Top 9 Crypto Narratives for 2026

PLUS: Real Assets Are Flooding Onto Ethereum

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “BTC at $174k by 2026?”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Top 9 Crypto Narratives for 2026

📣 South Korean authorities seek 5% cap on corporate crypto investments

📈 Real Assets Are Flooding Onto Ethereum

Let’s dive in!

💡 Insight

Top 9 Crypto Narratives for 2026

CoinGecko just released their latest deep dive on top crypto narratives for 2026, and it’s packed with signals that smart money is already rotating into.

In 2026 the market isn’t just chasing the next meme pump — capital is rotating into narratives with real utility, structural adoption, and institutional demand. These trends will shape where liquidity flows and which sectors outperform.

1) Meme Launchpads

The memecoin world is evolving beyond pure chaos: fair launch mechanics, anti‑bot protection, and reputation‑based minting are emerging. This lowers early rug risk and attracts longer‑term holders — not just degens.

2) ICO Launchpads

ICOs are coming back, but with milestone‑based escrow and compliance overlays. This attracts utility‑focused projects instead of flag‑and‑rug plays.

3) Prediction Markets

2026 isn’t just about betting on elections — users are wagering on macro events, weather, earnings, on‑chain indicators, and real metrics. Oracles + social data = real insight signals.

4) Privacy & Zero‑Knowledge (ZK)

Privacy isn’t just for illicit use anymore — ZK proofs for identity verification and confidential DeFi are becoming compliance‑friendly features, opening doors to institutions.

5) Perp DEXs

Decentralized perpetual exchanges are finally close to CEX UX and liquidity standards, offering cross‑margin and synthetic assets. This brings institutional traders back on chain.

6) Stablecoins & Stablechains

Stablecoins are no longer just trading tools — stablechain networks built around stable assets are emerging to rival traditional rails like SEPA/SWIFT.

7) ETFs & DATCos

Crypto is now mainstream in traditional portfolios. Spot ETFs for altcoins are underway, and Digital Asset Treasury Companies (DATCos) offer institutional exposure through stocks.

8) Real‑World Assets (RWA)

RWAs tripled on‑chain in 2025 and were the top performing narrative by ROI, signaling serious adoption of tokenized bonds, credit, and real estate.

9) Crypto Cards

Crypto stops being just an investment and becomes spendable money as wallet‑linked cards settle at point‑of‑sale without manual conversion.

Source: CoinGecko – Top Crypto Narratives for 2026

📣 Update

South Korean authorities seek 5% cap on corporate crypto investments

South Korea's Financial Services Commission is looking to set a 5% cap on corporate investments in cryptocurrencies, according to local media reports.

Seoul Economic Daily reported Sunday that the FSC has formulated a crypto trading guideline for listed corporations and professional investors, with a finalized version expected as early as January or February.

📈 Signal

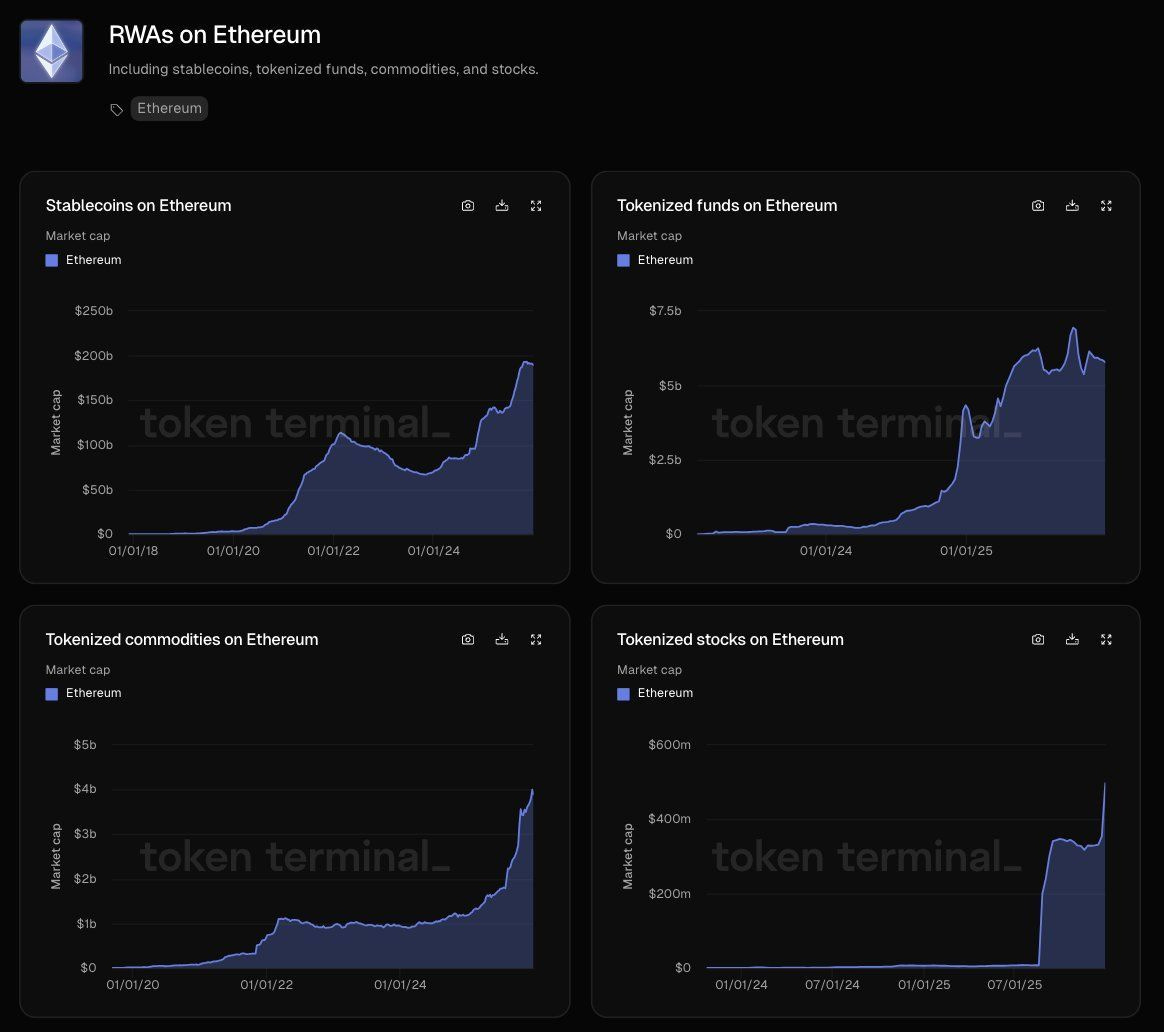

Real Assets Are Flooding Onto Ethereum

Real-world assets (RWAs) are moving onchain, and Ethereum is becoming the default settlement layer.

🔍 Powered by Token Terminal, here’s what the data shows:

🪙 Stablecoins on Ethereum: ~$190 billion market cap

📈 Tokenized Funds: ~$6–7 billion, compounding fast

🏭 Tokenized Commodities: ~$4 billion, breaking new highs

📊 Tokenized Stocks: ~$400–500 million, early but surging

Why it matters

Ethereum isn’t winning the RWA race because of hype — it’s winning because it’s already settling billions in real value with compliance-ready infra.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

A Treasury Bigger Than ETH ETFs (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time