👀 The Great Crypto Crash: What Happened and What Comes Next

PLUS: 4 out of the top 5 RWA chains are part of the Ethereum ecosystem

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Bitcoin Hits ATH: Here’s What Happens Next”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 The Great Crypto Crash: What Happened and What Comes Next

📣 USDT issuer Tether CEO Paolo Ardoino says “Bitcoin and Gold will outlast any other currency

📈 4 out of the top 5 RWA chains are part of the Ethereum ecosystem

Let’s dive in!

💡 Insight

The Great Crypto Crash: What Happened and What Comes Next

We saw a historic meltdown across the top 100 altcoins. Not just small caps — but blue chips.

Here’s how bad it got:

$ATOM: collapsed from $4 → $0.001

$SUI: $3.40 → $0.56

$APT: $5 → $0.75

$SEI: $0.28 → $0.07

$LINK: $22 → $8

$ADA: $0.80 → $0.30

This wasn’t a slow bleed. It was a brutal flash crash, wiping out months of gains in minutes.

📉 What Triggered the Crash?

At first glance, this looked like a classic overleveraged wipeout — and that’s partly true. But here’s the deeper context:

Geopolitical shock: U.S. President Donald Trump announced new tariffs on China, shaking global markets.

Panic selling followed: Crypto, being the most volatile asset class, was hit the hardest.

Massive leverage unwinds:

→ $8 billion in longs liquidated

→ $1.55 billion in shorts liquidatedTotal liquidations: Over 1.5 million traders wrecked

Open interest wiped: $9.55 billion gone in under 24 hours

The two biggest blockchains — Bitcoin and Ethereum — were also hit hard:

BTC: $1.37B in liquidations

ETH: $1.26B liquidated

👉 For context, the last major liquidation event in September only wiped out ~$285M in BTC longs.

This one? Over $10B total. Easily one of the largest in crypto history.

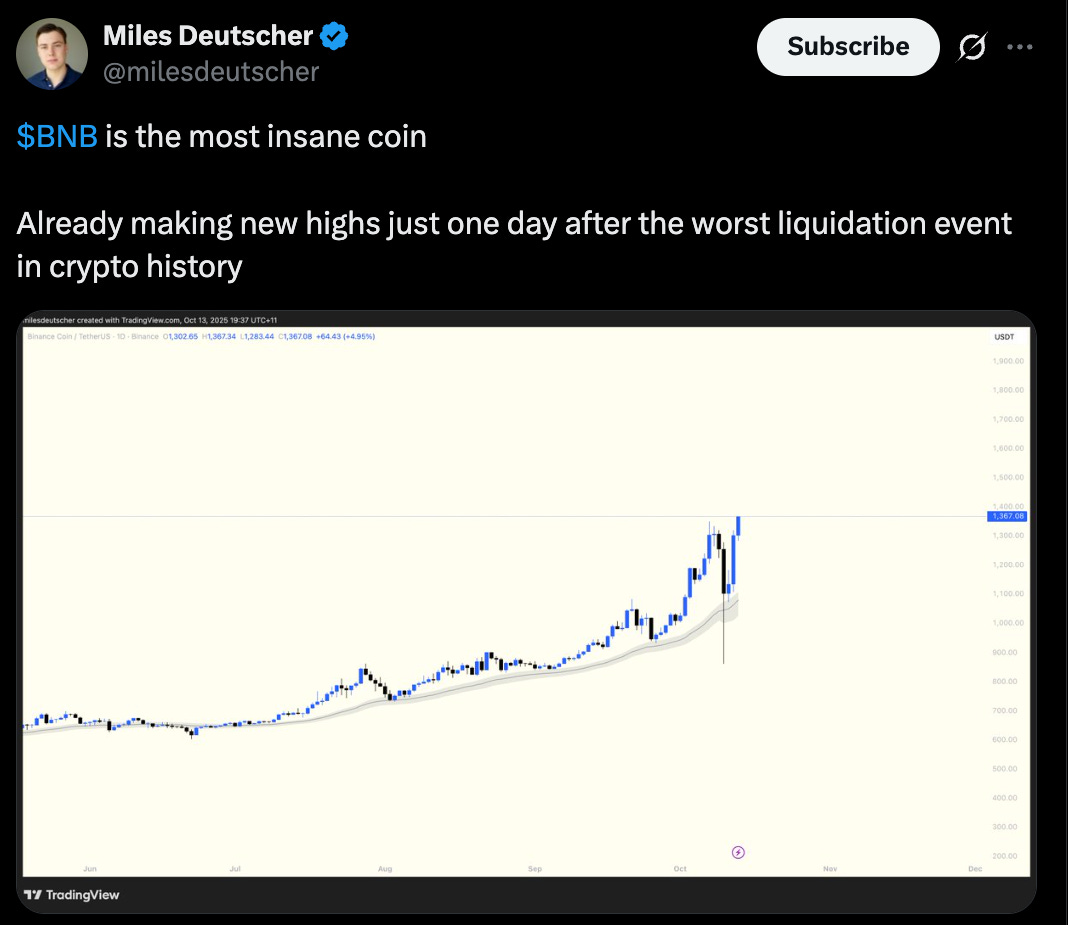

🔍 The Wildest Part? Some Coins Bounced Immediately

While most altcoins were flatlined, one name refused to die:

$BNB not only survived — it made new highs within 24 hours.

That’s not just resilience. That’s insane relative strength.

And when markets crash, that’s exactly what smart investors look for:

Which assets recover first?

Where does capital flow after fear peaks?

Who’s buying while everyone else is panic selling?

So… What Should You Do Now?

Here’s how we’re approaching the current setup — and how you can position yourself smartly for the rebound:

✅ Wait for confirmation before buying the dip

Don’t rush into knife-catching mode. Look for volume, structure, and reclaim levels.

✅ Focus on coins that held up well

Strength during panic = likely leaders in the next move up.

✅ Set alerts at key price levels

Re-entry opportunities are coming. You want to be ready, not reactive.

✅ Reset your watchlist

This is the perfect time to trim the noise and focus on high-conviction plays.

📣 Update

USDT issuer Tether CEO Paolo Ardoino says “Bitcoin and Gold will outlast any other currency

Tether CEO Paolo Ardoino said in a post on X on Sunday that “Bitcoin and Gold will outlast any other currency,” a minimalist line that aligns with how the stablecoin issuer has positioned parts of its reserves over the past two years.

On May 17, 2023, Tether said it would regularly allocate up to 15% of net realized operating profits to purchase bitcoin for reserves, adding BTC to surplus rather than using it to back circulating USDT one-for-one. The company framed the move as strengthening its balance sheet with a long-term store of value.

📈 Signal

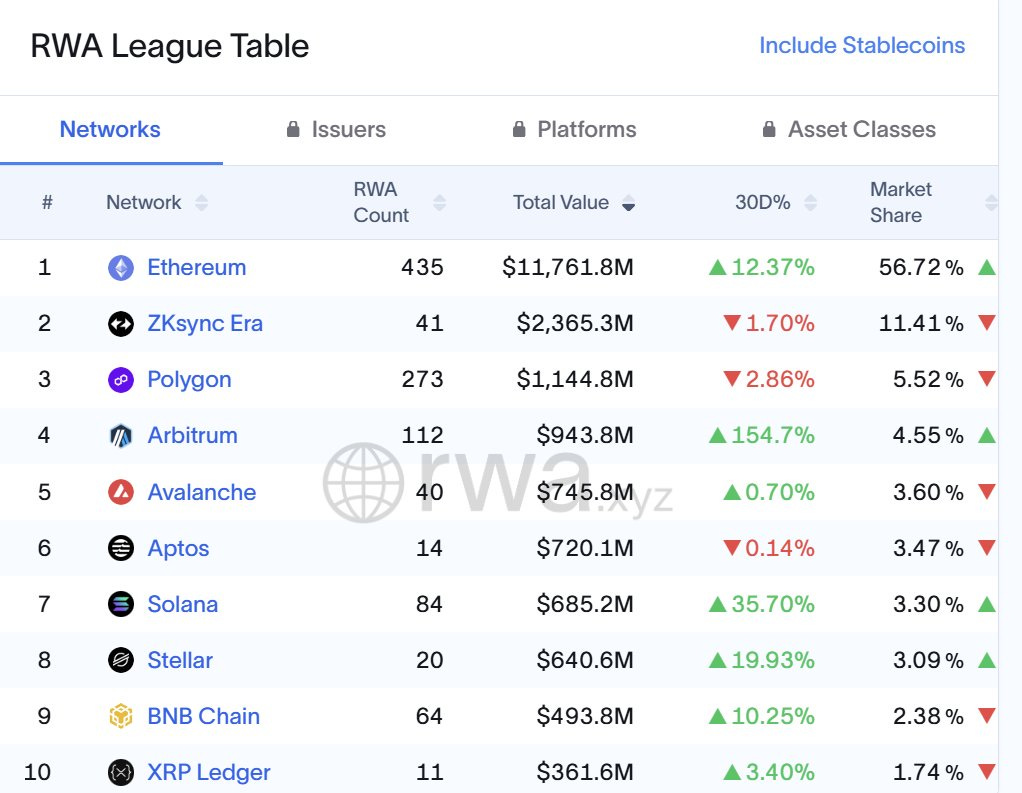

4 out of the top 5 RWA chains are part of the Ethereum ecosystem

Ethereum is still leading in tokenization.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

Here are some of our latest popular premium posts:

Where Are We in the Economic Cycle? (link)

This New Chain Could Kill Bridges Forever (link)

4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

This Chain Could Unchain Crypto’s Future (link)

Thanks for reading!

See you next time