The Case for Lido (LDO) Comeback

PLUS: Cathie Wood Buys the Dip (Again)

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “The Financial System Is Being Rebuilt On-Chain”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 The Case for Lido (LDO) Comeback

📣 Cathie Wood Buys the Dip (Again)

📈 Bitmine's Bankruptcy Narrative is Breaking

Let’s dive in!

💡 Insight

The Case for Lido (LDO) Comeback

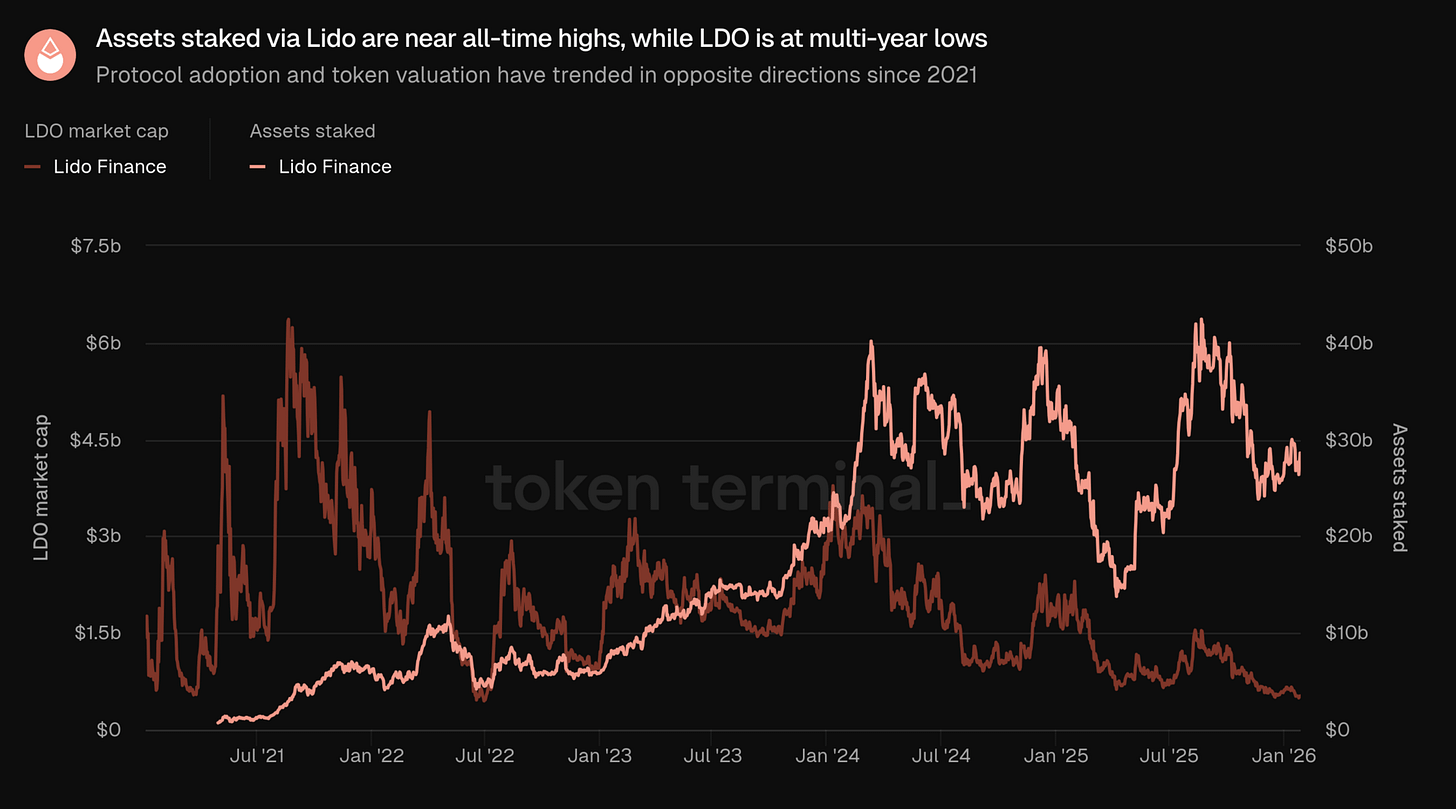

Lido ($LDO) has been bleeding slowly for over a year, down ~75% from its 2023 high.

But according to data from Token Terminal, the fundamentals tell a different story:

Revenues are stable → Lido continues to dominate Ethereum staking

ETH staked is growing, not shrinking

Yet $LDO has massively underperformed staking competitors (e.g. $RPL, $FXS)

There’s clearly a disconnect between Lido’s protocol health and $LDO’s price action.

👀 Why It Matters

Smart investors should watch for reversion setups where price lags fundamentals.

With ETH narrative heating up (restaking, ETFs, modular chains), any return of risk appetite could rotate back into liquid staking tokens—especially ones with:

Real protocol cash flow

Dominant market share

High token underperformance

That’s a rare trio—and Lido checks all three boxes.

📣 Update

Cathie Wood Buys the Dip (Again)

While Bitcoin continues to slide, Cathie Wood’s ARK Invest just went shopping—scooping up over $70 million worth of crypto-exposed stocks.

ARK’s buys include:

$43.7M of Coinbase (COIN)

$25.4M of Block (SQ)

Spread across ARKK, ARKW, and ARKF ETFs

This marks ARK’s 4th straight day of crypto buys, signaling strong conviction that this is a temporary dip—not a macro reversal.

📈 Signal

Bitmine's Bankruptcy Narrative is Breaking

Crypto Twitter’s bracing for Bitmine to collapse... but the numbers tell a very different story.

At current ETH prices (~$2,350), Bitmine is generating:

$25M/month from staking yield

$2M/month in interest on $586M in cash reserves

While sitting on $14B in ETH with zero debt

🧠 Takeaway

Don’t let bear market trauma cloud your judgment. Follow the on-chain fundamentals, not the fear.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

The 2026 Bitcoin Strategy Guide (link)

A Treasury Bigger Than ETH ETFs (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time

Solid thesis on the value disconnect. That triple combo of real cash flow plus market dominance plus underperformance is rare. The comparision to RPL and FXS makes the lag obvious. If ETH narrative picks up with restaking hype this could mean revert pretty quick especially since liquid staking tokens typically front-run broader ETH moves.