🚨 Time to reset?

PLUS: BlackRock's $ETH AUM surpasses $1B

Hi Investor 👋

welcome to a 🔒 premium edition 🔒 of Altcoin Investing Picks, the most actionable crypto newsletter.

Every week, we send actionable tips to help you build a profitable altcoin portfolio.

I hope you enjoyed our last issue “How to analyze Ethereum L2s”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Time to reset?

📣 Saylor acquired an additional 6,911 BTC for $584.1 million

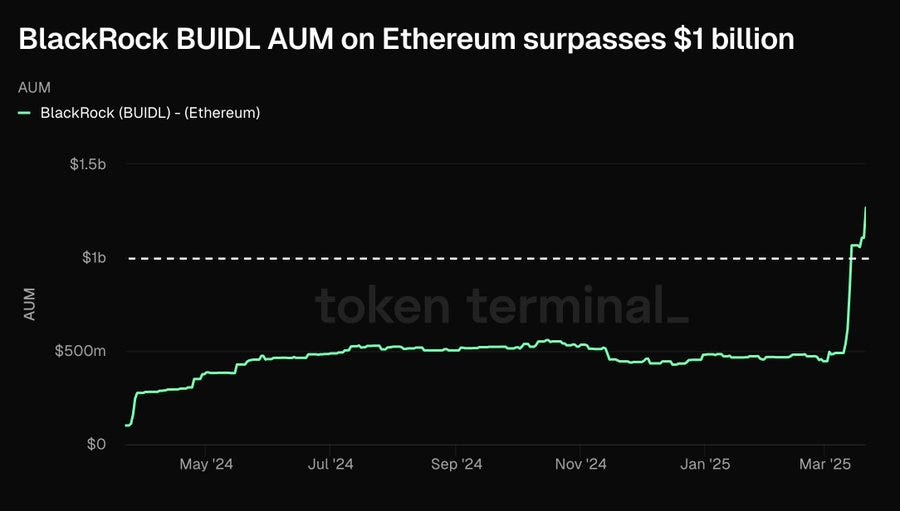

📈 BlackRock's $ETH AUM surpasses $1B

Let’s dive in!

💡 Insight

Time to reset?

The crypto landscape has shifted under the weight of changing macroeconomic conditions.

As a result, the coins leading the next risk-on rally will probably differ from the last one.

How to build your portfolio in 2025

Just because a token crushed it in 2024 doesn’t mean you have to sidestep it entirely.

So, keep a sharp eye on emerging trends, fresh catalysts, and any buzzworthy news that could spark the next rally.

Pay attention to new partnerships, groundbreaking technology, and shifts in market sentiment, so you’re ready to pivot when something promising comes along.

Here are some resources for your journey:

⭐️ Top Articles

🪄 Our Favorite Tools

📣 Update

Saylor acquired an additional 6,911 BTC for $584.1 million

Strategy surpasses 500,000 BTC holdings with a $584M purchase, further cementing its reputation as a corporate leader in Bitcoin accumulation.

The company now holds 2.4% of Bitcoin's fixed supply, with a total cost of $33.7 billion and an average purchase price of $66,608 per BTC.

📈 Signal

BlackRock's $ETH AUM surpasses $1B

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

With the free subscription, you’ll get one post a week. To get access to all of our posts (+3x the content), you can become a full subscriber for €139/year (or €19/month).

Here’s what full subscribers get:

Weekly reports on micro altcoins with 10x+ potential.

Weekly tactics that help you spot new opportunities, navigate the market and make more profits.

Access to our monthly ratings: every month we share the best blockchains to buy based on our value-investing framework.

Thanks for reading!

See you next time