Why Altcoins Are Losing to Bitcoin in the Most Institutional Cycle Ever

PLUS: Ethereum Just Flipped Visa and Mastercard

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Every ETH Crash Sets Up a Massive Run. This One Is No Different”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Why Altcoins Are Losing to Bitcoin in the Most Institutional Cycle Ever

📣 Robinhood is Coming to Indonesia

📈 Ethereum Just Flipped Visa and Mastercard

Let’s dive in!

💡 Insight

Why Altcoins Are Losing to Bitcoin in the Most Institutional Cycle Ever

In case you missed it, Glassnode and Fasanara just dropped one of the most data-rich institutional crypto reports of the year.

We went through all 35 pages and pulled out the charts and shifts you need to understand where the market is heading next — and where the smart money is rotating.

Let’s unpack it 👇

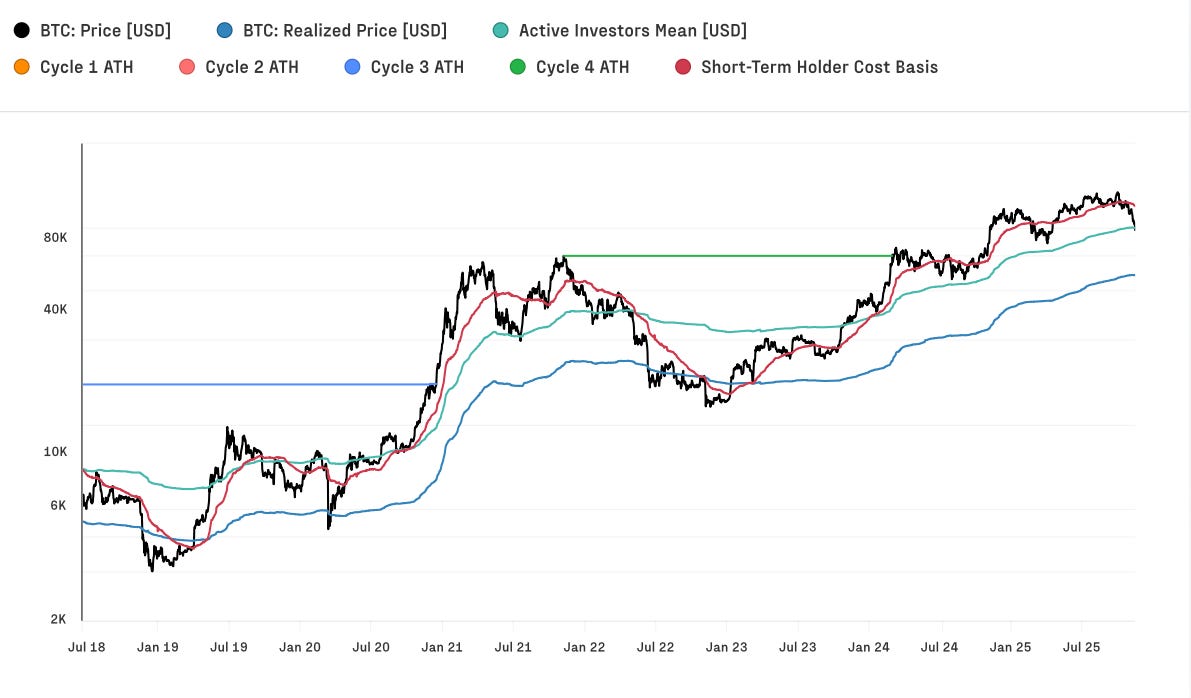

1. Bitcoin is Eating the Market – Again

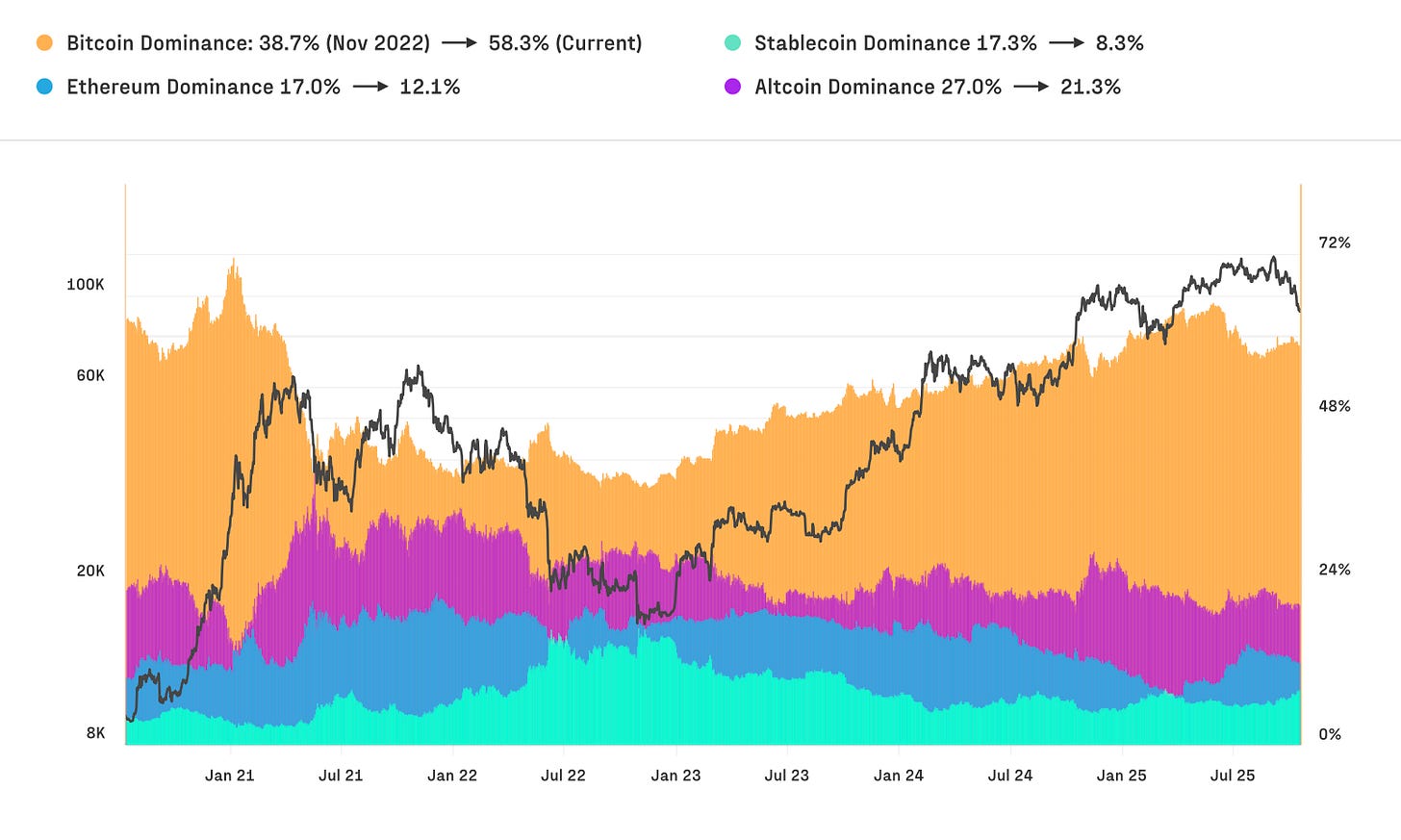

Since the November 2022 bottom, Bitcoin is up +715%, hitting a $2.48T market cap. Altcoins? Up ~350%... and fading fast.

📉 Altcoin dominance is down from 27% → 21%

📈 Bitcoin dominance is at 58.3% — the highest since 2021

💵 Stablecoins are growing, but less speculative — dollarization > degen

👉 Narrative takeaway: Institutions want liquidity, regulation, and brand. Bitcoin delivers. Your favorite midcap alt might not.

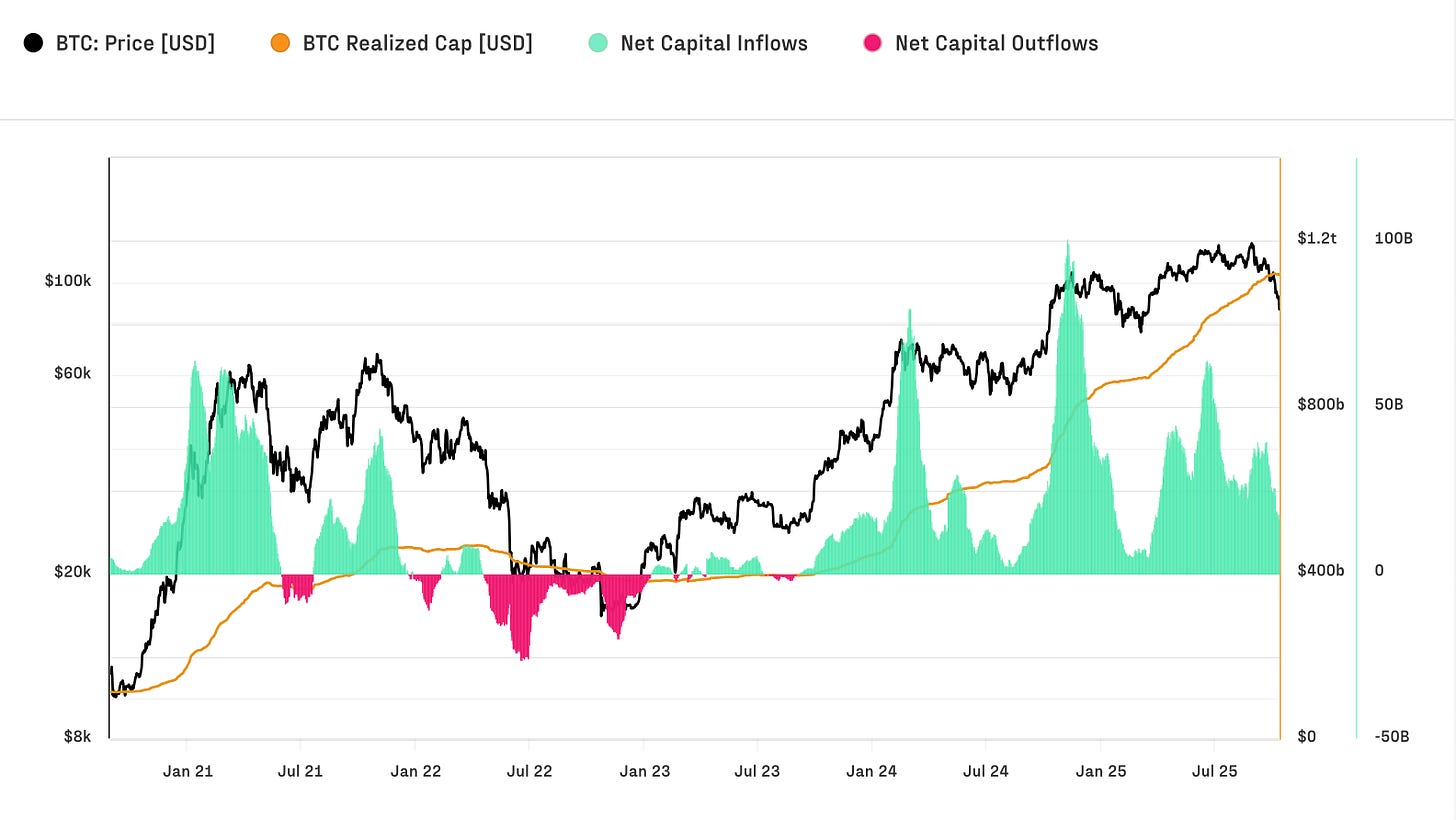

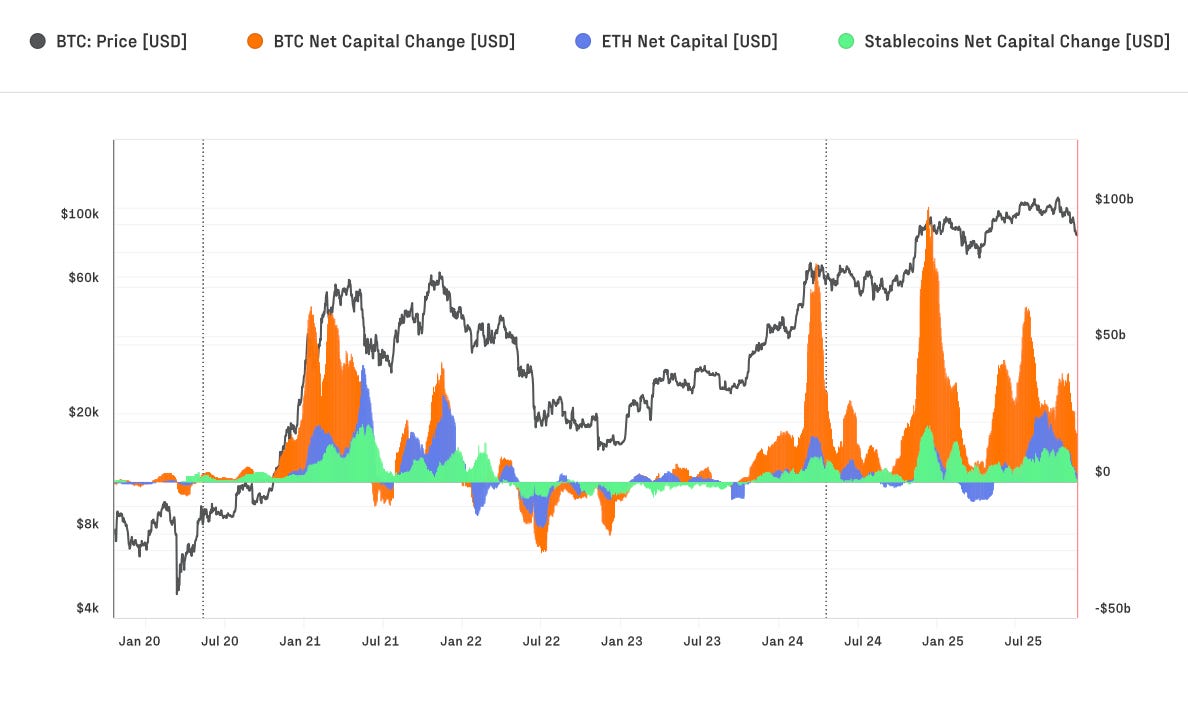

2. Capital Is Concentrated, Not Rotating

Glassnode shows that Bitcoin absorbed up to $190B/month in fresh capital, while Ethereum and altcoins saw minimal flows.

This is not your 2020–2021 cycle. Capital is staying parked in BTC, ETFs, and stablecoins. There’s no altcoin season — yet.

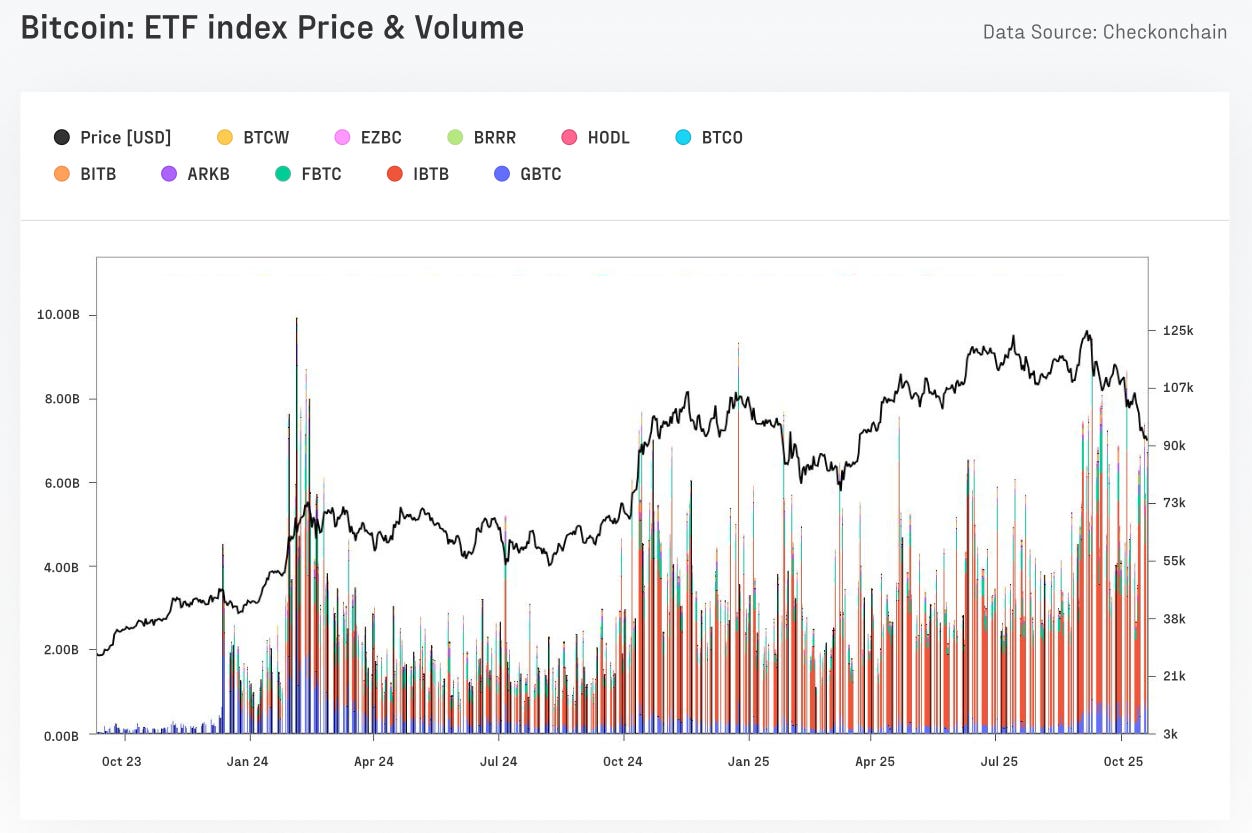

3. ETFs Changed Everything (And It’s Just Starting)

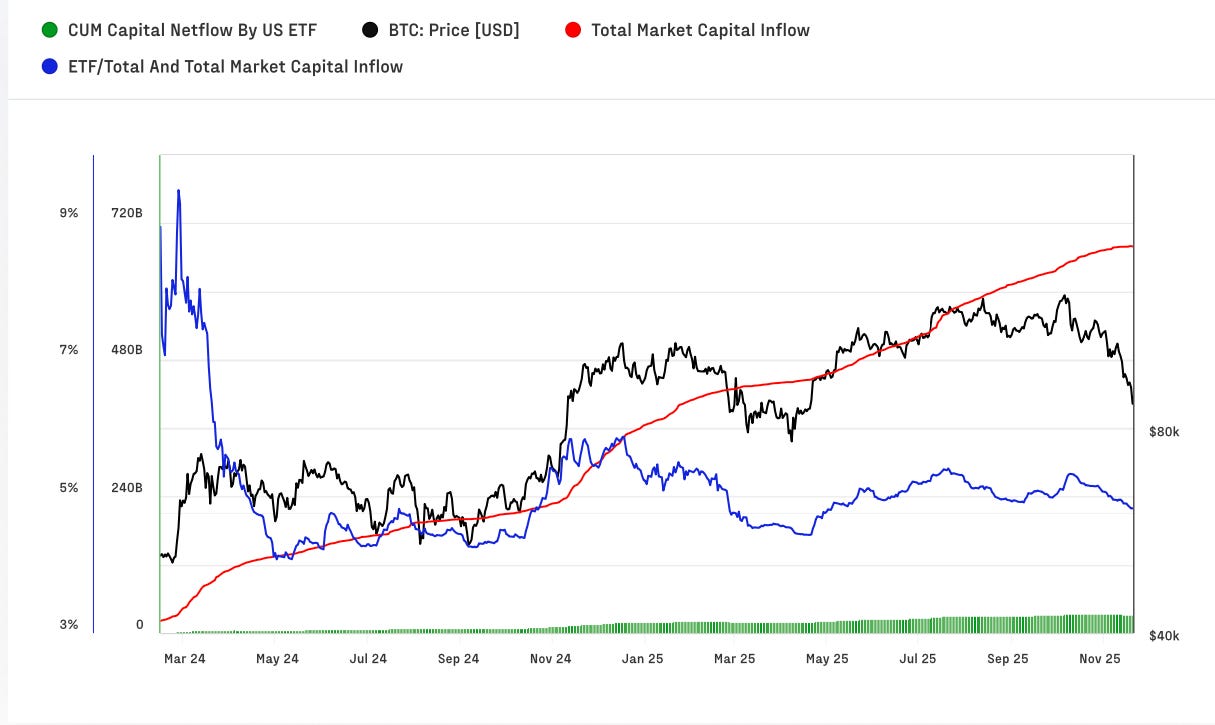

Since the launch of spot BTC ETFs in January 2024:

1.36M BTC now held in U.S. ETFs (~6.9% of total supply)

ETFs are responsible for 5% of all Bitcoin inflows (in just 22 months)

BlackRock’s IBIT alone did $6.9B in daily volume during the October liquidation event

🧠 Implication: ETF inflows are crowding out on-chain speculation. Retail is getting onboarded via Fidelity, not MetaMask.

4. Altcoins Are Missing in Action

📉 Ethereum’s dominance fell to 12.1%

📉 No new “alt season” patterns emerging

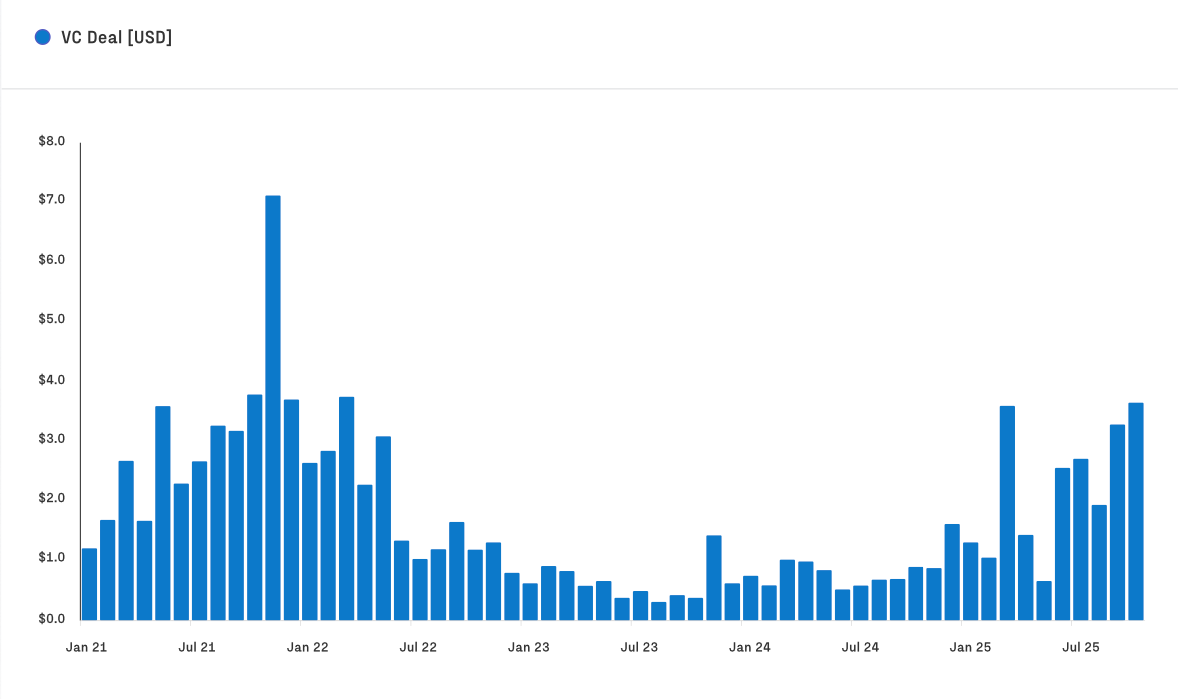

📉 VC activity tracks altcoins, and it’s drying up — except for Polymarket ($2B)

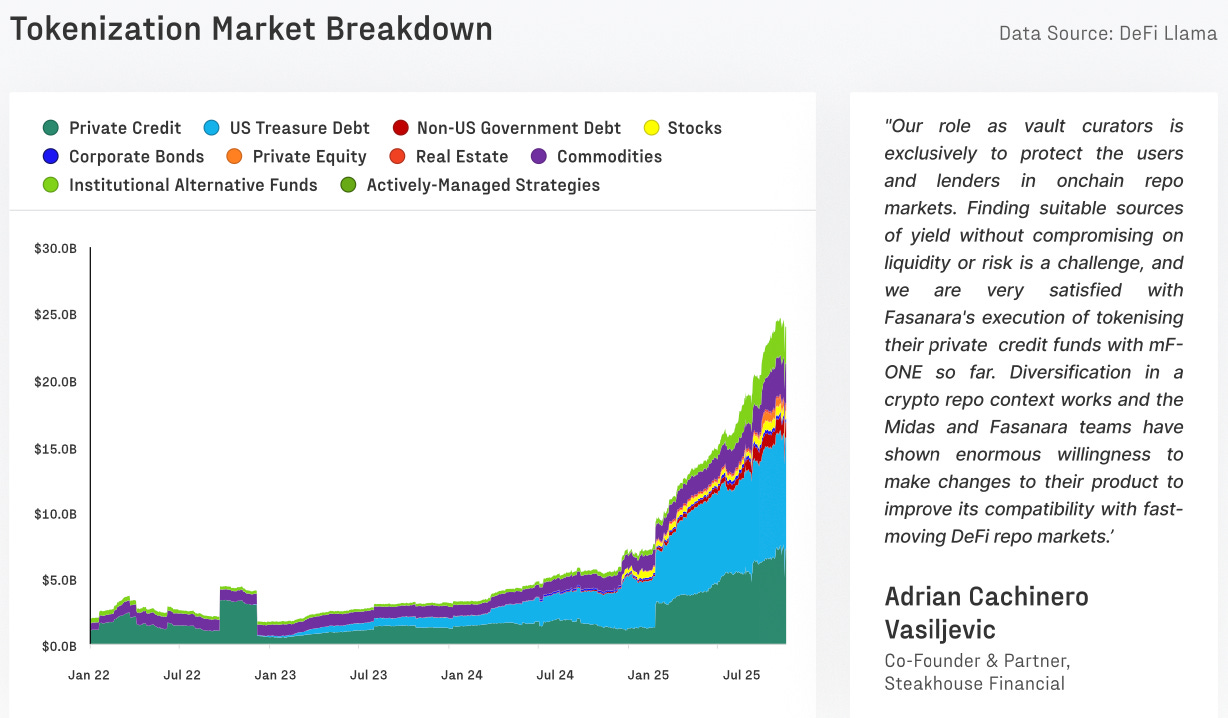

There’s a flight to safety — BTC, USDC, ETFs, even tokenized U.S. Treasuries.

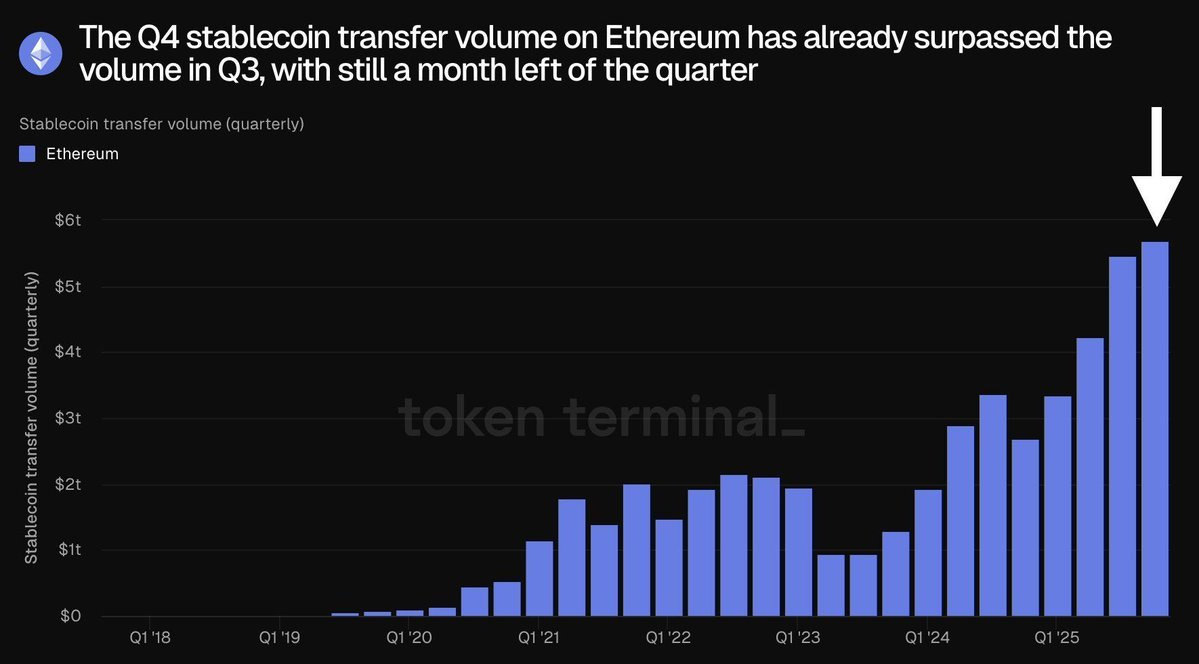

5. Stablecoins Now Run the Show

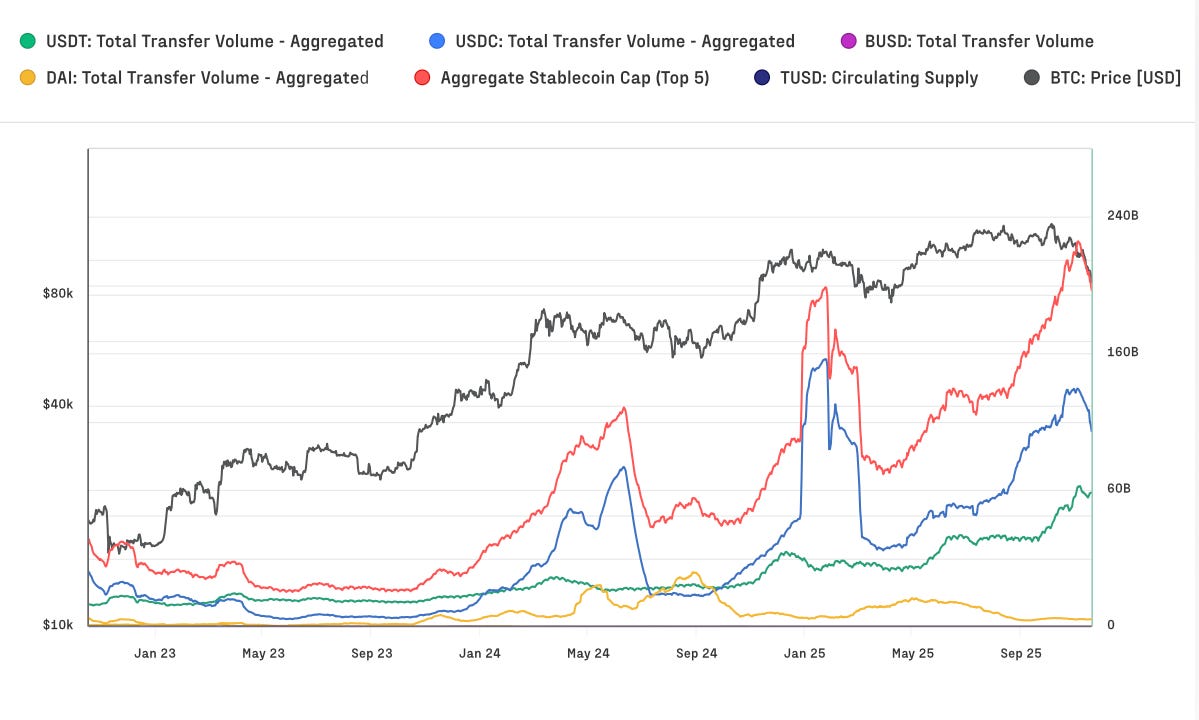

$263B in stablecoin supply (new ATH) — mostly USDT and USDC

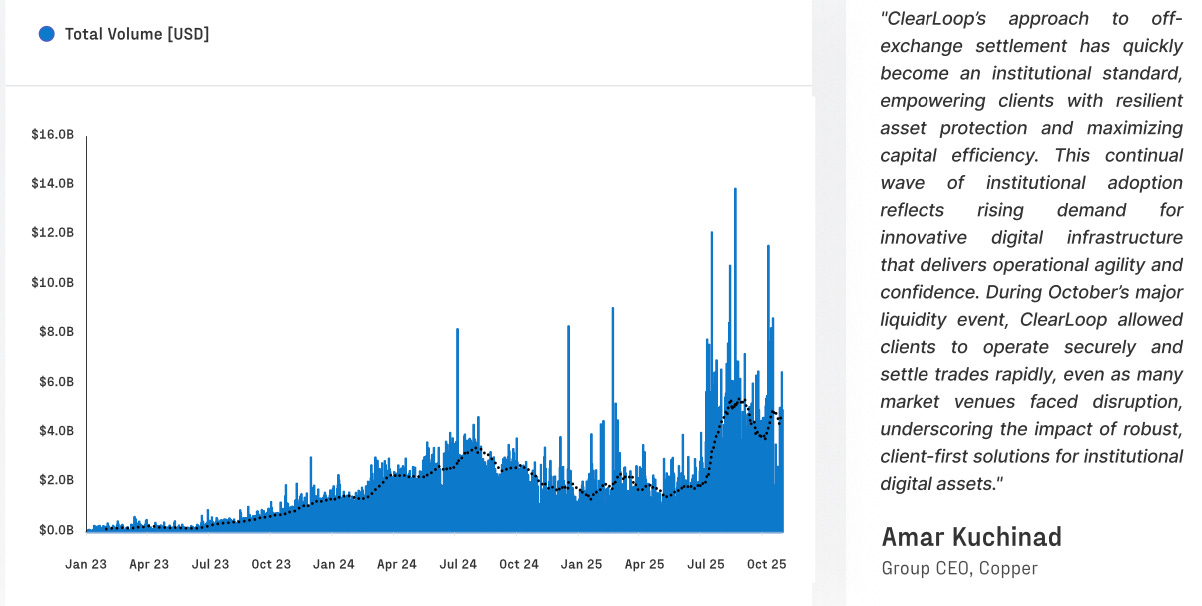

$225B/day in stablecoin transfers — they are the real on-chain liquidity layer

Stablecoins now power DeFi, CEXs, DEXs, everything

Play the stablecoin infrastructure trend. Look at protocols with real-world settlement, FX rails, or DeFi payment rails (e.g., THORChain, Kujira, Ethena, etc.).

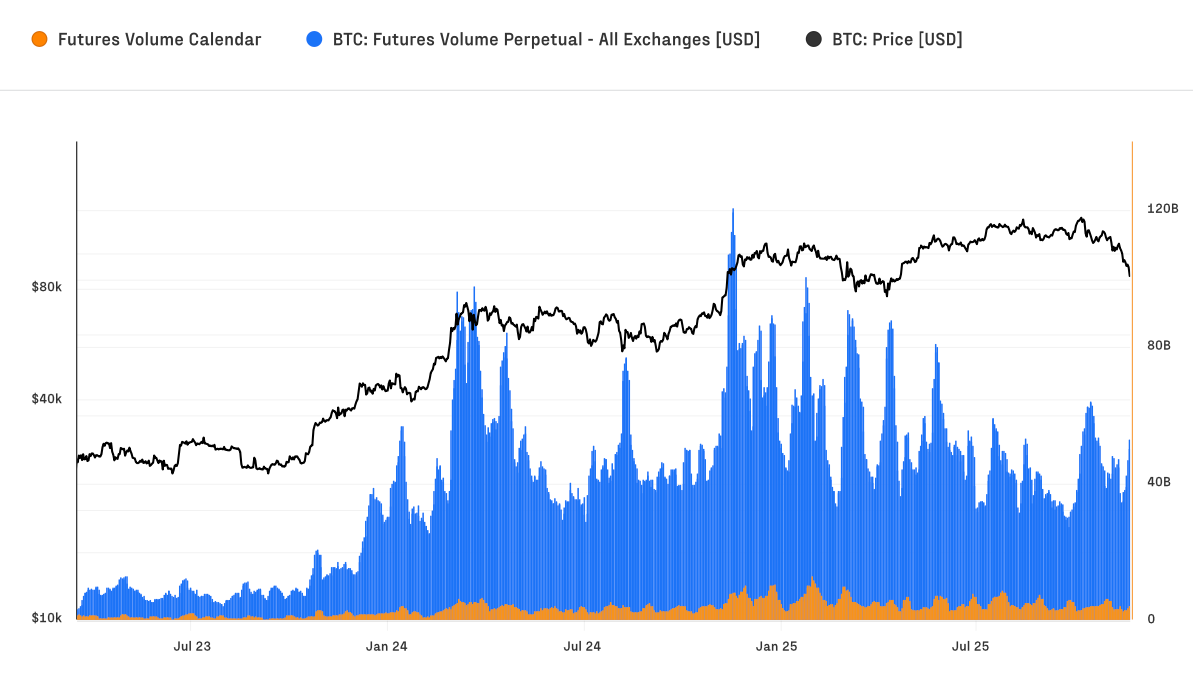

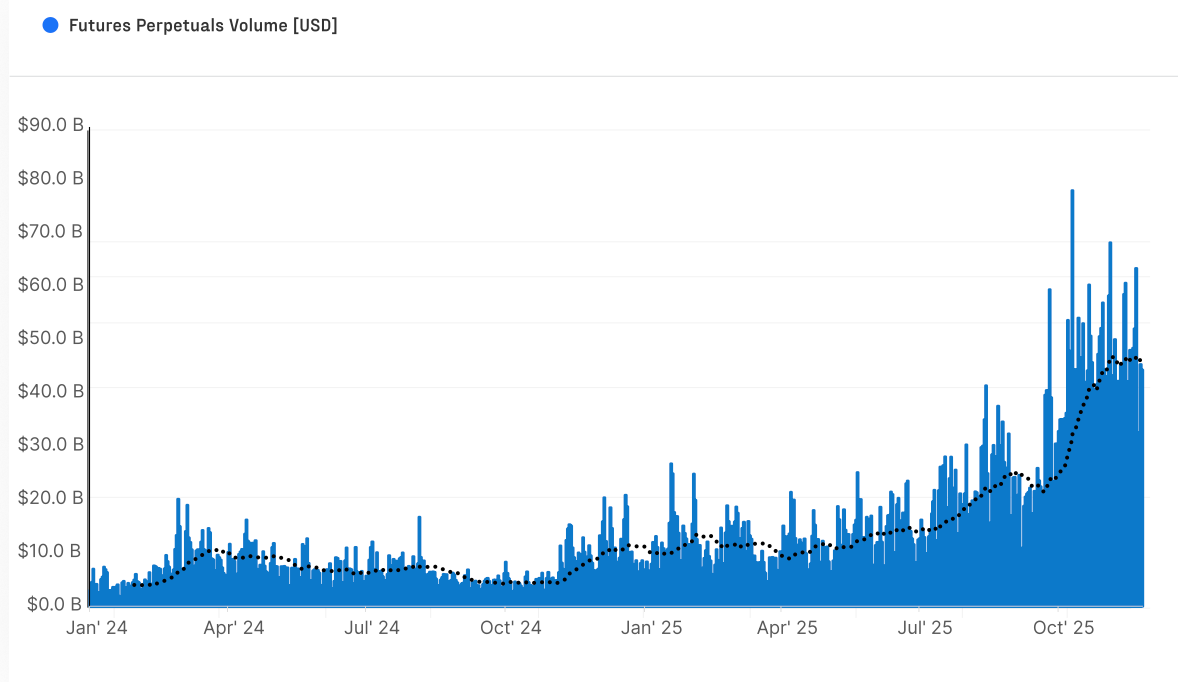

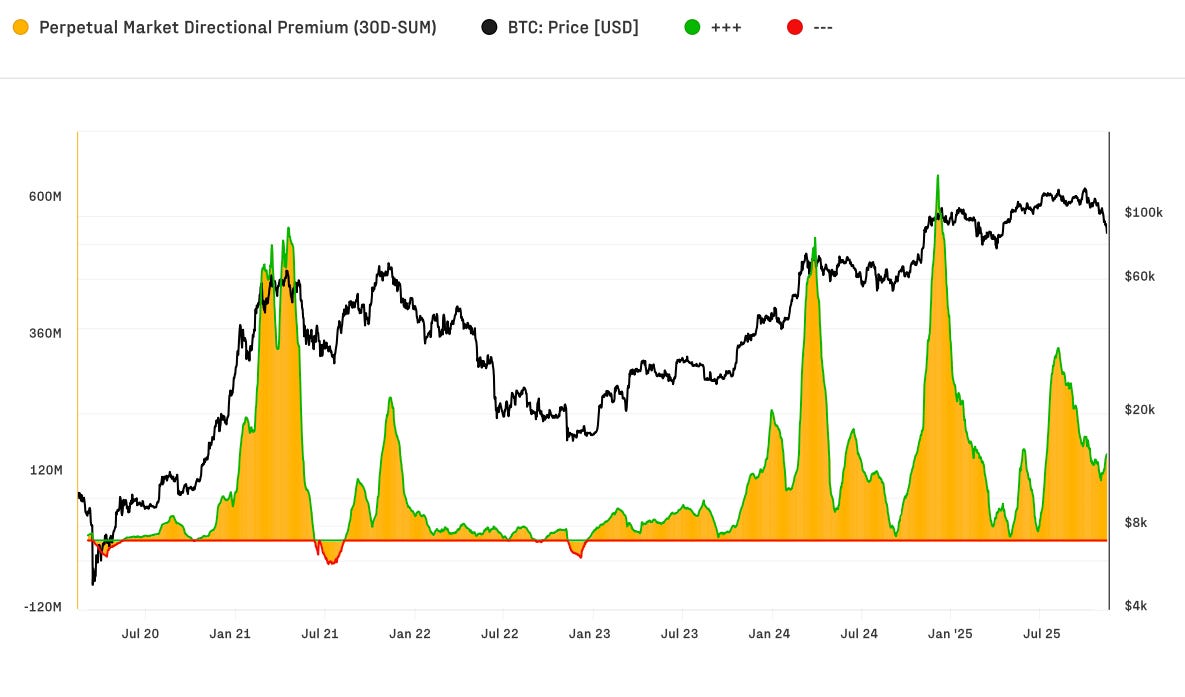

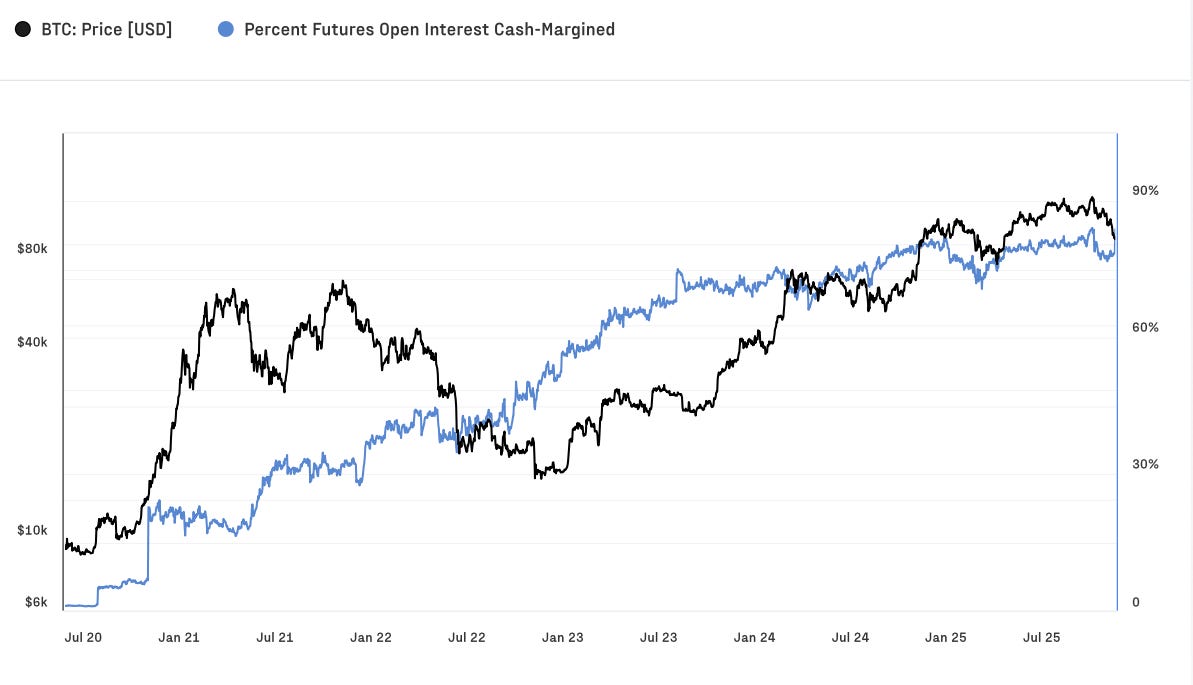

6. Derivatives Show We’re in a Mature (But Leverage-Prone) Market

$67.9B in futures open interest (CME = 30%)

93% of volume comes from perpetuals — DEX perps now 20% of that!

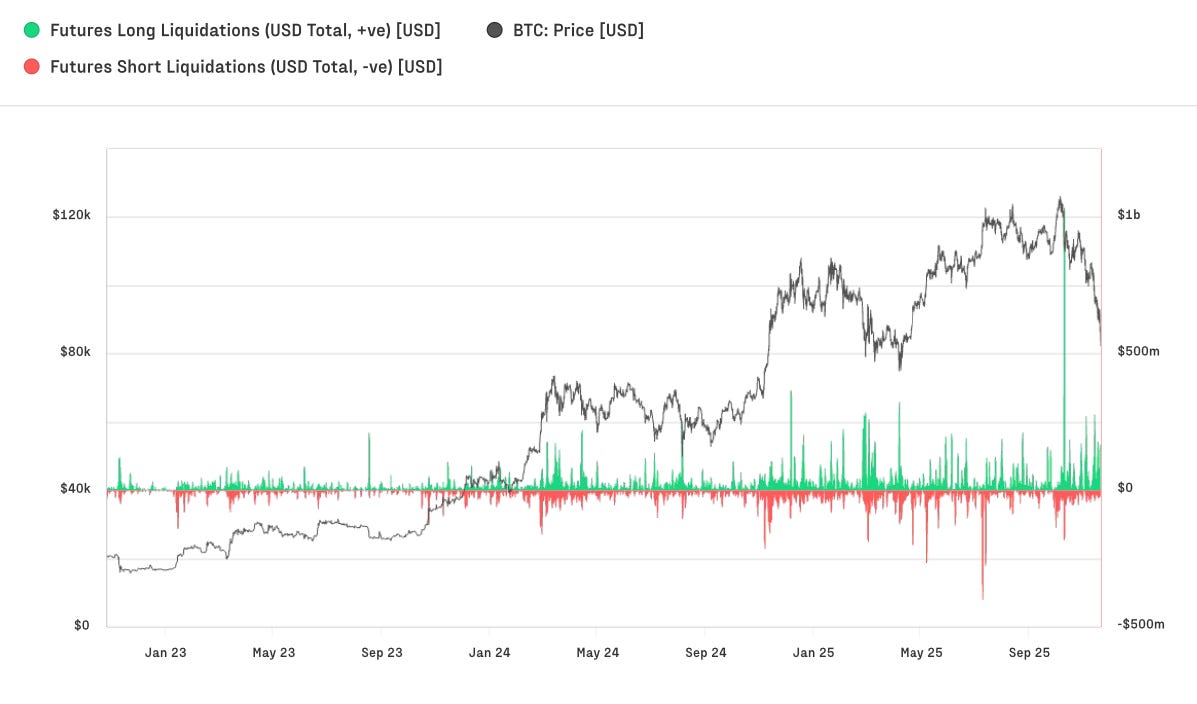

Black Friday-style deleveraging wiped $640M/hour in longs on Oct 10th

But here’s the bullish part: Spot markets soaked it up. Buyers stepped in

TL;DR: What This Means for You

✅ Bitcoin is the big winner of institutionalization

✅ Altcoins are lagging but potentially setting up for selective rotations

✅ Watch stablecoins, tokenization, and DeFi infra that plugs into TradFi rails

✅ Don’t fade ETFs — they’re not noise, they’re the new smart money

📣 Update

Robinhood is Coming to Indonesia

Robinhood Markets, Inc. has entered into agreements to acquire PT Buana Capital Sekuritas, an Indonesian brokerage, and PT Pedagang Aset Kripto, a licensed Indonesian digital financial asset trader.

With more than 19 million capital market investors and 17 million crypto investors, Indonesia is a compelling market for equities and crypto trading.

📈 Signal

Ethereum Just Flipped Visa and Mastercard

Ethereum is now the world’s largest dollar settlement layer.

And no one on Wall Street is ready for what’s coming.

In Q4 alone, Ethereum processed nearly $6 trillion in stablecoin volume

That’s more than Visa or Mastercard — with a month still left in the quarter

Ethereum has officially become the de facto settlement layer for digital dollars

The scale of this dwarfs anything from the DeFi 1.0 cycle

What This Means

→ Dollar rails are going on-chain. Stablecoins are no longer just a DeFi play — they are now global money movement infrastructure.

→ ETH is undervalued as monetary infra. Not just a smart contract chain — it’s a real-time, permissionless global Fedwire.

→ Protocols building on this trend are riding a trillion-dollar wave.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

Value Investing Ratings - November ‘25 (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

Is the Bear Market Already Here? (link)

We’re buying this token (link)

This New Chain Could Kill Bridges Forever (link)

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time

Solid breakdown. The point about ETFs crowding out on-chain speculation is kinda underrated, retail onboarding through Fidelity instead of Metamask fundmentally changes who participates and how capital moves. When institutions want liquidity and regulatory clarity over narrative plays, alts get sidelined hard.