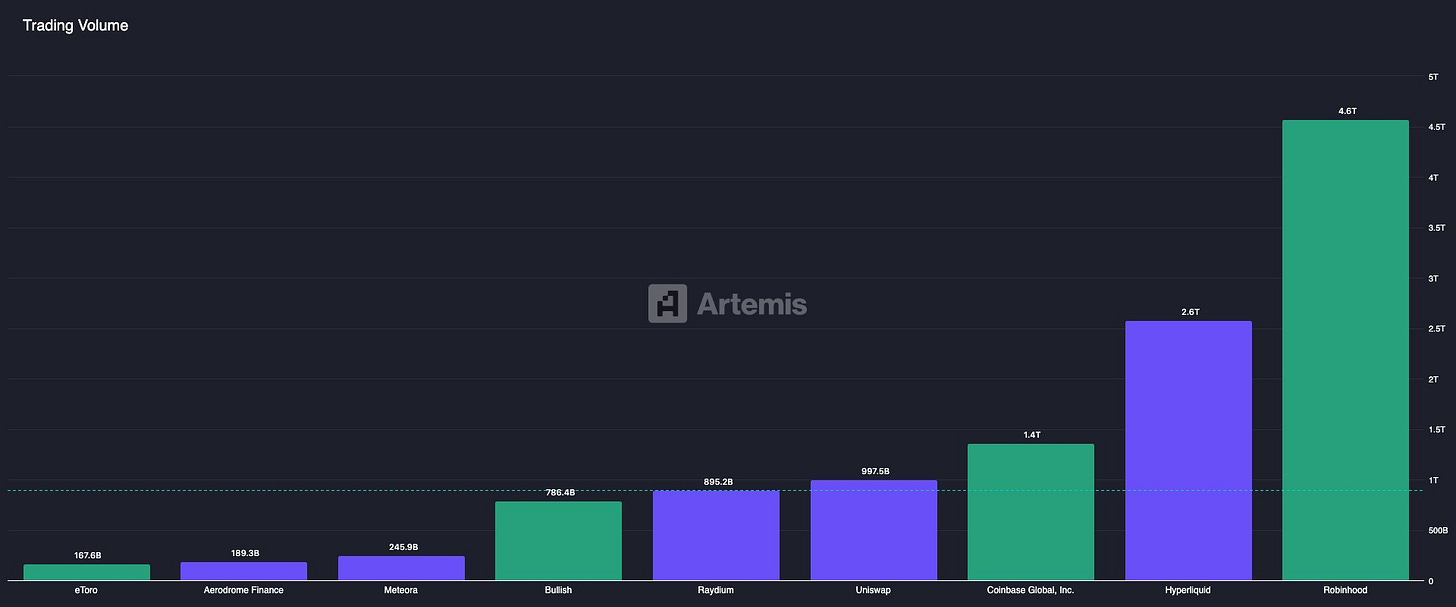

Trading volume:

Coinbase: $1.4T

Hyperliquid: $2.6T

Yes — an onchain exchange is doing ~2x Coinbase’s volume.

And the market is already reacting.

YTD price performance:

Hyperliquid: +31.7%

Coinbase: -27.0%

That’s a +58.7% divergence in weeks.

Why this matters more than it looks

Let’s zoom out.

Hyperliquid isn’t just “another DEX.”

It’s showing three dangerous things for centralized exchanges:

1️⃣ Volume is migrating onchain

For years, the bear case on DEXs was: “Users won’t trade size onchain.”

That’s now dead.

Hyperliquid is handling institution-scale notional with:

Deep liquidity

Fast execution

No KYC

Full self-custody

This is exactly what power users want in a post-FTX world.

2️⃣ The fee model is asymmetric

Coinbase makes money by:

Charging ~1% take rates

Acting as a regulated middleman

Hyperliquid:

Charges an order of magnitude less

Still captures massive absolute fees due to volume

Doesn’t carry regulatory overhead

Lower fees → more traders → more volume → stronger moat.

Classic flywheel.

3️⃣ The market rewards the narrative early

Price action tells you what fundamentals will confirm later.

While Coinbase stock bleeds:

Hyperliquid is being priced as infrastructure, not a trading app

Investors are front-running a future where:

“Onchain is the default, not the alternative”

This is how category leaders are born.

The real takeaway (and what to do next)

This isn’t about Coinbase vs Hyperliquid.

It’s about where crypto liquidity is going next.

If Hyperliquid can outperform:

A publicly listed exchange

With regulatory advantages

And brand recognition

Then imagine what happens when:

More perps move onchain

More chains integrate

More whales follow liquidity

📣 Update

Cathie Wood’s Ark Invest buys more Bullish as stock jumps over 16%

Cathie Wood’s Ark Invest purchased additional shares of Bullish on Monday as the stock advanced amid a broader rally in equity markets.

The firm bought a total of 57,164 Bullish shares today across three of its exchange-traded funds, worth around $1.83 million based on the closing price, according to the firm’s trading disclosure.

The move followed its purchase of 393,057 shares of Bullish on Friday, valued at roughly $10.8 million. Ark also sold about $22.2 million worth of Coinbase shares that day.

📈 Signal

Ethereum Usage Is Breaking Records

ETH mainnet transactions just hit an ALL-TIME HIGH.

👉 70.4M monthly transactions on mainnet

🧠 Takeaway

When:

Usage is at all-time highs

Network demand is accelerating

Price is still deeply discounted

You don’t fade it.

You prepare.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

The 2026 Bitcoin Strategy Guide (link)

A Treasury Bigger Than ETH ETFs (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time