Why Ethereum Is Still Underpriced

PLUS: Solana Dominates Chain Revenue in 2025

Hi Investor 👋

welcome to a ✅ free edition ✅ of Altcoin Investing Picks, the most actionable crypto newsletter.

I hope you enjoyed our last issue “Are Crypto Ecosystems Really Decentralizing?”

If you haven’t yet, subscribe to get access to these posts, and every post.

In today's newsletter:

💡 Why Ethereum Is Still Underpriced

📣 BlackRock’s BUIDL hits $100M million in dividends and passes $2 billion in assets

📈 Solana Dominates Chain Revenue in 2025

Let’s dive in!

💡 Insight

Why Ethereum Is Still Underpriced

There’s a simple fact the market keeps underestimating: Ethereum never left the center of the on-chain economy.

Even as new L1s and rollups launched, activity exploded across chains, and hype moved around — ETH quietly remained the core asset everything else is built on.

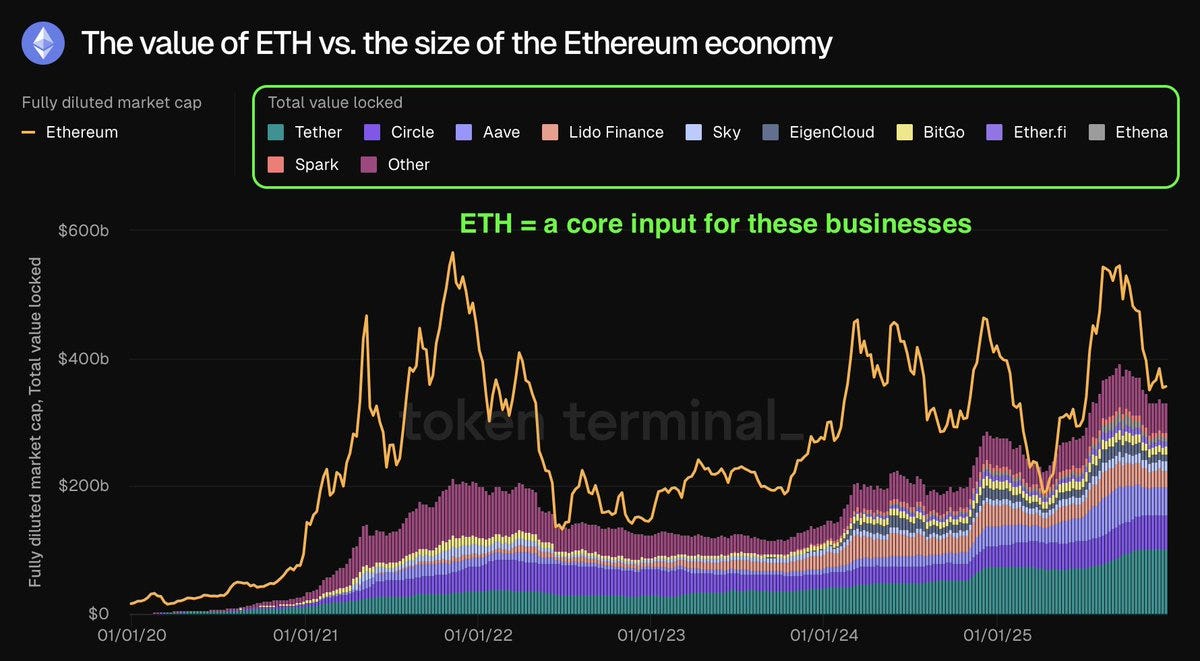

The chart shows Ethereum’s market cap (yellow line) vs the total value locked (TVL) across protocols built on Ethereum — DeFi, staking, restaking, custody, stablecoins, and more.

These aren’t just random apps. They’re real businesses with actual economic activity. And they all depend on ETH as a core input.

Let’s do some back-of-the-napkin math:

TVL on Ethereum: ~$330B

Market cap of ETH: ~$350B

That’s just a 1.06x premium over the value of the economy ETH secures and powers.

Now compare that to:

AWS trades at ~7x revenue

Microsoft trades at ~13x earnings

Gold trades at a premium to any economic utility it provides

Meanwhile, ETH trades almost 1:1 with the activity it supports — and assumes zero future growth.

Why This Matters for Altcoin Investors

ETH is the base money of the Ethereum economy — the same way the dollar underpins global finance.

So:

When ETH is undervalued → altcoin valuations on Ethereum are probably lagging too

When restaking (EigenLayer), staking (Lido, Ether.fi), and L2s grow → ETH demand structurally increases

When new apps launch → they’re priced in ETH, not USD

Put simply: if you’re betting on altcoins that live inside the Ethereum economy, you’re also betting on ETH.

And right now, ETH looks cheap vs what it already anchors.

📣 Update

BlackRock’s BUIDL hits $100M million in dividends and passes $2 billion in assets

BlackRock's tokenized money market fund BUIDL has paid out $100 million in dividends since its launch in March 2024.

The fund, valued at over $2 billion, invests in short-dated U.S. Treasuries and cash equivalents, and is one of the largest tokenized cash products.

BUIDL tokens are used in crypto market infrastructure and as collateral, bridging traditional finance and blockchain technology.

📈 Signal

Solana Dominates Chain Revenue in 2025

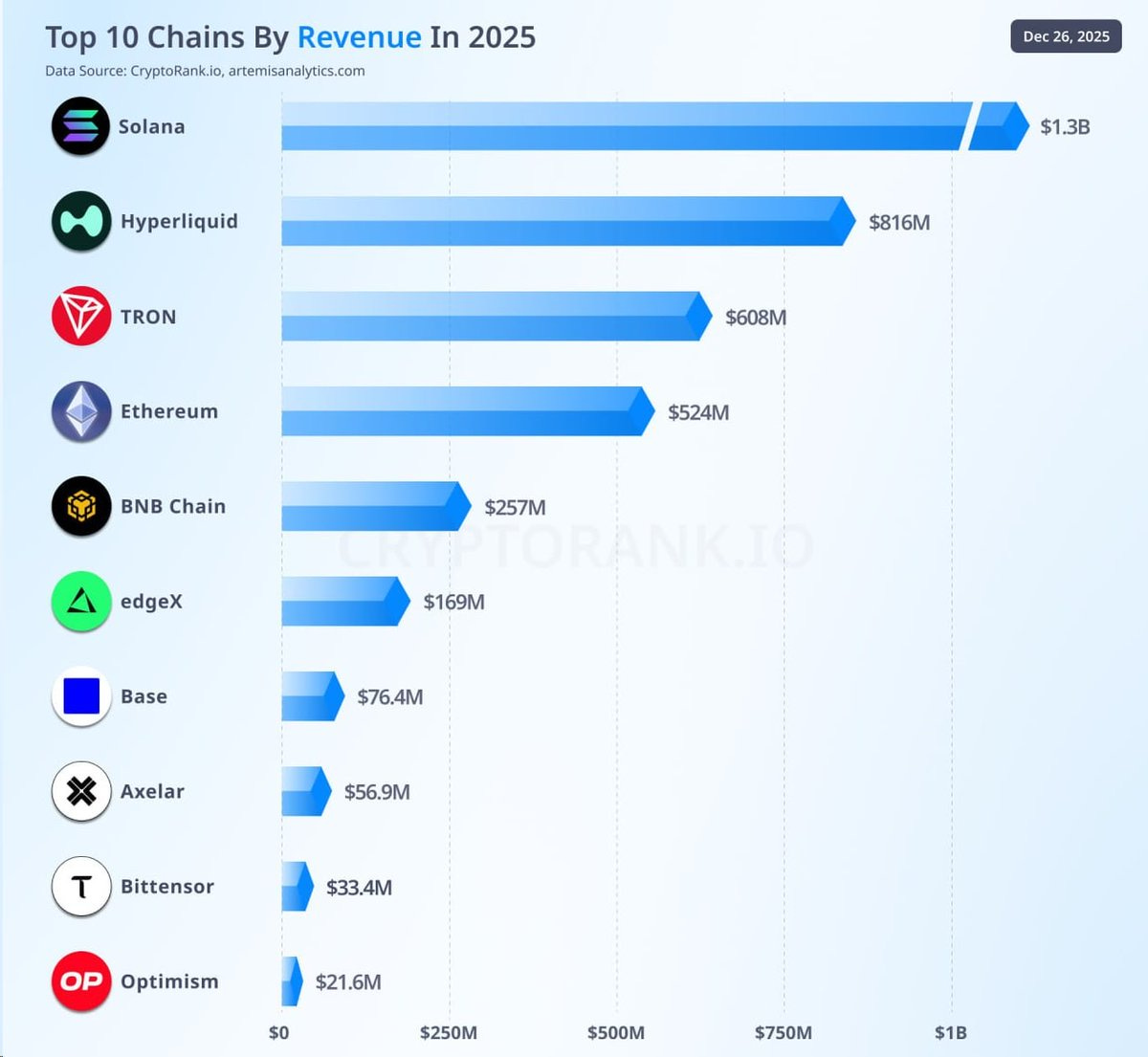

Solana just claimed the #1 spot in total on-chain revenue for 2025 — earning a massive $1.3 billion, according to CryptoRank data.

That’s 2.5x more than Ethereum ($524M) and more than the next two chains combined (Hyperliquid + TRON).

Why this matters

Solana is no longer just a fast chain — it’s becoming the most profitable.

Revenue = demand for blockspace. Demand = users, apps, and real usage.

If you’re investing in altcoins, follow the money — the chains with the highest revenue are where capital, talent, and narratives tend to compound.

Take action 🚀

If you want to level up your crypto journey, consider subscribing to the premium package.

When you subscribe as a premium member, you also get our report on bitcoin... a $299 value, for free when you subscribe.

And here are some of our latest popular premium posts:

Value Investing Ratings - December ‘25 (link)

AIP Stocks: The Ethereum Powerhouse Wall Street Hasn’t Noticed (link)

Why It Still Makes Sense to Bet on Blockchain Infrastructure (link)

The Long-Term Crypto Investor Playbook (link)

This Crypto Could Make Rollups, Bridges & Sequencers Obsolete (link)

I4 Undervalued Crypto Protocols Generating Real Fees (link)

Wall Street Wants Your ETH (link)

Thanks for reading!

See you next time

Great writeup. The 1.06x premium vs TVL comparison is pretty eye opening, especially when you put it next to AWS or Microsoft multiples. One thing I've been thinking about tho is how much of that TVL is actually sticky capital vs speculative flows that could evaporate in a downturn. Saw similiar compression happen with Terra's TVL metrics before things unraveled, where nominal TVL didnt translate to real economic moat.